A Technical History of Blockchain Design, Innovation, and Narratives

Part III: Next-generation chains and the birth of Solana

12.21.2023 | By: Alejandra Martinez, Rodolfo Gonzalez

In the previous installment of our three-part history of blockchain innovation, we explored how Ethereum introduced programmability, Proof of Stake, and a flurry of new energy to blockchain. In the last part of the series, we’ll discuss Solana’s origins, accomplishments, and our expectations for it as the leading next-generation chain. We’ll then wrap up the series by weighing Solana versus Ethereum and reflecting on the space as a whole.

Part I : How Major L1s Have Evolved & The Technical Legacy of Bitcoin

Part II : Ethereum, The World’s Computer

Part III : Next-generation chains and the birth of Solana

———

As discussed in previous sections, Bitcoin and Ethereum’s architectures make it impossible to scale throughput without relying on additional layers or introducing tradeoffs in security, composability, and data availability. Ethereum launched in early 2015 and revolutionized the space, but at that point many other entrepreneurs and developers were already looking for breakthroughs that would improve transaction throughput by several orders of magnitude through experimentation with alternative architectures. Ripple’s founding, for instance, dates back to September 2012.

Two major camps in the development of these next-gen chains emerged: first, EVM-based chains like Avalanche, Cardano, NEAR, and Polkadot, which rely on different sharding techniques to scale “modularly.” Second, monolithic chains, such as Algorand and Solana (both Foundation Capital investments), and more recently, networks like Aptos and Sui, which bet on integrated architectures. Collectively, these networks all aim to deliver step change improvements in network throughput, with sharding versus no-sharding as the core difference in their approaches.

These networks each introduced new consensus algorithms, powered by technologies like parallel transaction processing, verifiable delay functions, new block leader selection mechanisms, and message propagation protocols. They were also written in newer, web-scale, backend languages like Rust. Most of these new networks launched natively as Proof of Stake, and typically rely on powerful hardware to run their nodes, later developing light clients to verify transactions. These nodes are often hosted in data centers maintained and monitored by specialized providers incentivized via staking rewards, though many high-end home computer setups hooked to residential bandwidth can now also run these nodes.

Collectively, buliding these new networks looked impossible to all but the true believers. They had to maintain the security guarantees accomplished by Bitcoin and Ethereum, plus Ethereum’s programmability, while also materially improving performance and scalability. If nothing else, these next-generation chains have delivered multiple truly impressive technological feats, pushing the boundaries of performance, scalability, throughput, and transaction costs while preserving the security of their networks. They’ve also proven that bootstrapping alternative blockchain networks to scale is possible if the value proposition is strong.

Some of the Foundation Capital team’s best memories in crypto come from having a front row seat to seeing these incredible entrepreneurs go from publishing their ideas in whitepapers to launching networks in just a couple of years, all while avoiding a few brushes with death in the process. As these protocols solidify their performance and reliability, they’re becoming increasingly attractive launchpads for developers and entrepreneurs to try their luck at building the next big thing.

Out of these next-generation networks, we’ll focus on Solana, a Foundation Capital investment, as it has fostered the most vibrant next-generation developer ecosystem. We consider Solana the most promising of the next-generation networks, quickly becoming the one of the most prominent ecosystems to build venture-scale opportunities in crypto.

———

Solana: Global state at the speed of Nasdaq

Solana’s technical breakthrough

Solana’s founding vision was to create a global state with the speed of NASDAQ. This goal required an architecture that could securely execute both large and small transactions affordably. A good analogy for that architecture is a telecommunications network transmitting and coordinating messages across devices using a single clock. For those just ramping up on their knowledge of the network, we recommend listening to this podcast episode with Solana founder Anatoly Yakovenko. In it, he shares the network’s origin story, plus his take on technical aspects like hardware and bandwidth requirements of the network’s design.

Cover of Solana’s seed round pitch deck (2018). The protocol was originally called Loom.

