A Technical History of Blockchain Design, Innovation, and Narratives

Part I: How Major L1s Have Evolved & The Technical Legacy of Bitcoin

12.19.2023 | By: Alejandra Martinez, Rodolfo Gonzalez

This historical analysis helps new founders decide where to build by exploring each network’s technical innovations in their historical context. Foundation Capital has been investing in — and rooting for — this space for ten years. Our deep, long-term involvement means we’ve developed a time-tested view of how major L1s have achieved their current dominance and how their initial technical accomplishments will define them going forward.

In this three-part piece, we outline how Bitcoin, Ethereum, and Solana have developed over time. In doing so, we’ll cover how their unique architectural breakthroughs — as well as the design decisions that have followed from their inception — position each toward a particular set of use cases, both today and going forward. We believe these three ecosystems illustrate how, in the context of blockchains, technical breakthroughs enable new design spaces. Only then do narratives emerge as a way to keep onboarding new users and developers.

In this first part, we establish technical accomplishment as the core driver of blockchain evolution. We then use this lens to evaluate Bitcoin’s history, its current state, and future implications for builders.

Part I : How Major L1s Have Evolved & The Technical Legacy of Bitcoin

Part II : Ethereum, The World’s Computer

Part III : Next-generation chains and the birth of Solana

Introduction: How Major L1s Have Evolved

Technology is the bedrock of blockchain history

Blockchains, like all engineering projects, require multiple trade-offs to accomplish their goals. Each successive generation of blockchains has improved upon the past and made distinct design decisions to achieve new technical accomplishments. Design tradeoffs during this process created the conditions entrepreneurial developers need to explore new technical possibilities and build new businesses. Over time, developers test what use cases are possible (and not) within each network and collectively craft new narratives that attract users, capital, and supporting ecosystem participants. These networks and their ecosystems are now collectively worth hundreds of billions of dollars, with thousands of developers actively contributing to them.

During our decade of investing in crypto, we at Foundation Capital have identified and consistently invested in this specific pattern: technical accomplishment, not narrative, as the catalyst for all ecosystem development. When blockchains achieve new technical breakthroughs, developer talent and users follow. Our observations stem from our conversations with hundreds of founders across ecosystems and the 30+ projects we ultimately invested in. We’ve had great success and have also seen some projects ultimately fail, but our overall returns in the sector reinforce our conviction that thoughtful investment with a long-term view pays off.

We believe the biggest outcomes emerge from founders who are pushing technical innovation and knowledge creation in their respective ecosystems. This belief lies in contrast to what crypto Twitter and podcasts frequently convey. If you follow crypto social media, it’s easy to think that crypto is driven primarily by narrative, especially in the past few years. Loud voices and polarization, however, are motivated by the large financial incentives for becoming a public figure in the space, not for ground-level truth. Parsing reality from pocket padding is difficult, even for professional investors.

In the nearly fifteen years since Bitcoin’s launch, millions of crypto networks and assets have emerged. While there exists an abundance of tokens, the number of successful blockchain ecosystems remains small. Few ecosystems have garnered enough activity to really put their respective claims of technical breakthroughs to test. We chose to look at Bitcoin, Ethereum and Solana, based on their relative maturity across six criteria: technical differentiation, economic security against double-spend attacks and other network takeovers, positive economic incentives, developer interest, user engagement, and ecosystem support.

In this essay, we analyze each major network’s original breakthrough within the broader context of crypto’s technical innovations, their current state and roadmap, and our read on the implications for building in each ecosystem. Our hope is to provide a cross-ecosystem view for prospective founders new to their crypto startup journeys. One last caveat is that we mostly avoid questions of tokenomics in this piece, both for focus, and to keep an already sprawling text from expanding even more.

Bitcoin: From P2P electronic cash to store of value

Predecessors

A surprise to many who are early in their crypto journey is that blockchain history didn’t start with Bitcoin. Quite the opposite: the Bitcoin whitepaper was the culmination of decades of research and advancements in computer science, cryptography, economic research, cybersecurity, and other fields. There were multiple attempts at creating decentralized digital currencies throughout the 1980s and 1990s, and this history is a fascinating area of research whose artifacts often reside in cypherpunk forums and mailing lists.

