A Technical History of Blockchain Design, Innovation, and Narratives

Part II: Ethereum, The World’s Computer

12.20.2023 | By: Alejandra Martinez, Rodolfo Gonzalez

In the first part of this three-part series on blockchain’s evolution across networks, we dove into what influences these evolutions, what technical innovations led to Bitcoin’s broader market adoption and dominance as a store-of-value L1, and what Bitcoin’s hallmarks mean for its future. In this part, we’ll do the same for Ethereum. Specifically, what distinguishes it from Bitcoin, the trade-offs to its technological leaps, and the implications this has for builders in its ecosystem.

Part I : How Major L1s Have Evolved & The Technical Legacy of Bitcoin

Part II : Ethereum, The World’s Computer

Part III : Next-generation chains and the birth of Solana

Ethereum’s technical breakthrough

Programmability, at the cost of security

After spending some time in the Bitcoin ecosystem, Vitalik Buterin and his co-founders started Ethereum in 2014. Their objective? Building the world’s operating system. This would unlock new forms of economic activity not possible with the limited programmability of Bitcoin and reach previously unserved jurisdictions. Ethereum took Bitcoin’s base layer architecture of Proof of Work and improved slightly on its throughput while still following its small block size philosophy. Ethereum’s defining breakthrough was expanding blockchain’s programmability by implementing smart contracts (a term initially introduced by Bit Gold’s founder Nick Szabo in 1994). Ethereum’s smart contracts are deployed via Solidity, its own unique programming language. Ethereum’s programmability has enabled new types of economic coordination between parties, executed as instructions on top of the nodes running the protocol.

At the base layer, a Turing-complete scripting language introduced a vast new surface area for attack (compared to Bitcoin’s limited scripting capabilities), so Ethereum had security issues to address from the beginning. Ethereum’s design necessitated the separation of the compute layer (the Ethereum Virtual Machine) from the block producing function, which is powered by gas (transaction fees). At the EVM layer, all transactional data in a smart contract is visible to all users in the blockchain, including bugs and security holes that might not have quick fixes, in many cases due to ambiguity in the way the contracts are programmed. This security challenge is now understood as smart contract risk.

In 2016, an attack materialized on The DAO, when a hacker successfully exploited a smart contract vulnerability to siphon off a third of the autonomous crowdfunded VC’s capital ($50m, one of the largest crowdfunding campaigns in history) to a subsidiary account. The situation was controversially resolved via a hard fork of the Ethereum blockchain to roll back the chain and return all funds to the contract. The original unforked blockchain remains as Ethereum Classic.

Despite the persistence and substantial cost of smart contract risks, Ethereum’s programmability unleashed a huge wave of innovation: new types of token standards for fungible (ERC-20) and non-fungible tokens (ERC-721, or NFTs), new fundraising mechanisms (ICOs), and new organizational and governance experiments (DAOs). Many entrepreneurs are exploring how to get all these new capabilities to interact with each other in ever-evolving ways, giving rise to new types of native marketplaces and token exchanges.

