The Emperor Has No Tech: Why the Insurance Industry Desperately Needs Startups

05.16.2023 | By: Nico Stainfeld, Charles Moldow

When Lloyd’s of London faced the unique challenge of insuring a million-pound reward offered by a Scottish whisky firm for the capture of the Loch Ness Monster or protecting the precious legs of 1940s starlet Betty Grable, they turned to their underwriters to assess the risk and determine an appropriate premium to charge. This kind of underwriting—dealing with unusual risks with no data to inform the decision—can be considered a unique talent, perhaps even a form of art.

While these somewhat bizarre scenarios paint the insurance industry as avant-garde, the reality is far more pragmatic. The insurance industry stands on three pillars: distribution (captive and channel), risk assessment (actuarial tables), and service and support (claims and fraud). Historically, these functions required detailed workflows and significant manpower, which is why insurance, despite being among the world’s largest and most data-rich industries, has been painfully slow to embrace technology.

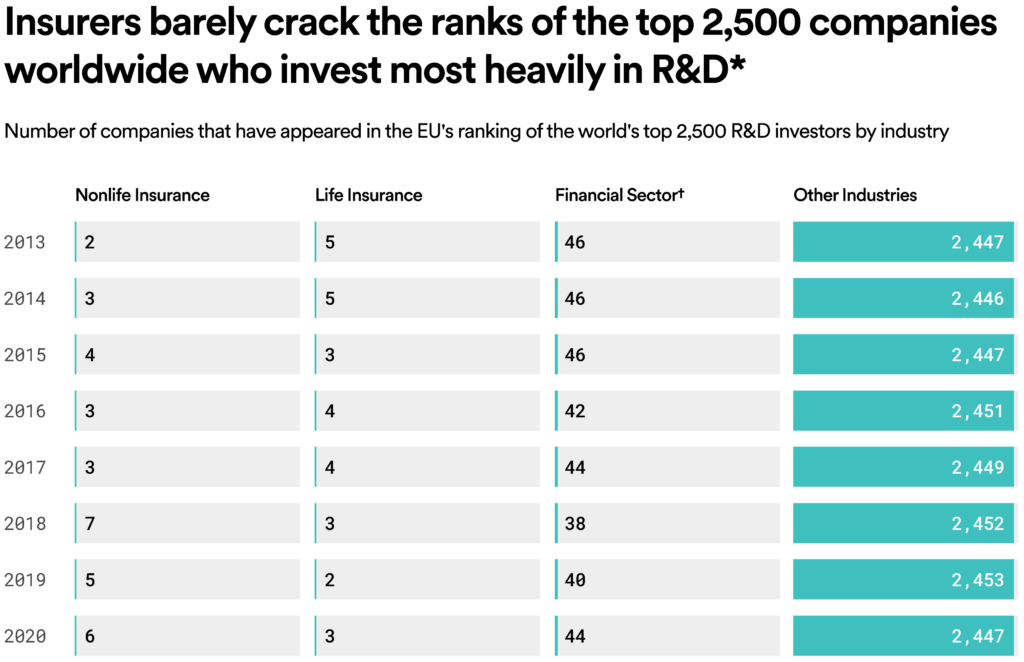

This fact isn’t lost on the industry. Insurance executives are desperate to harness data, machine learning and artificial intelligence to improve their ability to distribute, underwrite and service policies. Yet, because insurers have heretofore not required large engineering teams for workflow and process improvement, they lack the requisite skills to embrace technological innovation as readily as other sectors. By way of example, out of the world’s top 2500 companies by R&D expenditure, only nine hail from the insurance sector—three life insurance and six non-life—in sharp contrast to the 44 financial services firms on the list. This glaring capability gap creates tremendous opportunities for insurtech startups. We’re now at the dawn of a technological revolution that promises to reshape insurance as we know it and challenge virtually all of its existing processes and workflows.

The insurance industry is practically begging for startups to enter this space with AI innovations—much more so than big bank incumbents, which already employ tens of thousands of engineering personnel, making their “build vs. buy” decision considerably more challenging. Take JP Morgan Chase, which employed over 55,000 technologists as of late last year. In contrast, State Farm, the leading insurance carrier in the U.S., employs around 62,000 people in total. In the insurance realm, “buy” is the only real option for most incumbents—meaning that, in the coming quarters and years, carriers will be tripping over themselves to secure partnerships with, or even outright acquire, AI-driven insurtech startups. Believe us: if the Head of Insurance is the loneliest person at a tech company, the CTO is the most isolated individual at an insurance company.

Recent advances in AI—most notably, the rise of foundation models that can be adapted for financial tasks—are approaching the insurance industry like a runaway train. AI is poised to transform all aspects of the insurance process, from product development, underwriting, and pricing to claims management, distribution, and sales. Yet, most insurance companies are facing AI today with no idea how to engage with this paradigm-shifting technology.