The design goal of Solana is for the whole network to match the performance of a single node so that everyone in the world can access information simultaneously: a global state eventually supporting thousands of transactions per second. Solana’s foundational insight came from using Proof of History (PoH) for transaction ordering, memorialized in the “two coffees and a beer” story. This mechanism mathematically accounts for the passage of time, generating a timestamp for each transaction to enable transaction ordering. Now understood as a “verifiable delay function (VDF),” this clock-before-block consensus serves as the organizing force for defining how the rest of Solana’s technical innovations process transactions.

Solana’s founders reimagined the entire blockchain transaction flow, relentlessly optimizing each step of the transaction lifecycle to push performance using their new ordering method. Eight core innovations were proposed, including PoH-optimized replication algorithms, propagation algorithms that let Solana avoid creating a mempool, and parallel smart contract runtime. While not all of the core innovations made it to the final design in their original form, it’s important to mention that these technologies, while new in the context of blockchains, are actually adaptations of battle-tested techniques applied in telecom, chip design, and high-performance distributed systems. So while there was risk early on as to whether the pieces would fit together and work well (proved positively so far), the network’s future roadmap has begun to de-risk in terms of scalability, security and functionality. Performance improvements will come from optimizations at both the hardware and software levels, which will be more straightforward than the scalability roadmaps of other blockchains.

Solana’s design positions it well for future use cases and demand. The network has a high degree of composability: raw transaction data is instantly available, its large block sizes enable cheap transactions, and the network can already process 5,000+ transactions per second. Since launch, Solana has processed over 200 billion transactions — orders of magnitude more than all other blockchains combined!

———

Solana’s current state and recent innovations

Infrastructure

Not everything has been smooth sailing on the technical front for Solana. The network has had multiple downtime challenges at the infrastructure level. 2023 was a year focused on stability, and through recent updates the network hasn’t seen any downtime in the last 10+ months. With the upcoming launch of the Firedancer client, the network’s third after Solana Labs’ and Jito’s, network stability will likely continue. Once stability of the network clients is proven, Solana’s reliance on high-performance hardware means it will benefit from cheaper and faster hardware and bandwidth via Moore’s and Nielsen’s Laws. This means a 1000x throughput improvement in one decade is baked into the design, and throughput gains will come from continuously optimizing software to take full advantage of the new capabilities that each generation of hardware brings. This expectation contrasts with the technical uncertainty embedded in Ethereum’s roadmap. Many of the technologies implemented in Ethereum, including ZK experiments, originated from recent computer science academic papers. Most of the key individual technologies implemented in Solana outside of Proof of History borrow heavily from battle tested implementations in high performance distributed systems, cryptography, telecom, and chip design. They’ve then been adapted and optimized for high performance.

In addition to performance, Solana is far down the path to decentralization despite its young age. The number of Solana nodes is ~3,000, indicating a strong degree of decentralization. Solana has a Nakamoto coefficient of 31, which means at least 31 nodes would have to collude to censor the network. As of October 2023, this was higher than any other major POS chain. Both Solana and Ethereum have high holder concentration, with the top 100 wallets holding 32% and 44% of coins respectively (versus just 14% for Bitcoin), but Solana’s holder concentration is expected to decrease as more investor tokens are unlocked and FTX assets get sold and distributed to different parties.

