The New Fintech Frontier

04.10.2024 | By: Charles Moldow, Nico Stainfeld

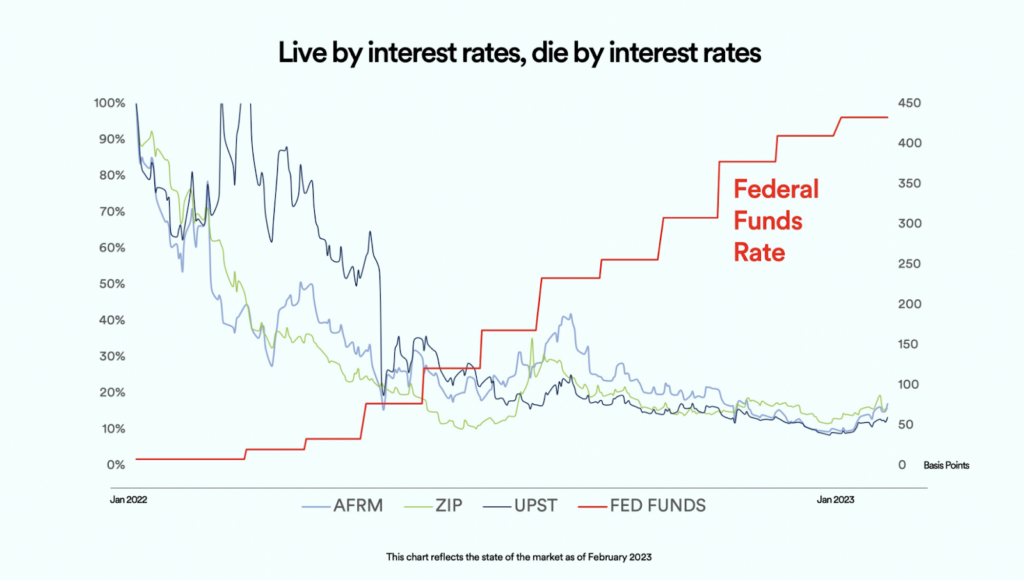

Financial services businesses are particularly sensitive to the macro environment—when the raw material is capital, the engine can shut off in a flash. In 2023, interest rates rose, inflation increased, and general economic uncertainty led to a correction of valuations and a general feeling of caution by most investors.

This period of rationalization is ushering in a new chapter for fintech, one more reliant on data than capital. Startups that can harness data as a core asset to build more personalized products, automate processes, and make better decisions will thrive (and become more desirable partners for incumbents with that data, like banks).

The current environment gives us even more certainty in our investment philosophy: that technology can fundamentally reimagine financial services to create, deliver, and capture value in new ways.

The question now becomes: how can companies create real value by turning data into gold instead of just painted rock?

The “Tech” in Fintech

We’ve long embraced the principle that “tech” is more important than “fin” in fintech. Instead of looking at companies with strong financial backing, we believe the companies leveraging software (AI, APIs, and blockchain, as examples) and data as their core assets are poised for long-term success.

Over the past two decades, the Internet, cloud computing, and smartphone adoption have driven radical fintech innovation. Today, AI is advancing in ways that will be equally, if not more important, to financial services than these previous tech revolutions. While many investors are jumping whole hog into financial services AI investing, we’re being more thoughtful.

There’s no doubt that AI will absolutely transform the entire financial services landscape. But in a world where model performance standardizes over time and the cost of developing software goes to zero, the real value in financial services boils down to having massive amounts of private, un-crawled data, and proprietary distribution channels. Right now, it’s mostly incumbents—banks, insurance carriers, etc.—possessing that. Who will be the Chase Bank of AI? Chase Bank.

That’s not to suggest that opportunity is limited for startups, just that incumbents have a huge head start as a result of the treasure trove of data at their disposal. Data is the new gold—whether it’s terabytes of transaction data, reams of unstructured customer service interactions or data ingested across disparate systems within the organization.

The Fintech Frontier

Of course, financial services behemoths are not the only companies that can claim they have unique, proprietary data.

We see it two ways: companies can either prospect for data gold or can make their fortunes being purveyors of picks and shovels to those with the data gold.

Prospectors

Prospectors hope to build enduring value through unique and proprietary data, generally in the applications space. The chances of striking gold are low but the rewards are immense—if an entrepreneur can create a truly valuable dataset, it could be massive. These companies understand that proprietary data is the key to creating sustainable value in a world where algorithms and infrastructure are increasingly commoditized.