Consider this post as a clarion call: a rallying cry to entrepreneurs of every background to heed the insurance industry’s desperate pleas and BUILD.

Two Sides to the Insurtech Equation

At Foundation, we approach insurtech investing by focusing on two personas. On one side sit insurance producers, such as carriers and managing general agents, who create, underwrite, and assume the financial risk associated with insurance policies. On the other side are insurance agents and brokers who act as intermediaries between insurance producers and consumers and businesses seeking coverage. AI is reshaping the way both of these players work in deeply interconnected ways.

For producers, AI, ML, and big data bring innovations in risk assessment, underwriting, and fraud detection. Traditionally, insurance underwriters based risk pricing on information gathered through detailed questionnaires provided to clients. These forms consist of structured and unstructured data which is often inaccurate due to human error, data manipulation, or misrepresentation. With natural language processing (NLP), insurers can ingest, organize, and analyze a broader and more abstract spectrum of information, in addition to what is provided by customers; this can include online reviews, social media posts, and regulatory filings. By synthesizing vast amounts of data—structured and, critically, unstructured—underwriters can create detailed risk profiles and optimize pricing. AI-powered predictive analytics lead to further efficiency gains, allowing producers to adapt their product offerings to changing market conditions. The result: producers can now profitably serve emergent and underserved risks, such as cyber, crypto, workers’ compensation, and micro-premium risks.

For agents and brokers, AI streamlines quoting and binding by automating tasks like data entry and document analysis. AI also improves marketing and sales efforts by analyzing customer data to identify potential leads, predict customer behavior, and optimize campaigns. Lastly, AI can provide automated customer service through large language models (LLMs) that are trained to interact with customers and provide personalized recommendations based on their needs. AI-powered chatbots can also assist customers in filing claims, further improving their overall experience.

A Few Things We’re Exploring

With our two target personas in mind, our team is prioritizing four market verticals in insurtech where AI’s impact is especially strong. Let’s look into each in turn.

Cyber Insurance

Today, every business is a cyber business, as long as it uses email or has a website. As businesses store and process more sensitive data and adopt technologies such as cloud computing and the Internet of Things (IoT), their exposure to cyber risks has grown in lockstep. The rise of remote work further expanded the attack surface for cybercriminals. In tandem, the regulatory landscape has matured and imposes sizable penalties on businesses that fail to safeguard consumer data. These trends, combined with the increasing sophistication of cybercriminals, has dramatically upped the financial and reputational stakes for businesses whose digital perimeters are breached.

Traditional methods for underwriting cyber insurance relied on customers’ responses to pen-and-paper questionnaires: a complex and error-prone process, and yet another example of how carriers have failed to meaningfully integrate technology into their stack. Enter AI, which can ingest, analyze, and synthesize data from a range of relevant sources to determine a business’s cyber risk profile. These sources include a business’s URL, network structures, endpoints, and operational data (including financial, HR, M&A, regulatory, and compliance), as well as public web scanning, signals intelligence from the dark web, and incident and claims data gathered from other customers.

Coalition, a leader in this space, offers what it calls “active cyber insurance.” While traditional insurance kicks in only after an adverse event has occurred, Coalition’s products are designed to prevent cyberattacks before they happen. To underwrite policies, it collects and correlates inputs from diverse data sources to generate a real-time overview of a business’s digital risks. It then continuously monitors its customers’ cybersecurity posture and uses AI to provide recommendations for enhancing security. Its broker dashboard now features an LLM-powered chatbot, trained on a mix of public documents and resources created by Coalition for broker inquiries and education, that can answer questions about cybersecurity best practices and cyber policy coverage options, among other topics.

Crypto Insurance

While cryptocurrencies represent a nearly $1 trillion asset class, the sum total of global insurance capacity for the entire crypto market is currently just ~1% of this figure. Legacy insurance providers are ill equipped to tackle the challenges of crypto insurance, which is technologically intensive and demands a specialized blend of insurance expertise and on-chain underwriting capabilities.

To fill this need, startups are offering a range of crypto insurance solutions, including executive risk coverage, crypto transaction insurance, and crypto-denominated risk policies. FC portfolio company Coincover, for example, uses AI to underwrite crypto transactions in real time. By pairing its proprietary platform data with live transaction data (such as wallet addresses, the transaction amount, and timestamp), market research, and knowledge of threat vectors, it assesses a given user’s risk and actively protects against loss. Other FC crypto insurance portfolio companies, such as Evertas and Breach, make use of a more conventional MGA structure. Supported by strong reinsurance and carrier partnerships, they protect against loss of assets under custody, ensuring that even in the event of a hack, clients’ assets remain safe.