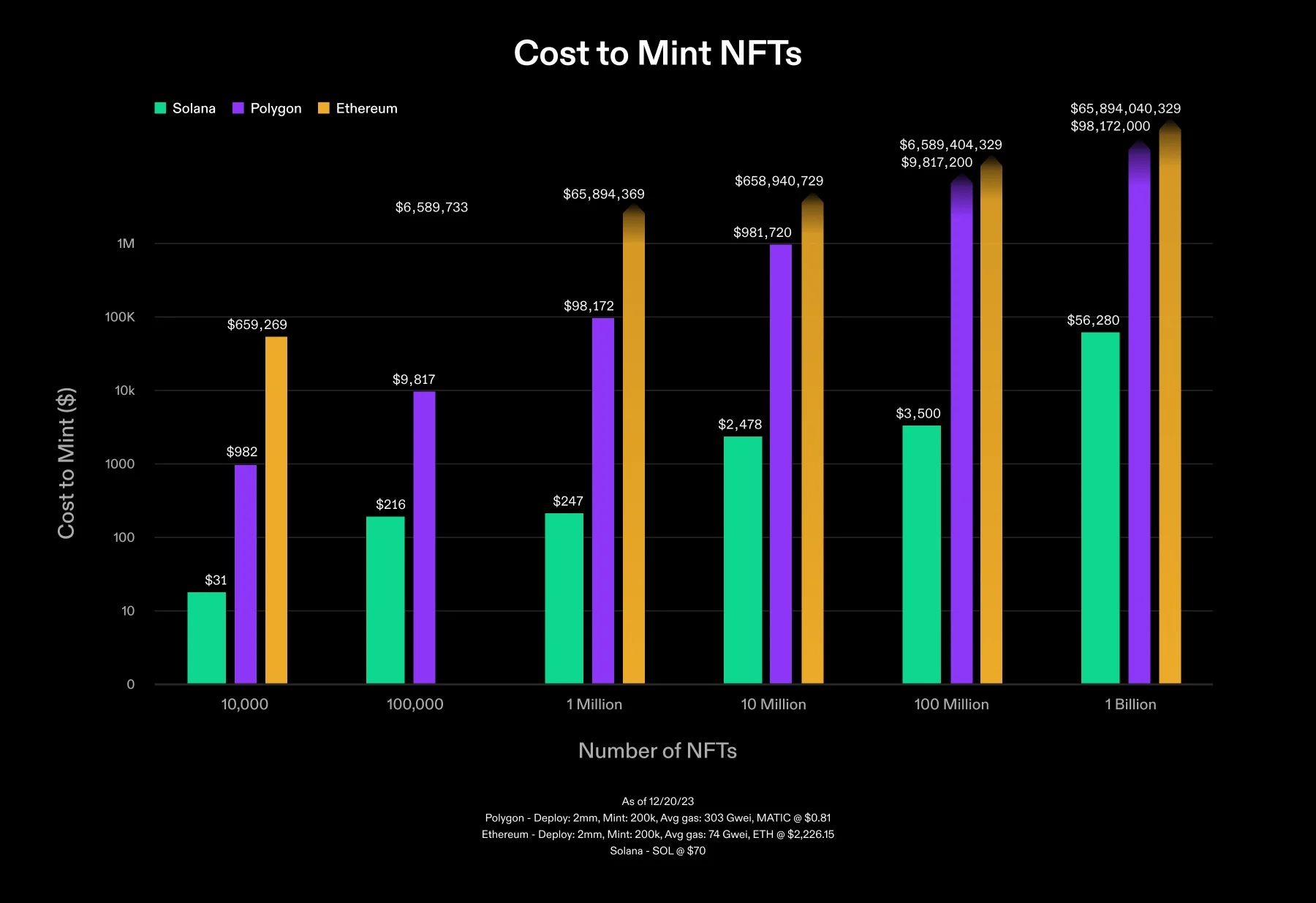

Several technical initiatives at Solana Labs are leveraging the network’s design to enable mass market use cases, embodying the mantra “Only Possible on Solana” (OPOS). Local Fee Markets isolate activity hotspots while preserving transaction sequencing through a global state (the analogy being that car traffic in San Francisco shouldn’t cause bottlenecks in NYC). As a result, transaction cost increases due to surges in demand from a single instance don’t affect fees for others. Additionally, the launch of state compression makes it cheaper to store data on-chain, resulting in cheaper mints at scale by an order of magnitude vs other chains. Compressed NFTs satisfy data storage requirements and ensure composability without an associated expensive rent. The network uses concurrent Merkle trees to make adding and modifying data to the chain economical and highly scalable. The network has seen initial adoption of the technology through cNFTs, which are significantly cheaper to mint than other alternatives.

