The Golden Velocity: a new SaaS metric to live or die by

I explain how and why to calculate your company’s Golden Velocity. I chat with the second-handsomest Ashu Garg in tech. I introduce you to my partner and frustrated tennis pro Apoorva. Plus, meet a missionary misfit who’s trying to save the world.

05.24.2022

By Ashu Garg

I. Here’s What I’m Thinking

Over the last month, markets have continued to trend downward, as inflation persists and consumer sentiment has grown grimmer with looming fears of a hard landing, i.e., a recession.

At the risk of stating the obvious, investor sentiment has also shifted as we face changed conditions. First of all, as the Fed tightens money supply and withdraws capital from the system, there will simply be less money sloshing around and, therefore, less funding available for all asset classes, including VCs and growth-equity firms. Second, multiples across the board, whether its revenue or EBITDA or FCF, have fallen by 40% to 60%. This mostly reflects the change in cost of capital and the reduced appetite for risk in the current environment.

As a result of this new reality, investors have become much more discriminating. Specifically, there’s been a flight to quality, with quality being defined as the ability to grow (albeit at maybe a slower rate) while also generating significant free cash flows. While the Emerging Cloud Index has fallen by 58%, for example, Microsoft is only down by 28%. I thought it would be useful to provide a framework for enterprise software CEOs to think about their long-term financial model. So, my partner Jaya Gupta and I did a deep dive into the data.*

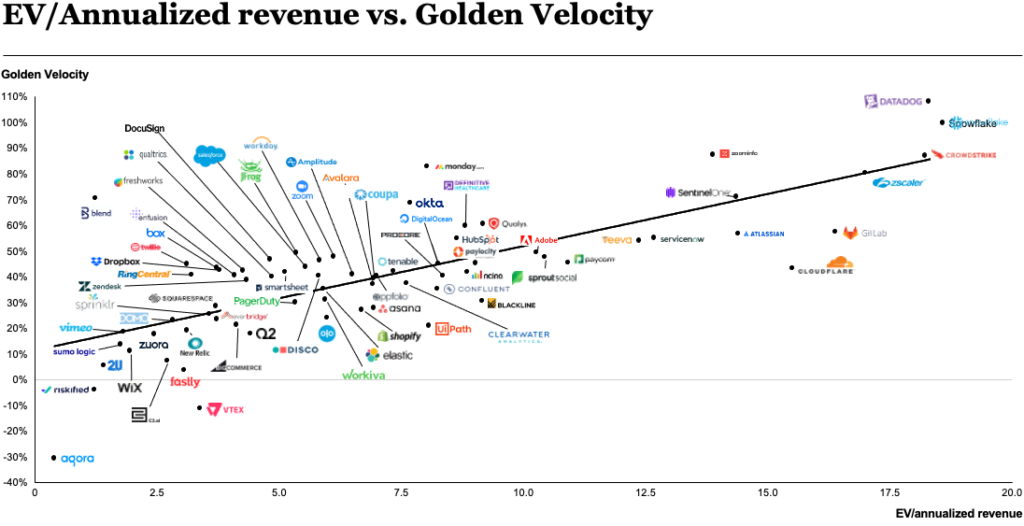

What our analysis found is that current revenue multiples highly correlate to the sum of LTM Growth + FCF Margin. As a shorthand, let’s call this number the “Golden Velocity.” The Golden Velocity is different in emphasis from the “Rule of 40” in that we stress the importance of getting to a clear path to positive FCF margins, not just EBITDA margins, as under the Rule of 40. Moreover, while the Rule of 40 is a straightforward threshold — greater than 40 is good; less than 40 is bad — what the data showed us is that it’s a continuum rather than a pass-fail measurement. So, a Golden Velocity of 80 is a lot better than one of 40.

As you can see in the chart below, solid performers in the market such as Salesforce, ServiceNow, WorkDay, and Coupa all have Golden Velocities in the 40-50 range and are rewarded with an EV/revenue multiple in the range of 5 to 7. Companies like Snowflake and Datadog, which combine high growth with positive FCF margins (their Golden Velocities are 100 and 107, respectively) are still being rewarded with EV/LTM revenue multiples of more than 18.

As the Golden Velocity falls below 40, we start to see the EV multiples decline, and the market punishes companies like C3.AI and Sumo Logic with revenue multiples of less than three. The usefulness of the Golden Velocity is that it’s a single metric that correlates with long-term valuation and thus provides a framework for making trade-offs. So, if your current Golden Velocity is way less than 40, then you need to define a path to 40, most likely by cutting expenses to improve FCF margin. And if you can build a business model that enables you to get to a Golden Velocity of 80-100, then you can expect to be rewarded with premium multiples by the market. Or as Jeff Bezos has said, “[S]tock prices are most closely correlated with cash flow. It’s such a straightforward number. Cashflow is what will drive shareholder returns.”