Embedded Insurance 2.0

The first phase of integrating insurance products into non-insurance platforms, services, and applications—known as embedded insurance—was primarily a channel-distribution play. These clunky, one-size-fits-all solutions were often offered as optional add-ons, with little to no personalization. Think of the generic checkbox for travel insurance at the bottom of an airline ticket or hotel booking purchase flow. When was the last time you even thought of clicking that?

We’re excited about the next phase, which we call embedded insurance 2.0. This iteration evolves the initial concept by layering on advanced data analytics and AI to offer personalized policies that are delivered at the point of need. While 1.0 policies are, at best, lightly customized, 2.0 policies make use of real-time data to continuously adjust premiums based on factors like usage, behavior, and evolving risk levels.

Building on this trend, FC portfolio company Pattern Insurance enables online travel, recreation, and events companies to sell embedded insurance to increase customers’ confidence (which took a big hit during COVID) and boost revenue. Pattern’s “Smart Proposal Manager” personalizes and dynamically prices policies for each buyer persona. Under the hood, an AI-powered recommendation engine constantly tweaks products to maximize conversion. Similarly, FC portfolio company Seel powers highly flexible and dynamic return assurance policies for e-commerce merchants. Using advanced SKU- and merchant-level analytics, Seel can accurately predict customer return behaviors and even offer on-time delivery guarantees.

Another example is Buddy, a friend of the firm. Their proprietary “insurance programming language” allows any company to integrate fully managed and compliant insurance products into a transaction flow. Here, again, carriers are lagging technologically: millions of legacy policies on carriers’ servers exist only as PDFs, and some extremely outdated policies may only exist as physical paper copies in a warehouse (!). Buddy’s systems can ingest all these historical policies and digitize them by breaking them down into their atomic components. Current users of Buddy include large auto carriers digitizing their offerings; e-commerce businesses and booking engines, which can embed relevant insurance options at the point of sale; fintechs, which can bundle insurance with lending, credit, and personal finance services offered through their websites and mobile apps; and insurance companies, which can streamline and standardize their product distribution.

AI-Enhanced Vertical SaaS

The fourth area we’re actively exploring is cloud- and AI-powered insurance software solutions. Startups in this category typically begin by addressing a burning pain point for a targeted, preferably underserved, user group. After establishing credibility within this niche, the startup can expand from its entry point into an end-to-end, customized solution for a given workflow. By integrating AI, the product can evolve from a basic CRM into a sophisticated copilot that surfaces key signals and recommends data-driven actions. The result is a powerful tool that guides and supports customers at each step of their workflow—and becomes more effective as its adoption grows.

In the broker and agent enablement space, FC portfolio companies Agentero and iLife are leveraging NLP to drive top-line growth and increase client NPS. Agentero, for example, employs AI to proactively surface cross- and upsell opportunities for independent agents. The platform also streamlines client communications and automates routine tasks through NLP. iLife, which serves life insurance agencies, is using generative AI to improves quote creation and client engagement. Beyond these process automation features, what stands out about Agentero and iLife is their ability to act as hubs connecting carriers with clients and vice versa. As we’ve already discussed, most carriers lack the technical know-how to reach these prospective customers with modern, digitally native workflows and products. However, by partnering with insurtechs, they can offer experiences that far exceed the proverbial “10x better” required to gain market share.

In enterprise insurtech, consider FC portfolio company EvolutionIQ. Its founders identified that existing insurance software providers were overlooking a specific segment of carriers: namely, those dealing with workers’ compensation and disability insurance. Historically, these carriers relied on manual methods to direct employees through the return-to-work process after a job-related illness or injury. EvolutionIQ began by digitizing this process with a SaaS-based policy management system.

From its initial focus on case management and automation, EvolutionIQ added AI to assist caseworkers in pinpointing the ideal intervention points to reduce claim costs and duration. Its ML models analyze both structured claims data and unstructured sources, such as injury information from doctor’s notes and emails. The models then combine these sources with proprietary data gathered through the use of EvolutionIQ’s platform.

By combining these sources, EvolutionIQ can flag suspicious claims for further review and optimize case management. For example, its software segments claims into three categories: simple claims for quick processing, complex claims that need more caseworker involvement, and claims with a high likelihood of transitioning to long-term disability, which require a specific set of examiner specialists. This segmentation scheme allows caseworkers to focus their efforts on the highest value interventions, rather than relying on gut feelings or ad-hoc decision-making. Powered by these AI-driven workflows and features, EvolutionIQ has been able to deliver over 10x ROI to its carrier partners.