Source: Solana Foundation, State Compression Unlocked ‘Cambrian Explosion for Digital Assets’

Attracting Developers: Only Possible On Solana (OPOS)

Solana has mostly relied on a combination of hackathons and hacker houses to attract new developers to build new applications. In addition to hacking, organizations like Jump Capital have built and spun out projects like Pyth and Wormhole. Efforts to create liquidity through monetary incentives pale in comparison. This strategy has brought builders with strong conviction in the technology, but bootstrapping liquidity has made scaling certain applications challenging.The Solana community has created a narrative for attracting users and developers that’s now being promoted by the Solana Foundation. Solana’s Possible campaign, focused on applications that leverage Solana’s unique architecture, seems to resonate with developers and companies looking to build applications that can scale today.

———

Implications for building on Solana

Application layer use cases

Assuming Solana’s protocol stability is on track to persist, core developer attention is turning to developing new use cases for the network. Solana’s performance, in combination with its high composability and throughput, positions it for distinct use cases, including supporting web2 use cases at parity while providing the benefits of web3. We see much opportunity here, as entrepreneurial developers are just beginning to explore the possibilities of Solana’s design space. We see opportunities not just in areas where other blockchains have found activity like DeFi or NFTs (although there are strong projects there), but in new high throughput projects with unique business models starting to emerge across multiple categories.

- In DeFi, Cube (a Foundation Capital investment) is using the Solana network to power trading that provides the liquidity of centralized order books with the self-custody of DeFi. Cube is able to match the speed of traditional finance by using Solana infrastructure for settlement with MPC wallets.

- In mobile, Teleport (a Foundation Capital investment) is using Solana to power an open ridesharing platform on-chain. Operators and drivers get to reap the benefits of helping to build the network and enjoy lower fees. Local fee markets on Solana mean that even in periods of high demand for other applications, the ability to order rides and get paid on the platform does not get compromised.

- In payments, Visa recently announced a partnership with Solana to extend its settlement capabilities. Visa cites Solana’s ability to parallel process transactions as a specific attractor for a payments pilot, along with the more well known advantages to Solana’s speed and cost.

- In social, Dialect is leveraging Solana’s composability to bring web3 into messaging and let users take actions directly in chat, a technology named “Smart Messages”. They also use NFT compression to distribute collectible chat stickers, millions of which have been minted by their community for free.

- In DePIN, Hivemapper is a global mapping product building the most current map of the world’s roads. Users are rewarded for collecting and verifying the latest data, while Hivemapper uses state compression to minimize the cost. As users verify the accuracy of mapping data, the verification is compressed into a Merkle tree to update the previous state. This capability is a huge unlock in having millions more miles left to map, which thanks to Solana can be done at a fraction of Google’s mapping cost.

- In commerce, Solana Pay recently integrated with Shopify via plug in. Initially, the low cost of Solana will lower transaction fees to a negligible few cents as opposed to the 1.5-3% charged to merchants by credit cards. In the long term, the integration with Solana and the interoperability it touts could unlock loyalty benefits for consumers and deeper relationships between merchants and shoppers.

As the benefits of building on Solana’s infrastructure become more obvious and memories of the network’s technical challenges become part of its coming-of-age past, we expect TVL to grow, and for new projects and developers to follow. Building on Solana at this point involves little technical risk at the ecosystem layer, so it is applications themselves, like Cube’s development with MPC technology and others working with zero-knowledge technology, that bear the grunt of testing and accomplishing the new technical breakthroughs.

There’s so much design space to explore at the application level that we expect many waves of innovative projects and technologies to keep emerging. In terms of supporting the ecosystem, we see opportunities for Solana-first infrastructure providers like RPCs and multisig solutions to scale, given the much higher throughput and data requirements in the network versus prior generation blockchains. In addition, we expect SOL-specific regulated financial products to emerge shortly after any BTC and ETH counterparts.