In the 1980s, David Chaum proposed eCash, a form of anonymous electronic cash which encrypted information (i.e., participants, amount) passed between individuals. In 1996, e-gold was the first cryptocurrency to enable peer-to-peer transactions while fully operating on the web. Two years later, Nick Szabo proposed Bit Gold. Bit Gold enabled peer-to-peer transactions while avoiding centralization through a title registry which stored new blocks through a proof of work system. That same year, Hashcash was built to prevent spam and DDoS attacks. Its hashing algorithm created an easily verifiable output that required brute force to crack, introducing a new level of security compared to prior proof of work proposals.

These projects failed for different reasons: some lacked decentralization and relied on third parties, others had economics that didn’t scale, and some remained academic experiments. While these predecessors didn’t survive, their legacy of anonymous transactions, decentralized systems, and secure consensus mechanisms paved the way for the technical innovations in the networks we use today.

———

Bitcoin’s technical breakthroughs

Proof of Work and other technical innovations

Several cryptocurrencies came before Bitcoin, but all of them were missing the key ingredient: a solution to the Byzantine Generals Problem with open-membership (to defend against untrusted nodes), and consequently the double-spend problem, via a permissionless network. Bitcoin solves both problems with its Proof of Work (PoW) consensus algorithm, where transactions are verified by a network of computers that continually compete to solve hard mathematical puzzles in a way that is prohibitively expensive to fake. Computing the answers to these puzzles — otherwise known as Bitcoin mining — is costly and difficult, but worth pursuing given the rewards. The miner who wins each competition is awarded Bitcoin tokens, at a pace of about one block every 10 minutes.

The results of each block competition are posted to Bitcoin’s distributed ledger along with the whole transaction history of the network – the full transaction history is publicly available for any node to maintain a copy and for anyone to download or query. Satoshi Nakamoto leveraged asymmetric cryptography in the design of the network: the expensive hashing computations performed by miners are hard to fake and costly to arrive at, but verifying the answers across the network is cheap and easy. This scheme solved the message propagation bottlenecks that typically bog down network consensus algorithms as their number of active nodes increases.

