The Mexican Auto Insurance Market

08.05.2023 | By: Rodolfo Gonzalez

We’ve announced our investment in Momento Seguros, a new fullstack auto carrier for Mexico. Here, we share more about our investment thesis on the market landscape for others considering building / investing in this exciting space.

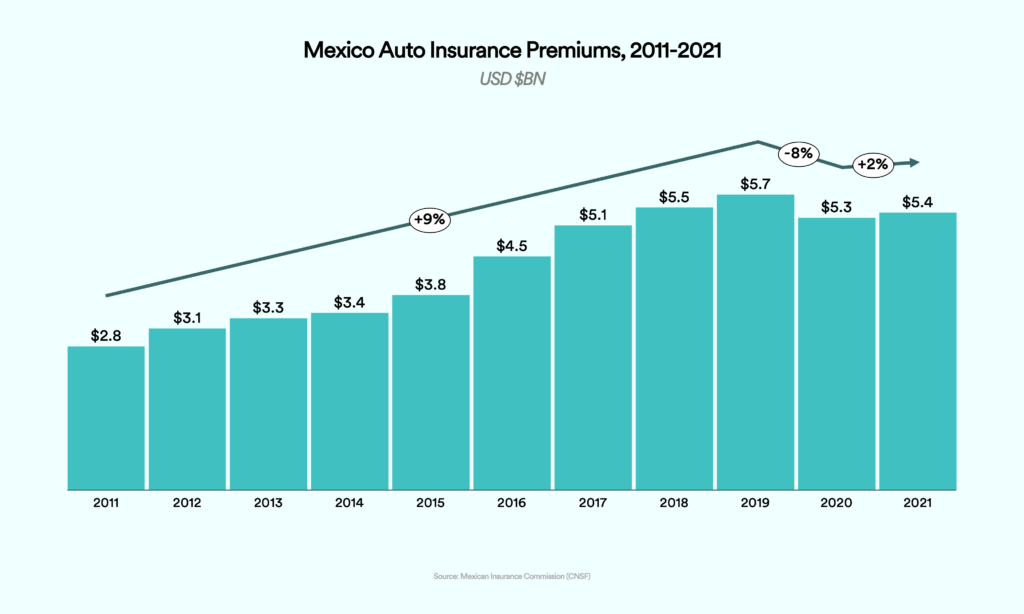

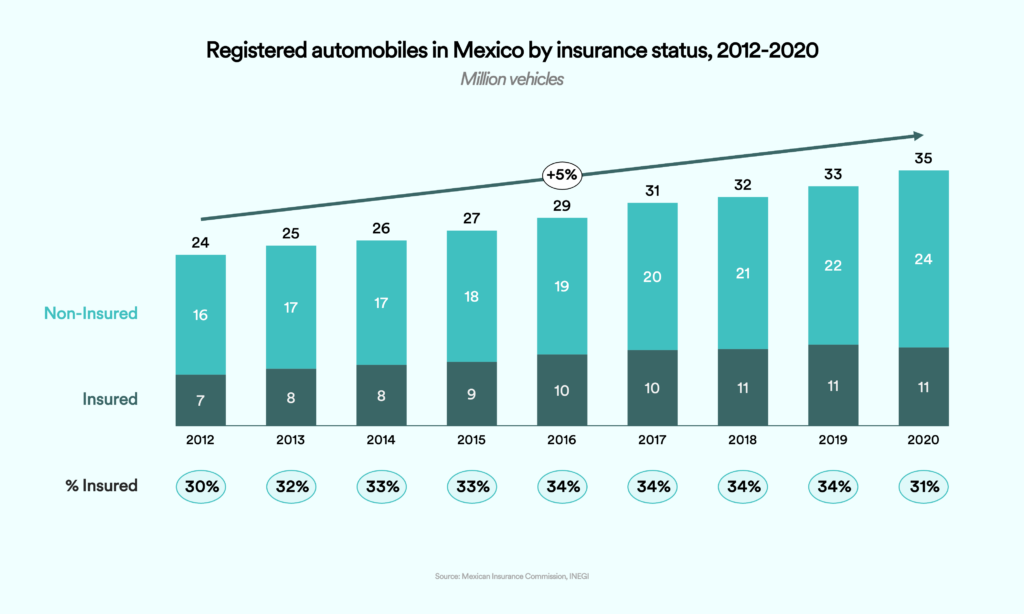

A little over a decade ago, I was an analyst for LatAm financial institutions at McKinsey. Back then, we described the Mexican auto insurance market as an underpenetrated but highly profitable one. Like other areas of consumer finance in Mexico, auto insurance was dominated by 4-5 incumbents and grew at half the rate of the rest of LatAm (at 6-8% YoY). Mexican auto insurers routinely exceeded 20% ROE, placing their profitability at the top of most international league tables. In 2012, only 30% of the 24m autos in Mexico were insured and consumers paid ~$560 USD (at 13 MXN per USD) in premiums per year, sizing the Mexican auto industry at around $5.5b annually.

