B2BaCEO: Newsletter, October 2022

This is what we invest. This is how you build a $4B company in four years. This is my partner and former stargazer Joanne. This is how we arrived at the generative AI moment.

10.27.2022 | By Ashu Garg

I. Here’s What I’m Thinking 🤔

In the last issue of this newsletter, I took readers through Foundation’s approach to making enterprise investments, specifically our focus on high-conviction, high-ownership, high-touch seed-stage investing. We mostly invest in companies before they’ve crossed the startup “valley of death,” i.e., before they have revenues. In fact, 92% of all the investments we’ve made since we initiated this strategy in 2016 have been at the inception stage.

Seeds, in other words, are the core of what we do in the enterprise practice at Foundation. It’s how we invest. In this edition, I’ll talk more about what we invest — what we put into finding outstanding founders and building great companies. In this regard, three things matter in early-stage investing: sourcing, picking, and building. At Foundation, we’ve innovated in each of these steps and I’ll give you a peek (just a peek) behind the curtains.

Source. We need to source founders well before there is a Pitchbook entry. That requires a different approach to building networks. We’ve invested in select networks that have a proven track record of yielding high-quality entrepreneurs. That includes newer initiatives, like our network of Beacons fund managers, as well as time-tested pillars, like domain-specific communities and alumni networks. My favorite example is our IIT network.

The Indian Institutes of Technology (IIT), of which I’m an alum, is a system of universities in India; globally, it ranks fourth in terms of the number of unicorns founded by alumni. Through various IIT events that Foundation Capital has hosted, I’ve met founders who we’ve invested (Mohit Aron @ Cohesity); recruited entrepreneurs-in-residence whose companies we helped conceive (Navneet Loiwal @ Coefficient); been introduced to future Foundation founders whose companies we incubated (Vijay Krishnan and Jonathan Siddharth @ Turing). There are many more such examples, but what they add up to is IIT-founded startups account for 30% of our enterprise portfolio and the IIT network has already generated three unicorns for us.

Pick. We source over a thousand startups every year and choose to invest in less than a dozen. When there is no product to see or customers to talk to, for us picking requires, and begins with, having a prepared mind and the ability to assess founders. By “prepared mind,” I mean developing domain-specific expertise, rigorous investment theses, and detailed market maps. In a recent blog post about our investment in Jasper AI, my partner Joanne discussed our history of investing in intelligent automation. The sector now accounts for almost 40% of our portfolio. I made my first foray into data and ML infrastructure, in 2013, with a personal investment in Databricks. My partner Steve led our investment in Cerebras in 2016, which was followed by our investment in Cohesity. Data and ML infrastructure now makes up a quarter of what we do. We went deep into cybersecurity four years ago and it accounts for another quarter of our efforts today.

Having a prepared mind allows us to very quickly filter from the thousand+ startups that we meet down to a hundred. And then we go deep on the men and women behind those companies. We spend an inordinate amount of time assessing whether the founders are merely great or truly exceptional. We need to understand not just their capabilities but also their personalities. We try to get inside their heads to understand what motivates them and how they will react when the going gets tough. We ask ourselves, Can this founder scale with the company?

Build. Once we’ve made an investment, the real work begins. Most companies, perhaps 95+%, fail to cross the valley of death. Our success depends on beating those odds. Crossing the valley of death requires a company to translate its technology into a product, identify demand for that product, and generate early revenues. We have a structured approach to helping our startups do this. I could spend the next twelve newsletters talking about what we do in this regard, but let me just briefly hit on a few of the typical areas where we help our founders, many of whom have never started a company before.

The first step is helping founders position the company and teaching them to sell the story to customers. Once you have a story and perhaps a product, you have to find customers to buy that product. Learning to sell is hard for technical founders. We help them get their first 10 customers. We even have a dedicated customer introduction program (Compass), which we rolled out less than two years ago. Most founders can hire engineers but struggle with hiring go-to-market teams. We therefore focus on helping them hiring their initial GTM team and closing key candidates. We then help founders raise their next round of funding, and in many cases co-pilot the whole process.