Proof of Stake

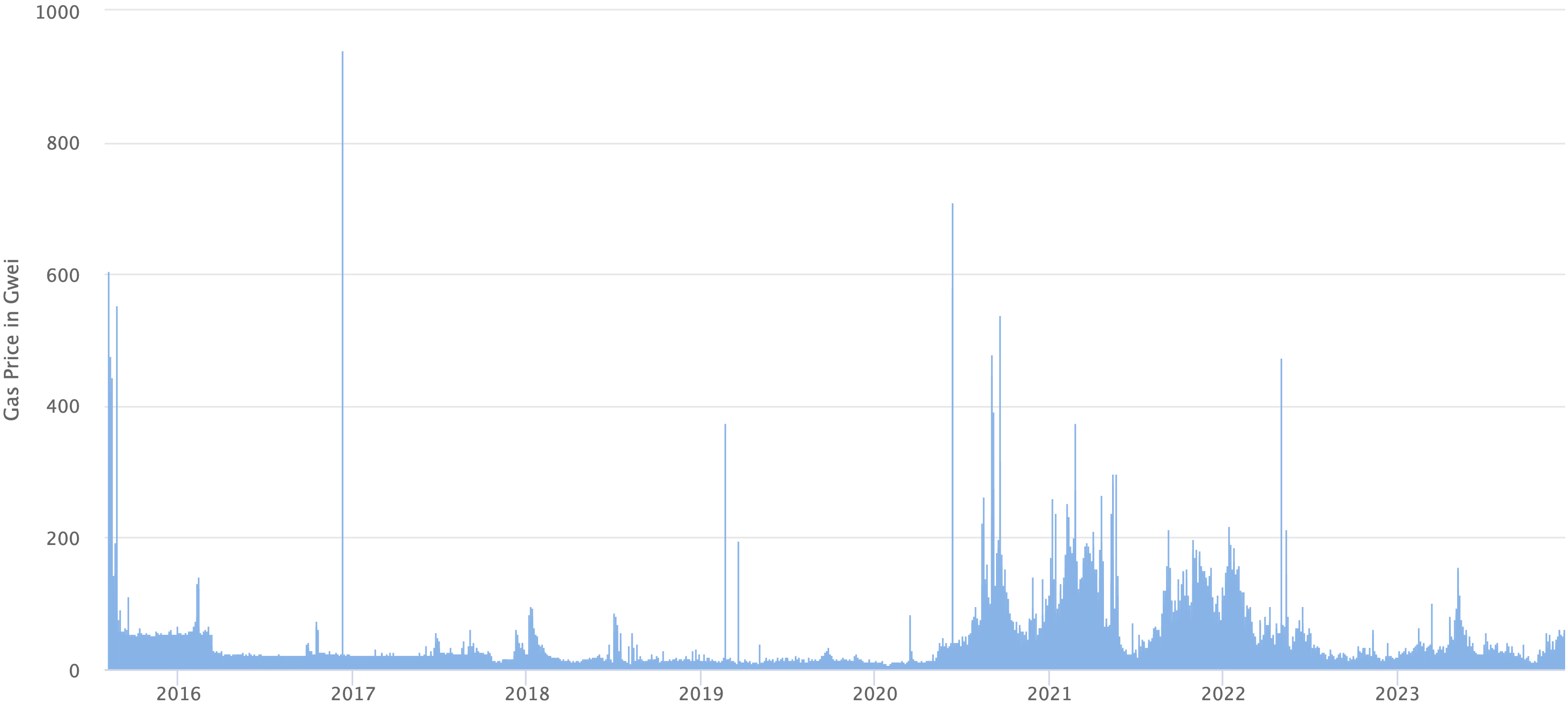

Because Ethereum’s original architecture was so close to Bitcoin’s, the protocol suffered many of the same growing pains. As new applications increased demand for blockspace, limited throughput drove transaction fees through the roof every time there was a spike in demand. When Brave (a Foundation Capital investment) ICO’d, many users paid thousands of dollars in gas fees, while the full token sale lasted only a few minutes. Scalability challenges reemerged shortly after with CryptoKitties (an NFT-based game), which caused Ethereum’s pending transactions to balloon and to result in network congestion, all from ~10,000 active users.

Ethereum Avg Daily Gas Fees spike when there is more network activity (Source: Etherscan)

The CryptoKitties episode made it clear that figuring out how to scale throughput, given the protocol’s architectural constraints, was a major challenge to Ethereum truly becoming a distributed computer the whole world could use. The scalability of Ethereum was a contested open question for years, as the engineering efforts required to upgrade the protocol were massive and high stakes. Upgrades at the base layer like Sharding and Plasma were proposed and put on hold (and have just been revived again!).