Security and resilience

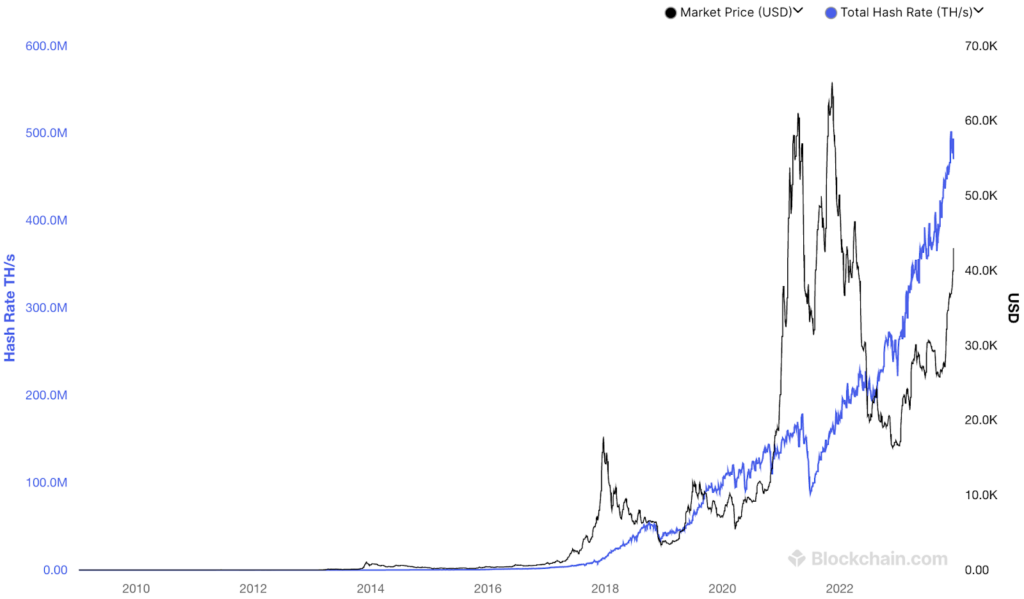

Bitcoin is now the longest running, most valuable by market cap, and most decentralized by holders of any cryptocurrency network. It has survived countless attacks by sophisticated and well-funded actors, as well as by the media, politicians, and the traditional financial industry. Despite its 474+ recorded obituaries, Bitcoin has proven impossible to kill thanks to its very compact protocol design, which makes it extremely secure but also lightweight enough that the hardware requirements for keeping a copy of the ledger are modest. Because the network produces blocks continuously and hashing power (the aggregate computing power dedicated to mining blocks) keeps increasing, it’s become substantially more costly and difficult for the network to suffer a 51% attack each passing year. This resilience is all thanks to a hardened ecosystem of believers and participants, i.e. miners, exchanges, and users. The main trade offs Bitcoin’s security and resilience create are its slow speed: 10-minute block times, maximum throughput of 12 transactions per second, and limited programmability. Over time, the security-first ethos has created a dev culture in which the default is not to change the protocol. This conservative culture relegates most experimentation on use cases and throughput to Bitcoin L2s.

Bitcoin Hash Rate

Growing hash rate over time maintains the security of the network (Source: Blockchain.com)

Transition to a store of value

Despite its remarkable success, Bitcoin’s initial vision of a “peer-to-peer electronic cash system” remains unfulfilled. Bitcoin’s narratives have evolved over the years, with two dominant ones emerging: Bitcoin as censorship-resistant e-gold (a store of value) and Bitcoin as the native reserve currency for the crypto economy. The former vision is compatible with Bitcoin’s original architecture, especially given its programmatic and finite supply schedule. The latter, in which Bitcoin is the numeraire for other currencies and implies more frequent transactions, requires additional technical accomplishments from the ecosystem, which could steer the network toward other types of economic activity.

Legal issues and privacy

How privacy and anonymity are perceived in the context of Bitcoin demonstrates how its narrative has evolved. Namely, asymmetric cryptography being implemented on a fully distributed, public ledger drove many early users to severely overestimate the privacy-preserving properties of the network, while also severely underestimating the permanent traceability of transactions. In the first few years of Bitcoin, privacy-oriented users saw it as a currency outside the government’s control (true in terms of supply), which could help them avoid surveillance, which has now proven untrue.

Bitcoin’s early use in dark-web marketplaces jumpstarted a cat and mouse game that gave rise to a set of technologies to obscure (and reveal) the traceability of blockchain transactions. As the network’s fame and value grew, security researchers and law enforcement agencies started aggregating datasets to identify wallet owners and to deanonymize blockchain transactions (Tracers in the Dark and many episodes of the Darknet Diaries podcast are great sources on this topic.) As tracing technology evolves and crypto wallets interact with more of the traditional financial system, illegal transactions conducted on crypto networks have now shrunk to less than 15 basis points of total transactions. The appeal of using crypto to skirt the law has diminished so much that by April 2023, even organizations like Hamas have suspended public-facing crypto fundraising activities.

