How We Practice

At Foundation, we support entrepreneurs at the earliest stages, when their ideas have yet to become innovations. As one of their first investors, we help them bring these ideas into the world. From taking their first board seat to helping them close their first hire, develop and iterate on their first product, and acquire their first customer, we back our founders at every step of their journey.

Our approach to investing in founders distills into three guiding principles: We go early. We go deep. We go big. When pursued repeatedly and in parallel, these principles allow our portfolio to be resilient, even as market conditions shift. Let’s explore each one in detail.

Early Stage: Founders’ first check

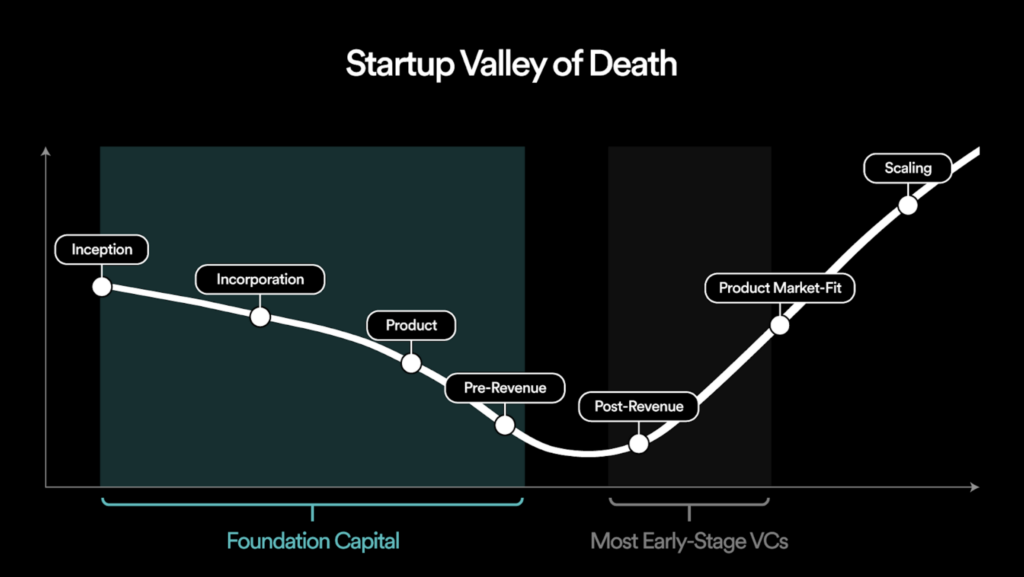

We like to invest in companies before they have revenues or, sometimes, even a product. We think about this in the context of the “valley of death”: the critical initial period when a startup’s operations have begun but it hasn’t yet generated positive cash flows. Crossing the valley of death requires founders to translate their technology into a product, identify demand for that product, and establish a stable of customers. These first few years of a startup’s life are when the combined expertise of our investing team can have the most impact. By standing behind our founders from day one, we ensure aligned incentives. Our successes are shared and interdependent.

Deep Conviction: Firmly held beliefs about the future

Conviction is a crucial prerequisite for any investment. However, in the inaugural days of company formation, when it’s just a few people and a pitch deck, conviction is paramount. In the case of early-stage venture investing, conviction goes beyond simply a strong belief: it entails a compelling perspective about the future. In our case, the future of work and enterprise software, finance and banking, and decentralized networks and protocols.

Conviction stems from developing a prepared mind on a particular problem space. Through primary research and first-principles thinking, we form hypotheses about markets, trends, and emerging technologies. We then refine these hypotheses in collaboration with builders, entrepreneurs, prospective customers, and the smartest people we know in a given area. We do this with speed and focus, over and over, all in support of surfacing uniquely interesting investable insights, including subsectors we like more than others, and attributes of a great investment or team in this area.

This level of immersion demands focus. Foundation isn’t trying to be everything to everyone. By honing in on three practice areas—enterprise, fintech, and crypto—we’re able to identify promising opportunities before they’re broadly obvious. Our practice areas act as interconnected circles that facilitate the exchange of ideas and insights. In our experience, creativity arises in the crosshairs. We thrive at these areas of intersection, which require us to balance focus and humility: a prepared mind and an open one.

Ultimately, innovation comes not from our foresight but from that of our founders. Products and markets are important, but an early-stage company’s success turns, first and foremost, on its founding team and the culture they create. Accordingly, we place high importance on getting to know prospective founders. To separate the merely great from the truly exceptional, we need to understand both their capabilities and their personalities. How scrappy, tenacious, and resilient are they? How nimbly can they navigate ever-changing tides? What unique attributes and experiences enable them to succeed where others stumble? Answering these questions allows us to discern what makes them tick and how they’ll react when the going gets tough.

High Touch: Sleeves-rolled-up involvement

Once the term sheet is signed, the real work begins. Most companies, perhaps over 95%, fail to cross the valley of death. Both our success and that of our founders depends on beating those odds. “Crossing the valley of death” is another way to express the process of turning ideas into innovations. This is where our strategy’s third pillar, high touch, enters. At its center lies a finely-tuned assembly of proprietary networks, communities, and platforms dedicated to supporting our founders.

First, we help our founders position their company and convey its “so what’s?” and “why nows?” to others. Once they have a powerful story and potentially a product, founders need a team to both realize and scale their vision. We provide the guidance, resources, and network they need to build winning teams. We do this through FC Talent: a bespoke recruiting function dedicated to co-piloting all things people and talent with our portfolio companies.

After the founding team and product are set, the next step is to find customers. That’s where FC Compass comes in. Compass is our customer network consisting of over a hundred VPs of security and engineering, together with AI leaders from top tech and Global 2000 companies, such as Coinbase, Crowdstrike, Samsung, and Walmart. This network is purpose-built to connect our companies with initial design partners and long-term customers alike. Along the way, FC Compass has evolved into a valuable source of insights into market trends and state-of-the-art technologies. It’s also grown into yet another powerful tool for bringing top entrepreneurs into our orbit. These relationships allow our founders to benefit from the collective wisdom of peers who have been there themselves.

Last but not least, we help founders raise their next round of funding and in many cases co-pilot the entire process.

Each of these principles—early stage, deep conviction, and high touch—returns to our steadfast belief in human ingenuity and the power of technology to create a better future. By focusing on the early stage, carefully building conviction, and offering hands-on guidance, we’ve established a track record of backing founders whose innovations, seeded from unique and contrarian ideas, reshape industries. Each aspect of our approach is tailor-made to empower entrepreneurs with the resources they need to move from budding vision to real-world impact. Consistently executing this strategy is what separates a passing tweet from an enduring venture practice. This is what we, at Foundation Capital, commit ourselves to daily.