Our Enterprise Strategy

I give you a brief overview of our enterprise investing strategy. I podcast with the CEO of Deel. I introduce you to my partner and futuristic daydreamer Jenny. Plus: Was design just a fad?

03.23.2022 | By Ashu Garg

Here’s What I’m Thinking

Over the past few newsletters, you’ve gotten to know some of my enterprise partners at Foundation. It occurred to me that I might’ve put the cart before the horse, as many readers aren’t aware that, in 2016, we refreshed Foundation Capital’s enterprise strategy and team. I thought it might make for helpful and interesting context, therefore, to introduce you to our B2B practice as a whole. So, in my opening commentary for this and the next edition of the newsletter, I’ll walk you through the Foundation Capital approach to making enterprise investments and building companies.

As B2BaCEO subscribers are well aware, the enterprise software market is massive and growing like a magic beanstalk. Large corporations spend more than $4 trillion on technology — and that figure is growing by roughly $40 billion every year. This includes companies that you don’t think of as software companies. Walmart, for example, has 15,000 software engineers and data scientists. As a result, despite this year’s correction, the market cap of publicly traded enterprise companies is now close to $10 trillion, and there are 232 enterprise unicorns — up from almost none 10 years ago.

In such an environment, clarity of purpose is critical, which is why the enterprise team at Foundation is focused on high-conviction, high-ownership, high-touch seed-stage investing. We’ve built the practice around this disciplined approach, rather than treating seed stage as a portfolio of options or dollar-cost averaging for the A.

For us, conviction begins with developing a prepared mind on a technology space. In our enterprise practice, we’re focussed on four subsectors: 1) applied AI, 2) data infrastructure and tools, 3) cybersecurity, and 4) developer tools/productivity. We’ve chosen to focus on these areas because of the depth of expertise that we’ve built and because it’s where we think the market is headed. We’ve been investing in AI apps for nearly a decade, beginning with the martech wave. Slightly more recently, we’ve built a robust portfolio of data infrastructure and security companies. Lastly, we’ve started to ramp up our efforts in solutions to help developers.

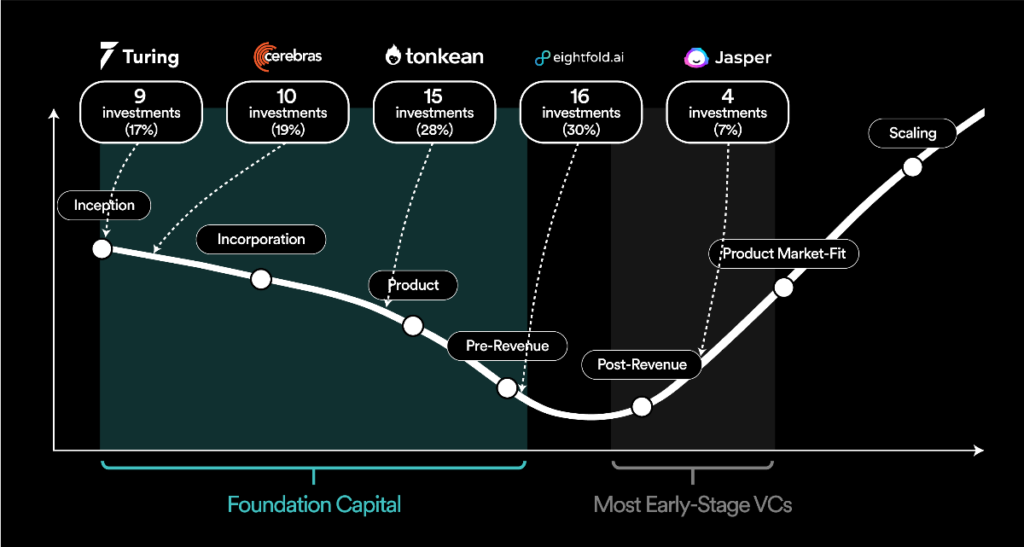

We invest in most companies before they have revenues or, sometimes, even a product. I tend to think about this in the context of the startup “valley of death,” the critical initial period in the life of a startup when operations have begun but the company hasn’t yet started to generate revenues. Crossing the valley of death requires companies to translate their technology into a product, identify demand for that product, and generate early revenues.

Of the 53 enterprise investments we made since 2015, 49 of them were pre-revenue at the time of the investment. This graphic breaks out our investments by stage, with the breakout companies at each stage highlighted at the top.

From the top left: eight of these investments, that is 15%, were pre-inception. Another 10 were pre-incorporation. And another 15, or nearly 30%, were pre-product. We also made 16 investments in companies that were pre-revenue and only four investments in post-revenue companies. In total, 92% of all the investments we’ve made since FC8 were pre-revenue.