Growth is still important, but growth at all costs only works when money is free. Money isn’t free any more and won’t be for a long time to come. When capital becomes more expensive, it’s a path to predictable, sustainable cashflow that will drive shareholder value. Profitability, in other words, matters again.

* Thanks to legendary CFO and board member Jack Lazar for reading and offering invaluable feedback on an earlier draft.

How to Hire People Better Than Yourself

In the new episode of the podcast, it’s Ashu Garg vs. Ashu Garg. My guest is my very good friend Ashu Garg, who also goes by Ashutosh. Ashutosh is the founder and CEO of Eightfold, an AI-powered talent-acquisition and management platform.

I’m a board member and early investor in the company.

In this conversation, Ashu and I trace Eightfold’s not-always-easy path from altruistic mission to Silicon Valley unicorn. We spend much of our time discussing how to hire the best people. And I get Ashu to share everything he wished he knew at the beginning of his startup journey.

Meet my Partner: Apoorva Pandhi

Where are you from originally? I grew up in a small city called Chandigarh, which is north of Delhi in India. I later moved to Delhi for undergrad and stayed there to work for a few years before moving to the US.

What did you want to be when you grew up? I come from a family of professional/semi-professional tennis players, so I always dreamt of becoming a professional tennis player myself. Sadly, I’m not half as good as my father and grandfather.

What do you invest in? While I look at opportunities across the enterprise stack, I spend the majority of my time in data, machine learning, and software infrastructure. From time to time, however, exceptional founders and massive unmet needs have drawn me into opportunities within GTM Ops, health care, and deep tech.

What’s the coolest technology experience you’ve ever had? Two different experiences come to mind. Both demonstrate that it’s about more than just the technology. The first is when I made the switch from Android to iPhone. Despite nudges from friends and family, I was resistant to switching to iOS, because I was well-acquainted with the Android platform and most Android smartphone vendors had added a ton of great features. But when my wife forced me to give the iPhone a chance by gifting me with one — and it changed the way I thought about a cell phone. It was more than a utility or phone — it was an experience, with intuitive user workflow, ease of use, media quality, and cross-device collaboration.

The second “coolest technology experience” was the air fryer. It’s a modern marvel: a new application of a tried-and-tested technology, which has permeated the health and wellness market. It exemplifies how powerful even an older technology (i.e., a convection oven) can be when it’s packaged for a specific use-case and reintroduced to the market with the right go-to-market strategy.

One word to describe the kind of founders you look for. The word that comes to mind is tenacity. Founders who are persistent, and who navigate continuously based on market feedback, are more likely to find product-market fit. To quote Finding Nemo:

When life gets you down,

Apoorva pandhi, partner at foundation capital

just keep swimming!

FC Portco Spotlight: Coefficient

Despite advancements in the cloud-data stack, most business users still cannot access the data and insights they need. Under-resourced data teams, code-heavy technologies, and ever-expanding data volumes make it difficult for business users to access the data they need to solve their custom business needs. To close this gap, Coefficient turns business users into builders. As a no-code, self-service app builder, Coefficient empowers business users to harness their spreadsheets and create business applications powered by real-time data. Now, business teams can leverage their existing skill sets to drive insights when they need them, without waiting for the engineering team. Sign up here to try Coefficient for free today — and start building frictionless business apps.

Solving Climate Change the American Way

Saul Griffith is an inventor, founder, environmental activist, MacArthur “Genius” Grant recipient, and former Foundation Capital entrepreneur-in-residence. My partner Steve Vassallo thinks of him as a “missionary misfit,” Steve’s label for women and men who are supremely talented, endlessly curious, passionately committed, and unconstrained by disciplinary boundaries. For the pages of Forbes, Steve interviewed Griffith, who thinks we have months, not years, to save the planet from the climate crisis. Learn more about the remarkable Saul Griffith’s vision for an electric future.

‘A Pressure Test for the Soul’

Startups are hard. That’s what people who’ve never done it might not understand. There is pleasure but also pain. There are highs and lows. There are great rewards; there are also real sacrifices. In this short documentary, 25 of Foundation Capital’s founders get real and share their personal stories. It is the best encapsulation of entrepreneurship that I’ve ever seen. So if you need a reminder of why we, in Startup Valley, do what we do, then meet our founders.

Published on 05.24.2022

Written By Ashu Garg