Eventually, the community decided to scale Ethereum in layers. In particular, via roll-ups that move computation and state storage off-chain while keeping some transaction data on-chain. By using compression techniques and roll-ups to substitute data for computation and to address data availability challenges, only aggregate transactions are posted to the base layer.

The main change needed at the base layer was switching the consensus algorithm from Proof of Work to Proof of Stake (PoS) via The Merge. This change was finally implemented in September 2022 along with changes to fees and the supply schedule to improve the economics of the system. The Merge was a massive engineering success, the equivalent of changing the engine of a plane mid-flight. The move to Proof of Stake opened up a new opportunity space for developers and entrepreneurs to explore liquid staking and dynamic fees. The Merge also laid the groundwork for further pursuit of Ethereum’s scaling roadmap.

———

Ethereum’s current state and recent innovations

Growth

Despite the throughput limitations of Ethereum, the pace of innovation on the protocol has been staggering and has brought in many new devs and users, along with liquidity, to the chain. Liquidity begets liquidity, so Ethereum’s fundraising figures and developer activity are testaments to the potential and continued exploration of what’s possible for the network.

At Foundation Capital we’ve had the privilege of backing Ethereum projects like OpenSea that have facilitated billions of dollars in NFT sales, creating new avenues for artists to make a living and to build direct relationships with their communities. We’re also involved with multiple projects and protocols across verticals, including at the intersection of gaming, DeFi, and NFTs, as well as the backend infrastructure that supports many of these use cases.