———

Bitcoin’s current state and recent innovations

Block wars and scaling challenges

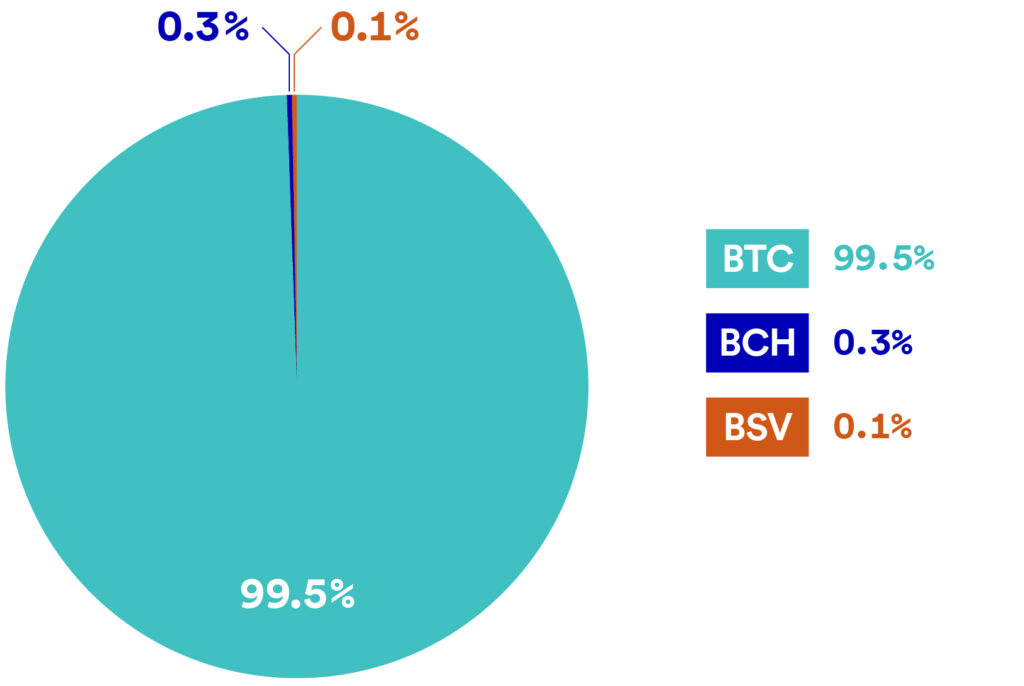

Bitcoin’s compute and energy requirements, consensus algorithms, and data storage architecture make it hard to support and scale high-throughput and highly programmable use cases. Tradeoffs between block size, throughput, security, and decentralization underpin the discussion of Bitcoin’s technical roadmap. As a result, the Bitcoin community has gone through intense debates, many resulting in schisms, i.e. hard forks, to define what changes to the protocol are acceptable and desirable. Through these rifts, the store of value narrative has won for the base layer of the network. Forks have mostly tweaked parameters rather than bringing unique technical accomplishments that would attract new users and incentivize a switch. All BTC forks (BCASH, BSV, etc) combined have less than 1% of the market cap and hash power of the original BTC network. However, we see desire for other use cases elsewhere: at publication, wrapped Bitcoin in Ethereum DeFi has a higher market cap than Litecoin, which was touted as a BTC testnet in its earlier days.

Hash Rate of Largest Bitcoin Forks

BCASH and BSV average hash rates (1.7 and 0.6 EH/s, respectively) are significantly below Bitcoin’s (488.7 EH/s), making them more subject to attacks (Source: BitInfoCharts)

As a store of value, a slow, measured evolution of the protocol has become a desirable feature rather than a bug. Recent upgrades like SegWit in 2017 and Taproot in 2021 gave Bitcoin more flexibility and security (albeit with their own set of trade-offs). Eliminating data storage caps helped the rise of Ordinals (Bitcoin “NFTs”) and tokens through BRC-20. While much of the efforts to scale Bitcoin and other networks focus on throughput, exploring its systems’ design space and narratives goes far beyond tweaking block size in the pursuit of more transactions per second.

Layers

Most other use cases, including P2P e-cash and programmable money, will happen via layers. Layers operate on top of the base layer, in this case Bitcoin, to give it additional scalability and functionality not possible within the confines of a base layer’s design. Stacks, a Foundation Capital investment, is working to introduce smart contract functionality, greater degrees of openness, and new token structures to the network. Their upcoming Nakamoto Release promises to bring forth a trust-minimized two-way Bitcoin peg system via a 1:1 BTC backed assed on the L2 called sBTC, which will enable native, fully expressive smart contract deployments. Other sidechains are introducing EVM compatibility to Bitcoin, enabling DeFi on Bitcoin with Ethereum programmability.