The 2020s brought new shocks and dynamics to the market via Covid and remote work. Mexico now has 11m+ additional autos on the road (35m as of 2020), but the market has been roughly flat at $5.4b USD in premiums since 2017 (plus large exchange rate swings in USD/MXN). Vehicle coverage decreased from pre-pandemic levels of 34% back to the 30% of 2012 (11m policies today).

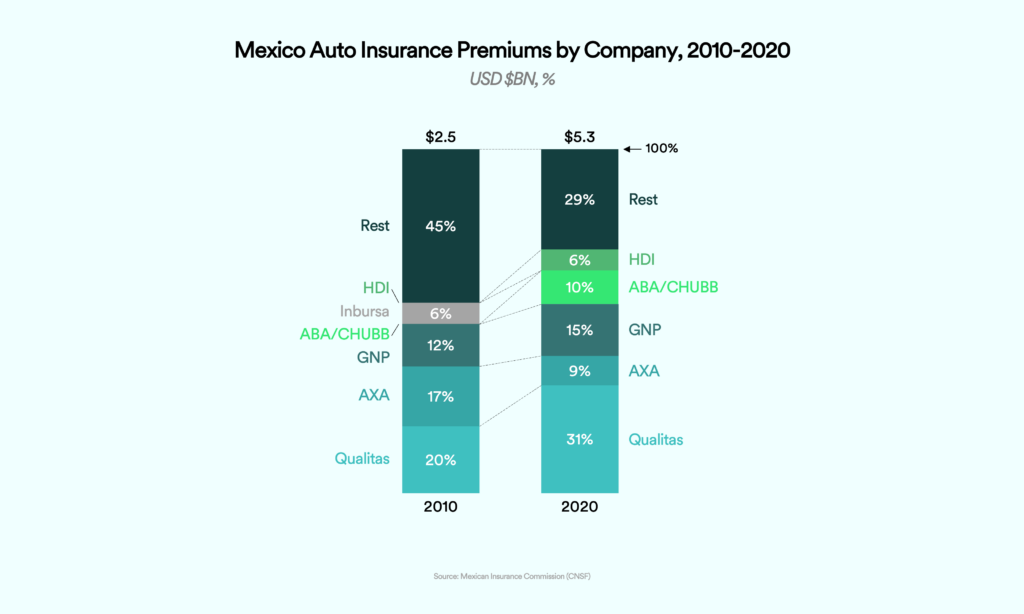

The last decade saw the market consolidate. The top five players now account for 70% of premiums, up from 55% in 2010. The largest player is Qualitas, a $3b market cap carrier founded in 1993, which IPO’d in 2012 and boasts 4.8m insured vehicles as of 2022. Qualitas has almost 20k agents and underwrote ~$2.5bn premiums in 2022. Multiple carriers have exited the market (many via M&A).

Many of the age-old pernicious behaviors and industry challenges to growth are still there: customer experience is bad for many carriers given their tendency to delay and/or deny paying claims. As in other areas of LatAm eCommerce, high rates of fraud drive rates up for everyone. However, some regulatory changes have been positive: Mexican insurers adopted Solvency II-like capital rules since 2015, bringing stability to the system. Also, third-party liability coverage became mandatory in most of the country by 2019, somewhat boosting demand.

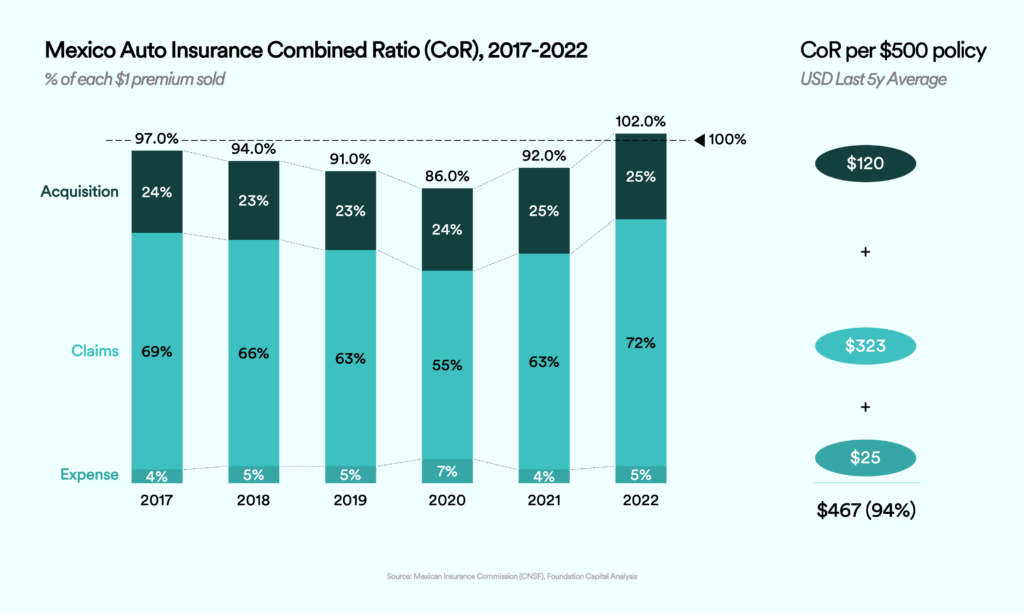

Following multiple years of premium growth and improving combined ratios, Covid + remote work altered the growth and profitability trends of the industry substantially. In 2020 and 2021, the industry saw premiums reverse to 2017 levels, but fewer miles driven brought claims ratios down, making for nice profitability levels across the board. However, 2022 saw the inverse effect: premium growth returned (albeit slowly), but claims expenses shot up (more accidents and more expensive repairs via inflation and supply-chain shocks). The market is starting to turn around — auto insurance grew ~15% YoY to 1Q23. Like in other countries, in 2023 carriers are pursuing profitability by raising prices and enacting cost-reduction initiatives.