Scalability challenges

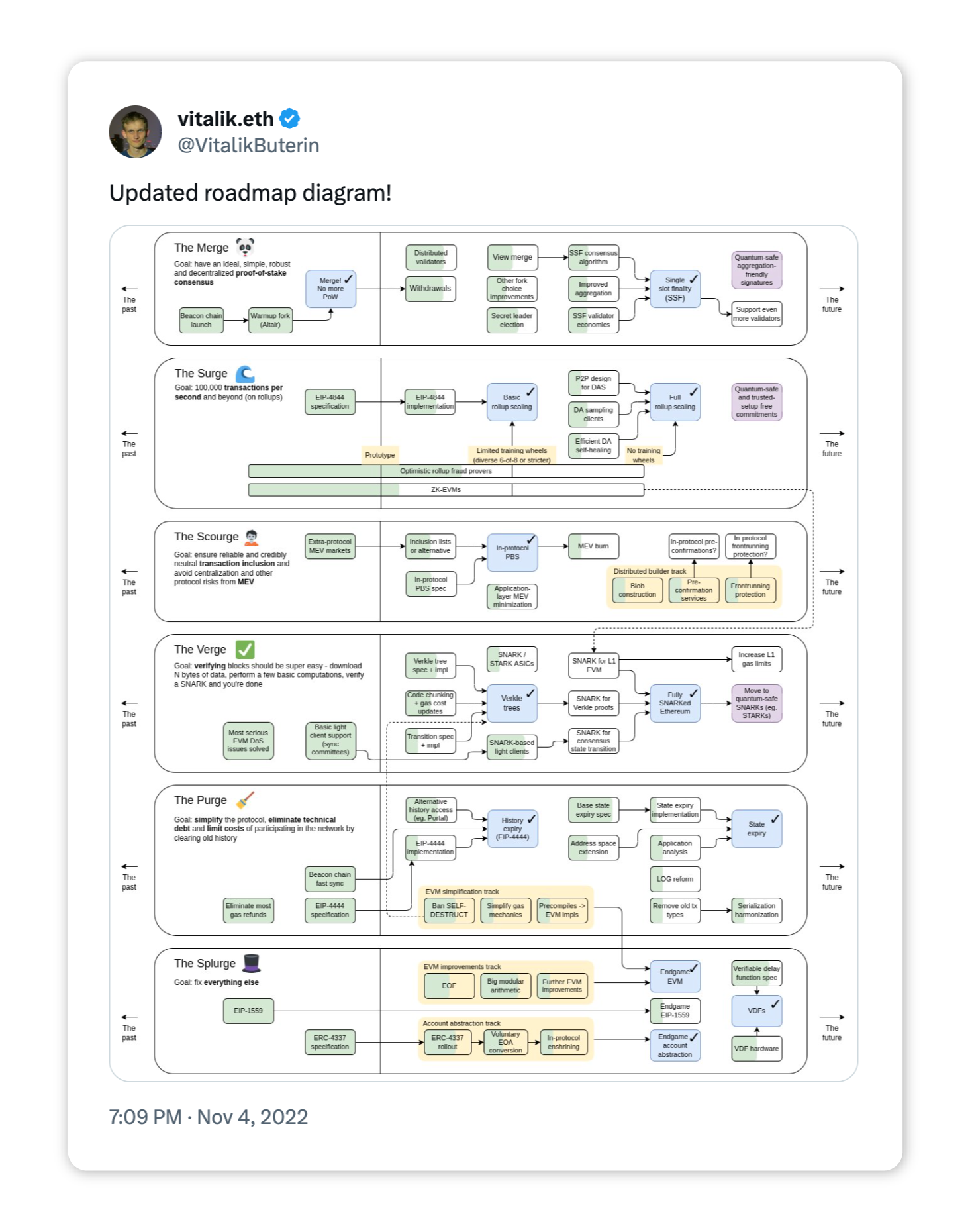

Even though growth of the ecosystem has been impressive, barriers to unlocking Ethereum’s full potential remain. Shortly after The Merge, Vitalik Buterin published an updated Ethereum roadmap largely focused on achieving scalability and implementing multiple economic policy improvements. The Merge and subsequent scaling roadmap enshrined Ethereum’s “small block” decentralization ethos, where a Raspberry Pi can both store a copy of the transaction history and validate it.

Ethereum Roadmap, Post-Merge (Source: Twitter)

While the architecture and outcome of these efforts are still in flux, Ethereum’s developer community is loyal, incentivized, and excited to achieve and deliver on an ambitious roadmap. Initially, the plan was to achieve scalability through execution sharding, but the approach has now shifted to a layered and rollup-centric strategy, with multiple experiments and approaches competing at the base layer. The L2s Polygon, Optimism, Arbitrum, and Base are introducing their own technical breakthroughs, allowing for higher throughput and attracting new users.

As the rollup-centric roadmap evolves, familiar technical trade-offs in the context of the ”blockchain trilemma” re-emerge for the subsequent L2s (and eventually L3s): throughput, transaction fees, composability, data availability, and transaction sequencing, which in turn require more clever engineering to address. The ecosystem is already working on a mix of “small” and “large” upgrades to face these challenges. In the near horizon, the upcoming Dencun hard fork will improve data availability for roll-ups via “blobs” of data. There are many more experiments in the works, including zero-knowledge (ZK) technologies and their promised privacy and scalability benefits. The partners at Foundation Capital are investors (from angel to institutional) in teams working on these problems and we will continue to make this a focus as the Ethereum roadmap progresses.

———

Implications for building on Ethereum

Roadmap execution

Ethereum is still early in supporting additional use cases at scale. Barriers to adoption remain as the community waits and sees whether the Ethereum roadmap will be executed with success. Though Ethereum now provides improved security guarantees at the base layer, each of the different rollups now face many of the same challenges around data availability, centralization, throughput, and transaction costs. For users, these challenges break composability, increasing the fragmentation of functionality.

