A New “Golden Age” for Alternative Lending

09.07.2023 | By: Charles Moldow, Nico Stainfeld

It’s no secret that 2023 remains a challenging year for companies of all kinds. Existing business plans continue to be upended by stubborn (albeit stabilizing) inflation, supply chain disruptions, wage pressures, and escalating geopolitical tensions.

Among those most impacted are lenders, who have been hit particularly hard by the double-whammy effect of rising interest rates and inflation. The Fed’s relentless rate hikes (which have pushed rates to their highest level in 22 years) have increased the cost of lenders’ products for borrowers while decreasing the appeal of their loan assets to investors on a risk-adjusted basis. In 2021, there was a surge of optimism around LendingTech, with many hailing it as a “golden age” for the sector. Today, many of the same voices argue that fintech investments can’t generate attractive returns, period.

At Foundation Capital, we take a different stance. We’ve been investing in LendingTech before the term was coined. For over 15 years, we’ve backed companies such as LendingClub, Doma, Auxmoney, OnDeck, Kiavi, Figure and Upgrade that have defined the category. Since we began investing in this space, which originated with unsecured consumer loans in the mid-2000s, LendingTech has gradually expanded to include auto, BNPL, factoring, mortgage, real estate, receivables, SMB, and student loans, along with other forms of specialty finance.

While LendingTech has many applications, I’d like to focus in this post on one of the areas where it has been most disruptive: alternative lending. Alternative lenders use online platforms to connect borrowers who are underserved by traditional lending institutions with investors seeking attractive, yield-generating ways to put their capital to work. Alternative lenders turn to technology to gain a competitive edge: for example, by underwriting borrowers’ credit risk with predictive AI models, acquiring customers using digital marketing, automating loan servicing through custom software, and providing customer service with AI chatbots.

Despite the pain LendingTech is currently experiencing, it’s my firm belief that we’re slowly but surely moving towards a new “golden age” of alternative lending. This post will explain why.

But first, let’s take a brief detour through recent history.

The Rise of Alternative Lending (2009-2021)

Between 2009 and 2021, we experienced a near-unprecedented era of free capital. Capital allocators were desperate for high-yielding investment opportunities due to the lack of return (or even negative return) from traditional forms of debt like mortgages or bonds. As a result, alternative lenders became very desirable options for capital deployment, offering risk-adjusted yields exceeding 8% compared to the almost zero return of risk-free treasuries.

Further feeding the growth of alternative lending was the highly favorable macroeconomic environment. As consumers and businesses continued to grow and demand more capital to fund additional growth, default rates remained extremely low. These trends continued even through the economic shocks of the pandemic thanks to massive government intervention and stimulus.

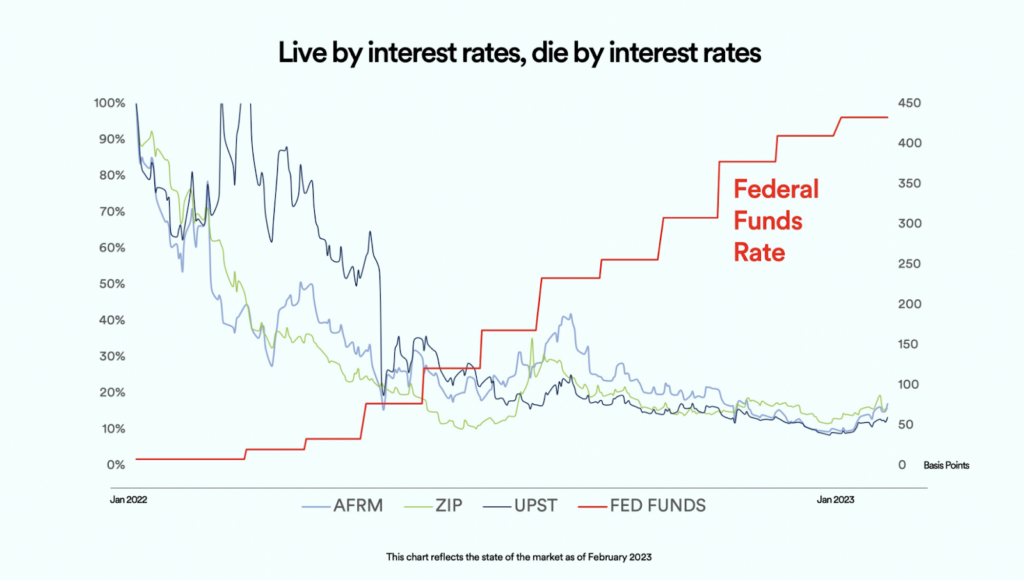

When capital is readily accessible, and demand for loans is high, lenders of all types experience rapid and profitable growth. As a result, markets became overly excited and drove valuations for alternative lenders to all-time highs. By way of example, at its peak in the fall of 2021, Upstart traded at more than 30x revenue: a figure that has since cooled to around 3x, up from just 1x at its lowest point. Similarly, Affirm saw its market cap balloon to $48 billion at its peak; that number is now hovering around $5 billion. These valuations were lofty even among the ranks of high-growth, high-gross-margin SaaS darlings.