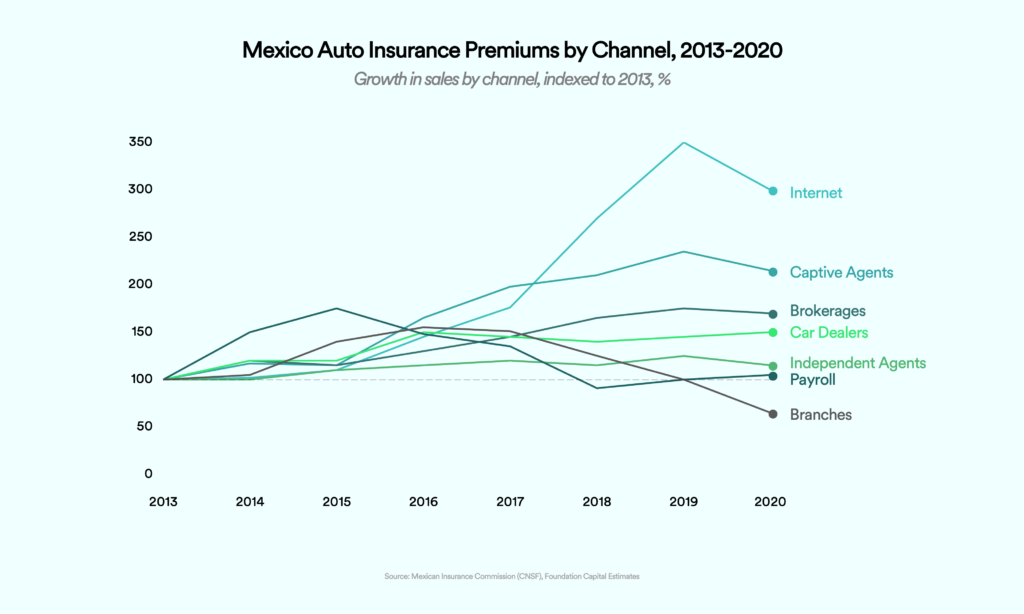

While premiums are just trending to surpass pre-pandemic levels, there’s been a change in the mix of acquisition channels. Over the past decade online became the fastest growing channel, now accounting for ~10% of premiums. As the Combined Ratio chart shows, acquisition expenses remain steady at 25% of premiums, reflecting the resilience and importance of the agent channel, although the mix between captives/independents and brokerages keeps evolving. Embedded channels like car dealerships show steady growth, as their offerings are often bundled with the financing products for the car themselves. Distribution via bank and physical branches essentially collapsed, reflecting a broader decline in bank branch networks. Payroll-deducted policies, another bancassurance product, hold steady, especially for the formal sector of the workforce.

As incumbents raise prices, they’re confirming their focus on serving the top of the market, especially the 30% of already insured vehicles. With 70% of the vehicles uninsured, the insurance gap is visible everywhere, especially in compact autos, which make 94% of LatAm’s market: the most popular car in Mexico is the Nissan Versa, which makes up 12% of cars sold but only 3.4% of the cars insured. Versa’s retail for ~$19k (vs $39k for the popular Audi A3 in the luxury market).

With regards to our investment in Momento, the key question is whether the broad compact segment of the market can be insured profitably. Momento and our team at Foundation Capital believe they can, and that even currently insured cars will find our fullstack offering attractive thanks to ease of use and overall product superiority. On the one side, the vehicles of the uninsured are cheaper to repair than the mid and luxury cars of the currently insured. On the other side, premiums represent a higher percentage of the vehicle’s estimated value. From our research and insight into other markets, the uninsured segment requires more flexibility in payment methods and terms — even if that means paying more in premiums (consistent with how lower income segments finance other purchases).

Where will the margin come from? The bet is that Momento can be best in class in distribution and customer service, while carefully building a low-fraud book of business. Despite more than a decade of investments in digitization and technology, the industry’s expense ratio remains steady at the 4-5% range, or $25+ USD per policy. Without disjointed legacy systems, Momento believes they can collapse this cost at scale by an order of magnitude. When it comes to distribution, unlike most insurtech carriers, Momento is working with agents from Day One, betting that ease of use of their agent portal will translate into better conversion rates thanks to low friction, bringing the overall CAC dollars down.

Putting it all together, we believe that Momento’s value proposition will resonate with Mexican consumers eager to get better value and service thanks to thoughtful product design, powered by best-in-class technology.

Published on 08.05.2023

Written by Rodolfo Gonzalez