Take Inspectify and Fairmatic as examples—both are companies that accrue mass amounts of data for industries reliant on that data.

Inspectify streamlines the home inspection process. To do that, they’re accumulating detailed information on millions of homes—everything from the brand of appliances to the condition of the foundation. This one-of-a-kind dataset is valuable for the entire real estate ecosystem, from insurers to contractors to investors. Inspectify’s data asset is unique and difficult to replicate, giving them a strong competitive advantage.

Fairmatic is revolutionizing the commercial auto insurance space by building an exclusive database with over seven billion miles of driving data. That allows them to underwrite policies with precision unmatched in the industry. The result? Loss ratios significantly lower than industry benchmarks. Fairmatic’s data-driven approach not only improves their bottom line but also creates a defensible moat.

What sets these Prospectors apart is not just their ability to acquire data but their vision for how that data can be transformed into valuable products and services. They’re not hoarding data for its own sake but developing sophisticated strategies for monetizing it in ways that create value for all stakeholders.

Companies that fit the “tech over fin” model with their own proprietary data sets can be real outliers in terms of value creation and we’re on the hunt for more projects that fit this mold.

Purveyors

On the other hand, Purveyors are the startups providing the picks and shovels in this data gold rush. They’re creating tools and platforms that help incumbents extract value from their vast data reserves. While large financial institutions have the raw materials, they often lack the skills and agility to fully capitalize on their data.

Canopy, for instance, offers a modern platform that helps lenders manage loans and maximize collections by harnessing underwriting and payment data. Push Cash plans to help companies quickly underwrite risk to facilitate instant money movement upon account opening—a game-changer for industries like stock brokerages and wagering.

The potential of the Purveyors is significant. They’re democratizing access to cutting-edge AI and data capabilities, putting powerful tools into the hands of incumbents. While their offerings might not be as glamorous as the Prospectors’ data troves, they’re just as essential to the future of fintech.

In a fintech landscape increasingly defined by AI and data, the Prospectors and Purveyors are staking their claim to the future. They will be the ones to lead the industry into a world of data-driven innovation and value creation, whether by unearthing new data gold mines or providing the tools to extract their value.

Picking the Winners

Our fintech investment strategy remains consistent through hype cycles or market fluctuations. But our tactics do change—identifying the fundamental shifts reshaping fintech, like the rise of data, AI, and the opportunity for partnership between startups and incumbents.

Our Fintech Team has honed guiding principles that help us navigate this dynamic environment and identify the winners. These aren’t just abstract ideas—they’re hard-won lessons from the trenches, and they’ve been critical to our success:

- We prioritize depth over breadth. Rather than spreading ourselves thin, we focus on select domains where we believe the opportunity for transformation is greatest, like data-driven underwriting, AI-powered risk management, and embedded fintech infrastructure. This deep expertise allows us to identify the startups truly moving the needle and providing them with meaningful support.

- We look for founders who share our vision for the future of fintech. Not those chasing the latest fad, but those who understand that success comes from applying innovation to solve real customer problems. We back entrepreneurs with the vision and grit to reshape the fintech industry, those who measure their success not just in valuation jumps but in lives impacted.

- We believe in the power of partnership. While the power of partnership between startups and incumbents isn’t a new idea, it’s never been more critical than in today’s fintech landscape. The winners will be those who can effectively bridge the gap between cutting-edge technology and complex, regulated industries. We look for startups that have the technical chops, the industry savvy, and the collaborative mindset to make these partnerships work.

- We’re committed to supporting our companies for the long haul. Building a successful fintech startup is a marathon, not a sprint. It requires navigating complex regulatory landscapes, building customer trust, and continuously innovating to stay ahead of the curve. We stand shoulder to shoulder with our founders throughout their journey, providing the capital, expertise, and network they need to succeed.

We back the visionaries who are shaping the future of finance, the ones who are turning data into gold and using technology to build a more efficient, more inclusive financial system.

If you’re a founder who shares this vision, who’s ready to build the next generation of fintech giants, we want to hear from you. Email us at cmoldow@foundationcap.com or nstainfeld@foundationcap.com.

Let’s work together to shape the future of finance.

Published on 04.10.2024

Written by Charles Moldow and Nico Stainfeld