Clivi: Managing Chronic Diseases in Latin America

06.20.2023 | By: Alejandra Martinez, Rodolfo Gonzalez

Investing in Clivi’s $10 million Seed Round

Our strategy for investing in LatAm is defined by two core ideas: (1) backing the most ambitious founders, and (2) backing projects leveraging the rapid penetration of Internet-connected smartphones to build massive user bases via tech-driven business models. The first idea is obvious, since founders from the region have long been underestimated. The second idea surfaces the unique opportunity. The region is home to many state-owned monopolies and large private oligopolies with low competition, while vast segments of the population operate in the informal economy. This structure translates into high-prices and low quality of service to consumers across most verticals. Physical infrastructure for most sectors is lagging and is already overwhelmed. The main hope to bring better services to consumers fast is via new entrants distributing digitally, bypassing traditional intermediaries by connecting directly with consumers through their phones. We’ve invested in this pattern multiple times across sectors, backing world-class entrepreneurs in consumer goods (Rappi, Justo), financial services (Momento, Fondeadora, Addi, Palenca), logistics (Nowports), and education (Platzi). Healthcare was missing, until we met Ricardo Moguel and the amazing team at Clivi.

We first met Ricardo in late 2021, and fell in love with his energy, charisma and life story: he is from a small town in rural Chiapas, and went on to study abroad and have a successful international career in the health insurance space. Ricardo led the Americas for Doctoralia (a medical appointment scheduling startup) up until it reached unicorn status. Through Doctoralia, Ricardo and team realized that even if you perfectly optimized the existing medical capacity in the region, it would simply not be enough to meet the demand for quality healthcare. Ricardo partnered with Kyle and Bruno to start Clivi, a digital platform to manage chronic diseases in Latin America, with the thesis that limited capacity could be overcome via digital distribution. The team chose diabetes as a starting point after two family friends died from complications from lack of proper treatment. Since leading Clivi’s pre-seed, we’ve witnessed their exponential growth from closed beta to actively managing thousands of patients a month. Today we’re announcing Clivi’s $10 million seed raise, co-led by our team at Foundation Capital and by Dalus Capital, joined by an outstanding group of co-investors.

The last few years saw a deluge of VC capital come into LatAm, most of it foreign. ~$35 billion USD has been invested since 2018, finally bringing investor attention to a region with 650 million people, $7 trillion in GDP, and a pool of talented entrepreneurs. Most of the capital has gone to fintech and consumer projects and is concentrated in a handful of companies. Healthcare is a $500b+ industry in the region (8.6% of GDP), but it has received <2% of VC investment. US/European investors tread carefully since healthcare is a sector where ‘tourist investors’ often get burnt from underestimating the industry’s complex structure and dynamics. Investing in LatAm healthcare requires lots of conviction and deep research (plus backing outstanding teams!). We hope this post helps founders, prospective investors, and partners, take the leap and dig into the space.

The Diabetes Crisis in Mexico, LATAM, and the developing world

There’s a massive difference in health outcomes for people with diabetes depending on quality and adherence to treatment, both of which are highly driven by income and by access to healthcare professionals. In the Americas, the US has the highest rate of obesity and diabetes. While extremely costly (even after adjusting for income), most people manage these chronic conditions and can keep enjoying their regular lives (albeit typically with shorter lifespans vs non-diabetics). In emerging markets, diabetes largely goes undiagnosed and untreated, and the resulting complications turn it into the main cause of amputations and vision loss. While COVID took first-place for two years, heart disease is once again the first cause of mortality in Mexico and other countries within the region, followed by COVID and diabetes. Both heart disease and diabetes are non-communicable diseases whose outcomes could be improved if treated and controlled.