———

Conclusion

The three L1s

As we’ve explored in this three-part piece, each major ecosystem required substantial engineering feats to accomplish security guarantees and the programmability of their digital tokens. As developers and users have explored use cases within each network, their respective narratives have evolved, from p2p cash to store of value, from world computer to base layer to the world’s economy and “ultrasound money,” all the way to global state at the speed of Nasdaq.

Oversimplifying the state of technical affairs of each network for the sake of summary, Bitcoin’s protocol is hardened and will evolve slowly since it prioritizes network security over everything else. Ethereum’s current roadmap is focused on scalability via modules and layers, relying massively on the success of multiple new technologies that didn’t exist until recently. Solana’s bet was to re-architect the whole blockchain transaction flow around Proof of History and is maniacally focused on increasing network performance. That bet now depends on making many disparate technologies (that were successful in telecom, chip, and mobile design applications) work together, akin to how Apple is able to make iPhone outperform Android thanks to system-level integration up and down the hardware and software stack despite rarely being the first to develop new technologies for mobile.

Blockchain is here to stay

Taking a thousand-foot perspective, we believe that the two core features of blockchain that have found product-market fit are economic security and smart contract support. These two features enable digital scarcity and online property rights, plus access to a set of shared, open, permissionless compute networks with different capabilities. The existence of different security models (PoW and PoS) and programmable smart contract capabilities across multiple networks provides useful redundancy — for developers to keep exploring the possibilities of blockchain technologies, and in keeping users and investors engaged in these networks.

Looking ahead, developers and entrepreneurs have largely moved on from creating new systems for preserving economic security and enhancing programmability in favor of optimizing existing setups and expanding technical network capabilities at the application and smart contract layers.

We believe that crypto ecosystems are here to stay, not just because the technology keeps avoiding death, but because droves of highly talented, ideologically- and financially-motivated developers keep tinkering with them and more and more users get unique value from interacting with the different ecosystems (thanks, narratives!). Each generation of blockchains is creating new design space and the technology in these networks is reaching (and in many cases exceeding), the performance of centralized, permissioned offerings.

Where to build

In the near future, we expect programmability and throughput to keep improving substantially in the Bitcoin ecosystem via layer 2s, but it’s unclear if any high throughput cases will ever thrive in that ecosystem. We expect more DeFi applications to emerge and for some successful experiments in other chains to get adapted to BTC. But given the lag in speed and throughput vs other base layers, and with increasing maturity of interoperability projects like bridges, wrapped assets, and virtual EVMs for cross chain transactions, it’s likely that other ecosystems and layer 2s figure out ways to perform substantial economic activity in native BTC without leaving their chains.

For most developers, the key question today is whether to build on Ethereum or on Solana.

In Ethereum’s favor, there’s a mature support ecosystem, which includes ETH experts and holders with power to influence product roadmaps at all the major exchanges, wallets and custodians, plus an established user base that could number in the hundreds of thousands to a few millions. There’s also existing liquidity in the form of TVL, and an ability to monetize new ideas using transaction fees and launching new tokens.

For many developers, the downside of building in ETH is inheriting technical debt – the uncertainty of the scalability roadmap paired with the inability to scale throughput at the base layer. This adds complexity to the developers’ architectural decision tree: which rollup to use, which execution environment, which data availability solution, etc. Bridges are also needed in order to maintain the interoperability across L2s, which introduce their own set of risks. This complicates the scalability roadmap of each individual application. Users struggle too: there’s high mental overhead in having to carefully plan transaction flows across a sprawling web of rollups and bridges. It’s hard to envision a future where “low value” individual users can consistently transact on the main ETH chain, a cause for reflection for many teams who are forced to think in terms of multichain support. In order to scale cost effectively, developers are having to accept new types of centralization and trust tradeoffs across their infrastructure stack.