I’m proud to say our refreshed approach has made us second to none at the inception stage. But compared to what needs to follow, investing this early is the easy part. In the next newsletter, I’ll talk about how we help our companies cross the valley of death.

How to Build an Organization

My guest for this edition of the podcast is Alex Bouaziz, co-founder and CEO of Deel, a global payroll solution that helps businesses hire anyone, anywhere. Founded in 2019, Alex and his team have grown the company to a unicorn with almost a thousand employees in just three short years!

In our conversation, he opens up about the thrills and perils of scaling Deel so rapidly. From the things he got right, like how to hire and how to foster a culture of excellence. To where he got it dead wrong, including titles and product development. We hit every angle of what it takes to build an organization.

Meet My Partner: Jenny Kaehms

Where are you from originally? I am from a creative and outdoorsy town, 40 minutes east of San Francisco, called Castro Valley.

What did you want to be when you grew up? Growing up, I wanted to be a science fiction writer. As a kid, I would organize my daycare friends and act out futuristic daydreams. I was planning on majoring in creative writing. My parents, who teach math and anatomy, encouraged me to study bioengineering so I would have something to write about.

What do you invest in? In general, I invest in emerging technology in new markets. Historically, I’ve been drawn to vertical AI companies. Companies that I’ve worked with include Luminar, Lambda Labs, and Forethought.ai. Now I’m spending a lot of time looking at the trend of “Total Experience.” Total Experience (TX) is a combination of UX, CX, and EX. TX is a response to distributed teams, dashboard overload, and the co-creation of products with customers. In TX I am looking at places where you can apply new technologies like NLU, image generation, and RPA to design software that helps someone make money, decrease costs, and be a hero to their company.

What’s the coolest technology experience you’ve ever had? I would define “cool” as a moment of awe and optimism about the future. And there have been several times when technology made me think, The future is bright. Here are just two recent ones:

2017 – The life-changing experience of a coworker’s child undergoing peanut-exposure therapy. After the therapy, the child could interact with a peanut without risk of dying.

2022 – The captivating Geoguesser trend on Tiktok. It left me in awe on two fronts: One, that we’ve mapped the world so thoroughly. Two, that there’s now a social game in which people have a map of the world in their heads — that just blew me away.

One word to describe the kind of founders you look for. Moxie. Someone with a unique resolve and courage about life. Founders are like forces of nature. They have to be. They have to have a resolve to create something from nothing. Moxie is a combination of determination, spunk, and tenacity. With moxie, founders can challenge and change the status quo.

Founders are like forces of nature. They have to be. They have to have a resolve to create something from nothing.

Jenny Kaehms, partner at foundation capital

FC Portco Spotlight: Arize

Arize AI is a machine learning-observability platform. With the adoption of AI/ML at an all-time high, it’s more important than ever to understand how this technology is affecting your business. When ML models are deployed in production, we lose all sight of how they are performing. Even the engineers who built them couldn’t tell you why they are buggy or not doing what they’re supposed to do. Arize is here to help!

By providing real-time analytics and observability, the Arize platform helps your teams determine when, why, and how your models are performing. We empower engineers to fix models with explainable analysis and catch upstream engineering issues. So if your team is fed up with the hours spent troubleshooting and debugging your models, you don’t have to just keep hoping for the best: you can Arize.

The State of Design in 2022

Whatever happened to design? Not so long ago, design was ubiquitous in the Silicon Valley discourse. Tech giants were acquiring design agencies, design thinking was touted as critical for strategic planning, some companies installed a chief design officer, even venture firms were hiring design partners. In 2017, my partner Steve Vassallo published a book called The Way to Design, which championed making design central to the building of companies, products, and just about everything else. But these days, the fanfare seems to have faded. And Steve found himself asking: Was design just a fad? He explores this question in his latest op-ed for Forbes.

Neha Narkhede, Co-Founder of Confluent, on How Uncertainty Leads to Personal Growth

Neha Narkhede is the co-founder of Confluent, an advisor to and investor in tech start-ups, an Indian American founder, and an all-around wise and thoughtful successful leader. My partner Joanne Chen spoke to Neha for her latest edition of American Dreamers, our series about Asian American tech founders and their journeys to establishing some of the most important businesses we use to navigate modern life. Neha shares crucial lessons she learned about what it takes to be a founder, as well as how to navigate her identity as an immigrant. “The more you get comfortable with your own identity and see ways in which you are adding value because of that identity — that’s the right way to go about this.”

Published on 05.20.2022

Written by Ashu Garg