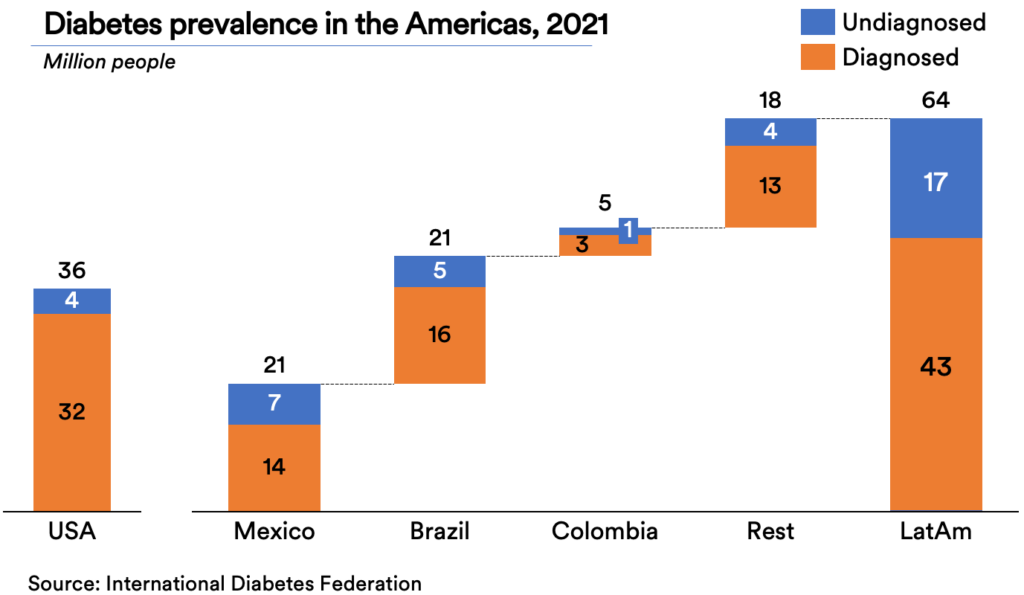

The emerging world is facing a major diabetes crisis. Massive increases in sugar & seed oil consumption, combined with more sedentary lifestyles and aging populations are driving the prevalence of the overweight and obese. Across the world, it is estimated that 10% of the adult population is living with diabetes, 75% of them in low and mid-income countries. Of LatAm’s 650 million people, over 41 million have been diagnosed with Type 2 diabetes. Mexico and Brazil alone have almost as many diagnosed cases as the United States (30 million vs. 32 million), but meta analyses of blood studies indicate the true rate might be 50%+ higher, implying that ~64m people in LATAM live with the disease. Mexico also holds the unfortunate distinction of having the highest child obesity rate, foreshadowing even more significant challenges ahead.

Properly managing diabetes requires multidisciplinary care. Unfortunately, broken healthcare systems across the region are ill-equipped to provide such treatment, with limited availability of medical professionals and high out-of-pocket expenditures:

- Insufficient Availability of High-Quality Medical Services: We can’t over emphasize the extent to which existing health infrastructure in the region is already overwhelmed. In the US, there’s about 1 endocrinologist per 5k patients. In Mexico, the estimates show 1 per 9k patients, while LatAm has about 1 per 15k patients. The ratio is unfortunately 20x higher outside major cities. As a patient, it’s hard to get professional care, and if you do, it’ll likely be once every few years or longer (often in the context of a serious emergency). This level of care doesn’t work to manage a condition that requires daily decision making. It is no surprise that outcomes in the region fall short of international standards.

- High Out-of-Pocket Expenditures: Health insurance has low penetration in Latam (10-30% coverage). Public vs private healthcare expenditure in LATAM is only 63% (versus 79% in North America), meaning a lot of the cost burden falls on people and employers. Professional treatment options for diabetes are expensive, averaging $100-250 per month across the region and are paid directly by individuals, who earn a median salary of $670 per month.