Similar to Bitcoin, there’s only a small number of developers with the highly specialized knowledge necessary to take on challenges at the infrastructure layers. This talent is expensive and hard to attract, which is why we often see large funding rounds for Ethereum infrastructure projects. It’s interesting to see the difference in engineering philosophies between Bitcoin and Ethereum. Bitcoin changes as little as possible and for the most part avoids new tokens. Bitcoin core development has perennially struggled to raise financing (other than through the forum of public good fundraising), albeit the situation has improved in recent years. In contrast, Ethereum’s embrace of the token model has been conducive to private fundraising and it also simplifies project business models via transaction fees. This approach encourages more attempts from developers to strike it big by solving a piece of ETH’s scalability puzzle. They’ll do so partly out of goodwill to the ecosystem, of course, but also because technical contribution can be a great business strategy in the world of permissionless networks run on open source software. At Foundation we’re actively backing some of these projects, as we believe that making meaningful technical contributions to the ecosystem will continue to lead to success.

In addition to Ethereum’s technical questions, philosophical considerations on decentralization will return for developers. Rollups might eventually crowd the base layer out of users hoping to execute “low value” retail transactions, leaving only high-value use cases in getting to interact with the main chain. We’ll return to these questions in the final section of this writeup.

Business model innovation

Ethereum’s level of adoption, liquidity, and decentralization make it the natural fit for many projects — and there’s no doubt that Ethereum’s network effect positions it well for the future. These pros are reflected in its high TVL and the prevalence of yield-seeking “hot money” excited to try new experiments on the chain. DeFi projects like Compound or Aave are representative of this impetus. They’re tapping into smart contract capabilities and the liquidity of the network to build and scale new financial primitives native to crypto. Some projects raise institutional backing early on and many are able to fundraise directly from the crowd via tokens. Teams in ETH are more willing to launch a token than those in other ecosystems, and it’s relatively easy to launch one on Ethereum. The protocol generates substantial revenue in gas and transaction fees, so it’s easier for projects to monetize directly, helping alleviate business model questions at a faster pace than in chains with lower TVL or interest in programmability.

ETH’s initial network effects around developers, liquidity, and users will likely provide enough momentum and financial support to materialize ETH’s ambitious roadmap, but likely on a longer timeline than initially hoped. In terms of business model innovation, we don’t consider Ethereum’s surface area of smart contracts to be fully explored yet. In specific areas within DeFi, NFTs, and decentralized social networks, many of the “it” products will continue to emerge in Ethereum first. Teams are proving adept at connecting technical breakthroughs to the rest of the ETH ecosystem. We’re seeing this with staking primitives enabling liquid staking, which then make their way into DeFi, enabling successive waves of code, product, and primitive (mixing and remixing).

Finally, Ethereum’s supporting ecosystem of wallets, node providers, exchanges, and custodians is second only to Bitcoin, and it’s arguably as close to gaining regulatory clarity as a commodity. Similar to Bitcoin, we expect continuous supporting ecosystem innovation plus the eventual launch of institutionally-backed ETH products for investors.

Ethereum’s smart contracts gave us new ways to transact and coordinate on blockchain. Its switch to Proof of Stake was a massive technological feat. But speed and scalability issues are impeding its vision to become the world’s operating system, and current solutions have introduced other problems. Despite some roadmap uncertainty, Ethereum today still exposes founders to early network effects and more opportunities for fundraising, fees, and liquidity than other ecosystems. This can be attractive to founders building use cases that are less sensitive to cost and speed and to Ethereum-native teams who have navigated the growing technical complexity of the ecosystem.

Solana, a next-generation chain built atop Ethereum’s technical accomplishments in programmability, was born a native Proof of Stake chain. How does its architecture position it differently than Ethereum? Don’t miss the next and last part of this three-part series, where we break down Solana’s relentless focus on network performance and new applications for the “single global state.”

We’re excited to continue participating in this ever-evolving, blockchain landscape with you.

Thank you to Muneeb Ali, Xen Baynham-Herd, Anatoly Yakovenko, Raj Gokal, Jon Wong, Mert Mumtaz, Annie Weiss, Steve Vasallo, Andrew Han, and Charles Moldow for your feedback and contributions to this three-part piece.

Published on 12.20.2023