This era of plentiful capital made alternative lending products appear extremely attractive to both consumers and investors. But, as it turns out, not all that glitters is gold.

R.I.P. Good Times (2022-present)

The good times came to a screeching halt in early 2022, as they always eventually do. Lenders (and much of the innovation economy as a whole) have been forced to grapple with rising interest rates, inflation, and a surge in consumer defaults.

Looking back, it’s striking how quickly the tables can turn. The two strongest tailwinds—low inflation and high growth—have quickly become headwinds. Higher interest rates have suddenly offered capital allocators a plethora of high-yield, low-risk alternatives like bonds. As capital has moved to these newly attractive opportunities, it has rapidly rotated out of the alternative lending category. This is only logical: if you can get high yield with low risk, why settle for high yield with high risk?

At the same time, growth has slowed dramatically, with a weaker economy leading to an erosion in loan performance. From there, simple bond math tells us that elevated defaults will pull down the yields of these assets, making them even less attractive. From there, the death spiral is on: originators must tighten their underwriting criteria to control losses, which dramatically slows origination and growth. This means less revenue and, with a fixed cost structure that is likely way out of whack, higher cash burn. Because lenders can’t slash operating expenses quickly enough in the free fall, many don’t survive the transition, or live on only to become a shell of their former selves.

Five Reasons for Renewed Optimism

But, fear not, all is not lost! For all the doom and gloom around LendingTech, a new golden era for alternative lending is fast approaching. Here are the five catalysts that we expect to drive it.

1. The Return of Cheap, Abundant Capital: With inflation cooling, we’re likely to see interest rates follow suit in the medium term. This shift will once again make alternative asset yields attractive. As the capital floodgates reopen, cash will become both readily available and affordable.

2. Strong Value Prop to Consumers: As the cost of capital comes down, alternative lenders are poised to regain their competitive advantage over traditional giants like banks and credit card companies. These established players, who previously hiked rates aggressively to counteract the deteriorating quality of credit, will be intentionally slow to reduce rates. That means that, even as the Fed cuts rates, these lenders will hold their rates steady to maximize their interest income from their large existing customer bases. Their strategy bets on customer inertia and the steep costs associated with switching banks.

Alternative lenders, who are unencumbered by extensive existing customer bases and highly reliant on acquiring new customers for growth, can turn these market dynamics to their advantage. By promptly reducing their lending rates when market rates decline, they can attract a new cohort of borrowers who are dissatisfied by the lagging response of traditional lenders. Even as they lower the interest rates that they charge new borrowers, the corresponding decrease in the cost of capital will yield wide interest margins. These margins will soon translate into high profitability, even when accounting for potential defaults and recoveries.

Beyond just interest rate considerations, some of the fastest growing and most profitable alternative lenders are using product innovation to deliver unique value to consumers. Take FC portfolio company Upgrade as an example. Upgrade designed a new kind of credit card that turns every purchase or card balance into an installment plan with fixed rates and straight-line amortization. This allows consumers to avoid the traps of endless revolving debt that come with typical credit cards. Such innovations are good both for consumers, who enjoy more responsible and lower-cost credit, and for business: Upgrade Card has been the fastest growing credit card in the U.S. for the last three years, and Upgrade is now the only fintech company among the top 20 largest credit card issuers in the U.S.

3. Leaner, Meaner Operations: In the face of recent downturns, alternative lenders have tightened their underwriting criteria to accept only the very best customers. Many have also pared down their bloated operating infrastructure, which was a vestige of boom times. These leaner lenders, with their rationalized cost base, are well positioned to enjoy high operating margins when capital once again becomes abundant. In addition, while traditional competitors face internal obstacles to innovation, these smaller, more agile lenders can adopt cutting-edge technologies like generative AI to enhance their marketing efforts and improve customer service.

A prime example is FC portfolio company Lending Club, which, according to a recent J.P. Morgan research report, has 40% lower costs to originate loans when compared to the broader industry.

4. Battle-Tested Risk Models: Before committing capital, investment managers want to see how alternative lenders’ models perform in various economic climates, both favorable and adverse. Despite the turbulence of the past three years, many alternative lenders have been able to demonstrate robust loan performance. This hard-won track record has built crucial trust with investors.

5. Market Share Gains: Lastly, those alternative lenders who have weathered the downturn will face less competition and are in a prime position to gain market share once they turn their acquisition engines back on.

Fintech “locals” understand these cycles. In the coming months, they’ll have fresh evidence to show that fintech investing can indeed lead to outsize rewards.

Let us know what you think!

If you’re working at the intersection of lending and technology, we’d love to hear from you! Reach out at cmoldow@foundationcap.com or nstainfield@foundationcap.com.