On the Horizon: Generative AI

In the coming months, we’re eager to track how generative AI accelerates innovation in insurtech. Specifically, we foresee AI-native insurtechs incorporating LLMs to drive further automation and personalization, as well as enhance fraud detection, risk modeling, and pricing accuracy. LLMs can also help insurtechs improve non-core, NLP-intensive functions such as customer support, marketing, and sales. While these improvements may not be transformative on their own, their combined effect can significantly boost overall efficiency and user experience.

As described at the outset, the insurance business can be broadly broken into three categories: distribution, underwriting, and servicing. Stay tuned for future posts that break down the impact of AI on each of these categories.

Call for Startups

Attention all builders! If you’re thinking of diving into AI, consider insurance! If you’re working on a project in any of these areas, we’d love to connect. We specialize in early-stage investments, ranging from pre-seed to Series A, with a particular emphasis on seed. We’re especially interested in engaging with founders at the outset of their entrepreneurial journeys. Drop us a line at cmoldow@foundationcap.com, rgonzalez@foundationcap.com, or nstainfeld@foundationcap.com.

_

* From the EU World 2500 / Companies assigned to industry sectors according to NACE Rev. 2 and ICB frameworks

† ‘Financial sector’ includes Banks (23 ranked companies in 2020), Financial Services (23), Equity Investment Instruments (0) and Nonequity Investment Instruments (0) Source: EU Industrial R&D Investment Scoreboard

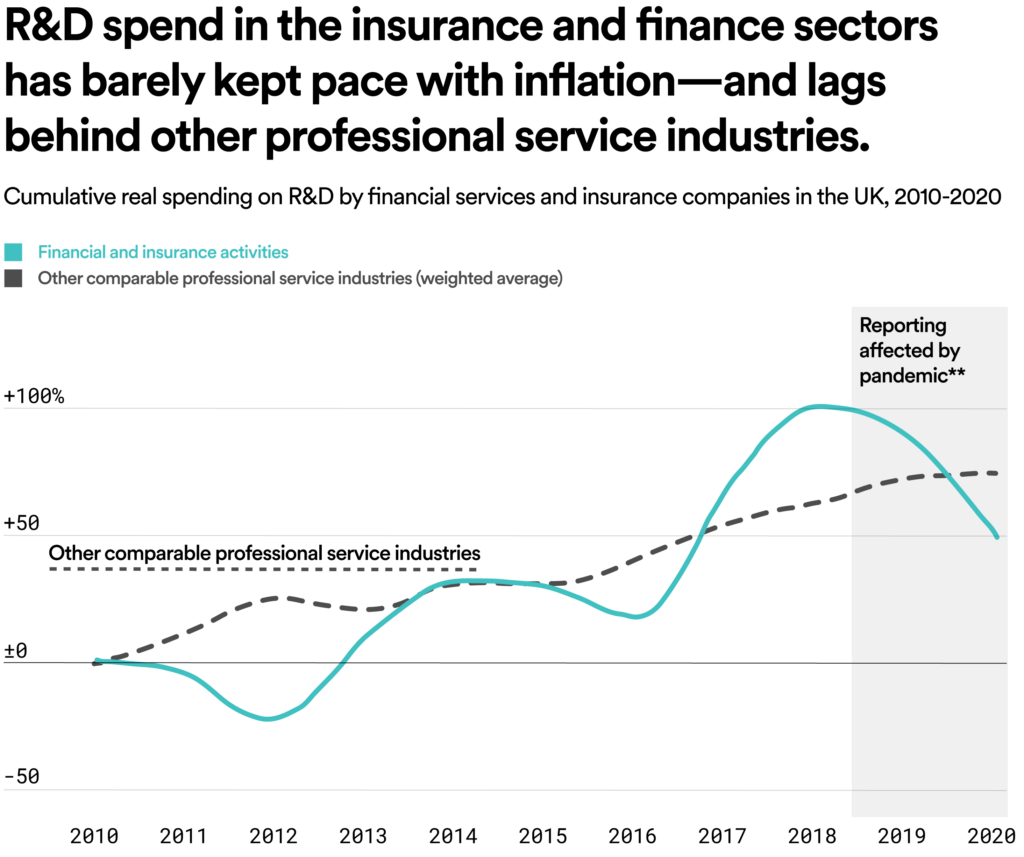

** Estimates for 2019 and 2020 more uncertain than prior years due to lower survey response rate. Notes on data:

(1) Businesses divided by Standard Industry Classification (SIC),

(2) Weighted average for other service industries includes: Publishing activities, Telecommunications, Computer programming, consultancy and related activities, Information service activities, Legal and accounting activities, Activities of head offices; management consultancy activities, Advertising and market research, Office administrative, office support and other business support activities,

(3) Expenditure figures adjusted for inflation using HM Treasury’s Gross Domestic Product (GDP) deflator series.

Source: Office for National Statistics

Written by Charles Moldow and Nico Stainfeld