Despite all these concerns, the network effect of the ETH ecosystem makes it the default choice for many teams, particularly those that grew up professionally with the ETH network over the past 8+ years. For these teams, getting to 1k users and high value users in the Ethereum ecosystem more quickly offers some advantages vs building on other networks. These teams might also be able to make the decisions on bridging, data availability, etc. more quickly vs teams without full network context. In any case, navigating broken composability while maintaining acceptable degrees of security guarantees and decentralization within the modular ETH world will require increasing expertise, plus time to test and harden the different stack permutations (some technology combinations already work better than others).

Solana brings a different set of trade offs to developers. In its favor are orders-of-magnitude advantages in speed and transaction costs for users and developers: the analogy of dialup internet versus broadband in terms of traffic and blockspace is now popular for this reason. As network stability challenges subside, Solana is likely to become the default option for projects that need high throughput for low transaction value use cases. Even without crypto, microtransactions are for the most part uneconomical for most existing payment rails (except for a few QR-code success stories like those playing out in India and Brazil), but they could be unlocked by next-gen blockchains like Solana.

For example, for a typical credit card transaction of $30, Visa yields $1.2 in fees (30% + $0.30 per trx). Transactions closer to the $0.30 fixed cost are not profitable for small merchants, despite costing Visa the same amount of money to process. A new payment rail on Solana, given cheap transaction fees, can make it less expensive for the processor and enable the merchant to accept additional forms of payment. In terms of cost, a typical small business could pay for a whole year’s worth of payment processing fees on Solana with the fees they pay traditional networks over a single weekend. Additionally, they could remove the ‘$10 USD minimum swipe’ requirements without hurting their profitability. For the payment processing networks, there’s also an opportunity to tackle high-value / high-risk use cases, like skipping SWIFT’s expensive and slow system for international wires with instant, near free transactions on Solana.

Visa, Jump Capital, Google, and AWS are all early examples of large organizations with substantial technological capabilities that are testing business case hypotheses, finally graduating from crypto pilots and MVPs into pursuing mission-critical business opportunities using Solana’s technological edge.

Similar to previous waves, we are also seeing many new developers around the world onboard directly to Solana without spending time in ETH first (in prior cycles, we were surprised to meet developers and users that had not transacted in BTC before, but were ETH power users). Given that Solana’s architecture and programming language are substantially different from Ethereum’s EVM-centric world, it’s likely that many ETH-trained developers will delay or opt out of exploring Solana until the benefits of doing so (or costs of not) become substantial, particularly in terms of bringing net new users to crypto.

For the last decade, we at Foundation Capital have had the privilege of backing multiple incredible founders who strongly believe that crypto is a force for good in the world and dream of onboarding the next billion users onto blockchain, independent of their tech stack of choice. While network and ecosystem decisions have clear influence over the success or failure of a given project, we are committed to helping founders explore the design space of the ecosystem at large — from day one, for many years to come.

Solana’s end-to-end redesign of blockchain architecture led to improved performance, speed, and composability versus its predecessors. Given that its stability issues are seemingly resolved, the community has turned its attention to use cases that can leverage Solana’s unique attributes. This work presents the opportunity to unlock better technical stacks for a variety of use cases. We are starting to see early signs of the Solana ecosystem creating its own network effect, but there is still much to build.

In this three-part series, we explored how unique technical accomplishments have led to the adoption of Bitcoin, Ethereum, and Solana for a variety of use cases. Though base levels of security, decentralization, and scalability are beginning to become table stakes across all chains, the tradeoffs of initial design decisions continue to guide narratives and use cases for each chain. A deep understanding of these accomplishments and tradeoffs can be helpful to anyone operating or building across these base layers.

We’re excited to continue participating in this ever-evolving, blockchain landscape with you.

Thank you to Muneeb Ali, Xen Baynham-Herd, Anatoly Yakovenko, Raj Gokal, Jon Wong, Mert Mumtaz, Annie Weiss, Steve Vasallo, Andrew Han, and Charles Moldow for your feedback and contributions to this three-part piece.

Published on 12.21.2023