The Lightning Network aims to enable fast and cheap transactions on-chain with payment use cases in mind. As of Q3 2023, adoption of these new capabilities is still in its early stages. Liquidity within the Lightning Network, down from its July 2023 peak, is still 0.5% that of Ethereum in DeFi contracts. Ordinals have seen some adoption, but marketplace transactions declined to almost zero before recovering to previous highs during Q4 2023. Ordinals’ inconsistent traction demonstrates that additional functionality will take time to find its place within Bitcoin’s broader story of scarcity.

Looking forward, many of the latest BIPs are focused on the application layer. We believe the adoption of such proposals will precede new business models based on Bitcoin transactions, while testing the boundaries of Bitcoin’s design and its willingness to adopt new scalability products. For example, a new proposal, BitVM, proposes using off-chain computation to enable more advanced Bitcoin apps without needing to fork the Bitcoin L1. BitVM could allow the movement of BTC to L2 (like the sBTC peg) in an even more trust-minimized design.

———

Implications for building on Bitcoin

Speed of innovation

As exemplified by Bitcoin’s limited scripting language, security always comes before innovation.

Most new technical innovations in BTC will come from true experts in the protocol and highly technical minds have already explored much of the network’s native possibilities. That pool of developers is very small in number and its growth is beginning to stagnate. These developers also need political and financial capital to campaign over many years to successfully enact any protocol updates. Furthermore, a large share of the Bitcoin community is deeply skeptical of any other tokens or networks, closed or federated, adjacent to Bitcoin’s, and a subset of the community is also skeptical of use cases that don’t conform to the Store of Value narrative.

Much of core BTC development centers on how to make more efficient use of its limited block space. This constraint makes it harder for newcomers to try new, “fun” experiments than on other chains. We believe this is the main reason there are few sizable or credible teams (probably less than 20), trying to scale Bitcoin at the protocol level, even when including layer 2s, sidechains, etc. We salute Blockstream, Rootstock, and a long list of loosely associated contributors for their longstanding commitment and contributions to the advancement of Bitcoin.

We anticipate that most of crypto’s new use cases will emerge and scale on other chains first, even though many of these experiments can be traced back to early Bitcoin forums. We also agree with Muneeb Ali, the founder of Stacks and Trust Machines, that “worthy” experiments will eventually make their way to Bitcoin, as long as it continues to be the largest L1 by market cap and user base. We’ve now seen this phenomenon with smart contracts, inscriptions, and NFTs as they’ve gone from Ethereum to Bitcoin. By sheer size, successfully implemented experiments in Bitcoin could have an outsized impact on the industry for the foreseeable future.

Institutions and TradFi

In contrast to Bitcoin’s slow evolution at the protocol level, we expect the pace of innovation among its support ecosystem of miners, custodians, wallets, and exchanges to accelerate. Bitcoin holds a unique place in the minds of institutional investors and regulators across the globe, and is the most supported network in existence. Many in TradFi are working to bring structured and regulated Bitcoin products, like Bitcoin ETFs, to markets around the world, potentially providing additional financial exposure to the space. In our conversations with institutional investors, barriers to adoption include self-custody of assets, KYC, AML, and asset handling compliance, plus the need to use custom software to deal with anything in crypto. We expect substantial and continuous innovation for facilitating the interaction between the traditional financial system and Bitcoin.

Bitcoin’s economic security made it the first crypto network, but this hallmark means it is not natively built for high-throughput use cases. Measured innovation is desirable for the store of value narrative that has taken hold, so truly novel use cases are bound to arise on other chains first. However, because of its size, value, and resilience Bitcoin will remain influential for a long time to come.

Stay tuned for part two of this series, where we’ll dive into the Ethereum chapter of blockchain history — its contributions of programmability and Proof of Stake, its challenges, and its role in the ever-evolving blockchain ecosystem.

Thank you to Muneeb Ali, Xen Baynham-Herd, Anatoly Yakovenko, Raj Gokal, Jon Wong, Mert Mumtaz, Annie Weiss, Steve Vasallo, Andrew Han, and Charles Moldow for your feedback and contributions to this three-part piece.

Published on 12.18.2023