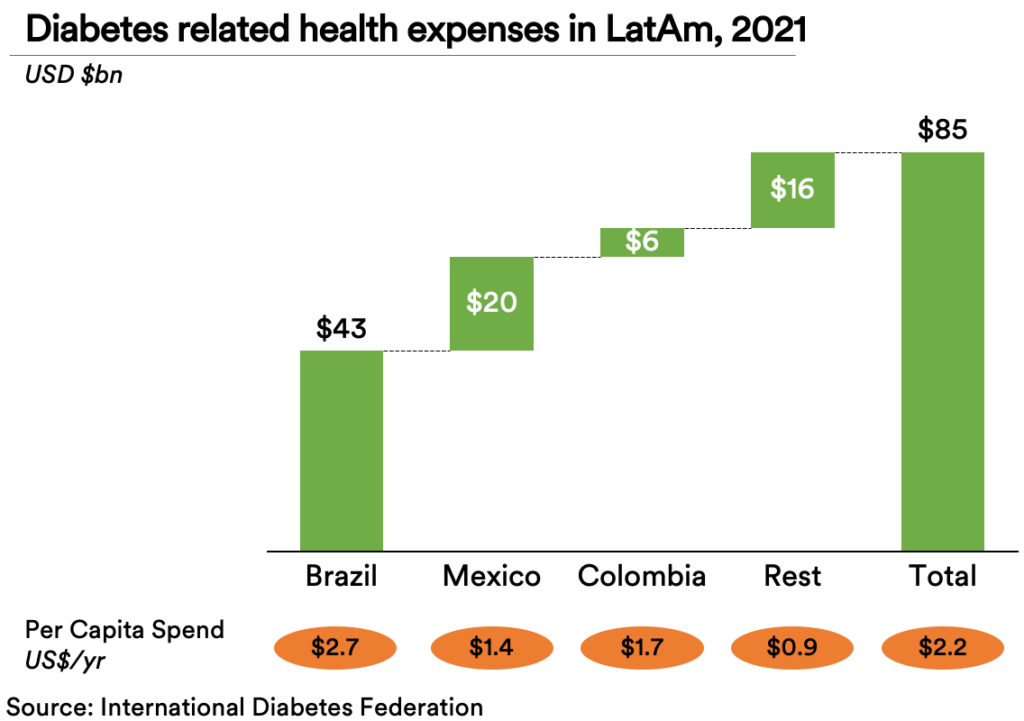

Accurate market size figures are hard to come by since 80% of diabetes patients are left untreated or resort to alternative medicine. The International Diabetes Federation pegs annual diabetes expenditures at $66b USD for Central & South America, plus ~$20b for Mexico, bringing current spend to $86b, about 17% of regional healthcare spend. We expect diabetes rates to accelerate as the diagnosis rate increases and demographics shift. LatAm has a young but aging demographic, so the cost burden of diabetes is expected to balloon in coming years. While not the current market focus, the US-Hispanic opportunity is also massive and equally urgent, since the CDC estimates US Latinos have a 50%+ chance of developing type 2 diabetes over their lifetime. Anecdotally, the Clivi team found a number of dual citizen US-Latinos already found the service on their own and subscribed directly.

Using Technology to Address Gaps in Health Infrastructure for Diabetes

Our investment thesis for Clivi is straightforward: Patients know they are fully responsible for their health given low insurance coverage and high out-of-pocket spend. Much of that spend already goes to subpar or ‘alternative’ treatments. Millions of people would benefit (and pay for) high quality care that includes continuous monitoring and prompt access to specialized care if it’s conveniently and privately delivered via their mobile phones. If Clivi becomes the largest private diabetes clinic in the region, we believe that other participants – insurers, employers, and maybe even public health systems – will collaborate with the company to bring the product to millions of patients.

So far, the thesis is playing out. In less than one year, Clivi became the second largest private diabetes clinic in Mexico by meeting patients where they are – WhatsApp. Selling subscriptions directly to consumers means Clivi obsessively absorbs patient feedback to continuously improve their product. The core offering consists of three main products:

- Virtual Care – appointments with real doctors specializing in key areas recommended by international guidelines (endocrinologists, nutritionists & psychologists)

- Ongoing Care – 24/7 live chat support, glucose and weight monitoring with progress reports, and specialized content to teach patients how to make smart health choices such as improving nutrition and staying physically active

- Clivi Pro – a full-service offering that includes convenient access to hardware (glucose monitors), inputs (glucose strips), and medication

Health outcomes are early, but nothing short of impressive: In the first 6 months since launch, Clivi patients registered an HbA1c reduction of 1.7 points, 3x vs untreated diabetes and 2x vs Livongo’s self-reported reduction (which we consider best in class). By month 12, the aggregate HbA1c reduction consistently reached 2.4%, which will translate to an extension of almost four years of life expectancy for patients, along with a reduced need for medication.

On the doctor/provider side, Clivi’s technology is advancing at a fast rate. The company is building a patient management platform that not only drives its own operations and dataset, but also plugs into many other systems and databases. Through AI and workflow automation, Clivi’s doctors already support >300 patients each (and >800 patients per endocrinologist) while improving quality of care. Their goal is ambitious: to empower specialists to handle 10x more cases from here.

To date, other solutions in Mexico haven’t matched Clivi’s combination of quality of care, affordability and scalability. As partners to Ricardo and team Clivi, we’re excited to see the company become the largest diabetes clinic in Mexico by the end of 2023 and of LatAm shortly after. The team is working tirelessly to create an experience patients would be happy to use for the rest of their lives. We’re excited to see Clivi become the chronic disease management hub for LatAm, building an ecosystem of insurers, providers, and employers to support wide distribution of the product. We believe there’s a massive opportunity ahead to serve millions of people throughout the region.

Published on 06.20.2023

Written by Rodolfo Gonzalez and Alejandra Martinez