Now that you see how in the trenches we get with our companies, hopefully that helps you to understand why high ownership at the time of initial check is so important to us. We want to ensure that there’s perfect alignment between us and our founders from the jump — because their success is our success and vice versa.

That’s it: source, pick, and build. Easy to say, but doing these things consistently, effectively, and stage appropriately is what makes the difference between a meaningless tweet and a true venture practice. That’s what we, on the enterprise team at Foundation Capital, do every day.

II. How to Build a Hundred Billion Dollar Company

Jonathan Siddharth is cofounder and CEO of Turing, the platform that helps companies source, vet, match, and manage the world’s best software developers remotely. Jonathan started Turing in Foundation Capital’s offices four years ago and he’s since grown it into a $4B company.

On this episode of B2BaCEO, Ashu gets him to talk about how he did it: from best practices for hiring execs and communicating with investors, to the unique fundraising machine that Turing’s built, to navigating through choppy economic waters.

Jonathan is one of the most methodical, forward-thinking entrepreneurs active today. For four wild years, he’s been living the startup life, and fighting the founder’s fight, and embodying this show’s ideal of growing from engineer to CEO.

III. Meet My Partner: Joanne Chen

Where are you from originally? I was born in Jinan, China, a city of nine million people known as the “City of Springs.” For the first years of my life, my grandparents raised me. When I was five, I took an airplane (by myself) to join my parents in Montreal, where my father was studying and had decided to remain after the Tiananmen Square Massacre. We then moved to Ottawa and, later, Cary, NC. I’m a mutt culturally, in other words, and am good at adapting to new circumstances.

What did you want to be when you grew up? In high school, my teacher convinced me to sign up for his spring break astrophysics camp. We went to the mountains, where there was no light pollution, to study the visible planets. I was hooked! I spent my free time looking at objects in the sky and eventually published a paper on two supernova remnants (3C58 and G54.1+0.3). I thought I would go to college to be an astrophysicist! Alas, my parents gave me two choices for majors: computer science or bioengineering. I wound up studying EECS at Berkeley.

What do you invest in? I invest in early-stage applied AI companies that are building the automated enterprise. The role of data in self-driving companies is a preoccupation of mine. I’m fascinated by the inflection point between AI technologies still in research mode and AI technologies that are commercially ready, and that has translated into first checks into companies like Jasper and SafelyYou. I also think a lot about the social implications of AI.

What’s the coolest technology experience you’ve ever had? Upgrading from my pink Motorola RAZR to the original iPhone. Going from button forward to buttonless was a small detail but huge change for me. Then, it was trying the iBeer, the beer drinking app, in the first iOS store.

One word to describe the kind of founders you look for. Self-learning. It takes grit, iteration, and a whole lot of luck to be successful. Along the way, a company must change very quickly and, therefore, needs a CEO who can learn and adapt even more quickly.

IV. Startup Spotlight: Gable

Remote work has become essential to how enterprises operate. But people operations and workplace teams aren’t equipped to manage a distributed workforce at scale. Rates of burnout and employee disconnection and disengagement are high. The line between HR and real estate is blurry. Leaders need a new way to accommodate their remote team members and enable them to connect with their colleagues, wherever they are, all while being able to measure their effectiveness and real-estate spend. What they need — is Gable.

Gable is a centralized management suite for HR and People Operations that makes it easy for teams to search, book, and optimize use of flexible workspaces. Gable currently curates over a thousand readily bookable spaces on its platform. Its unique software, which integrates with HRIS tools and Slack, can provide a holistic way for employees to book a space — regardless of whether it’s company owned or not. At the same time, Gable provides visibility to other team members and relevant data for managers.

A distributed company doesn’t have to be an administrative nightmare. Gable empowers remote work.

V. The Past, Present, and Future of Generative AI

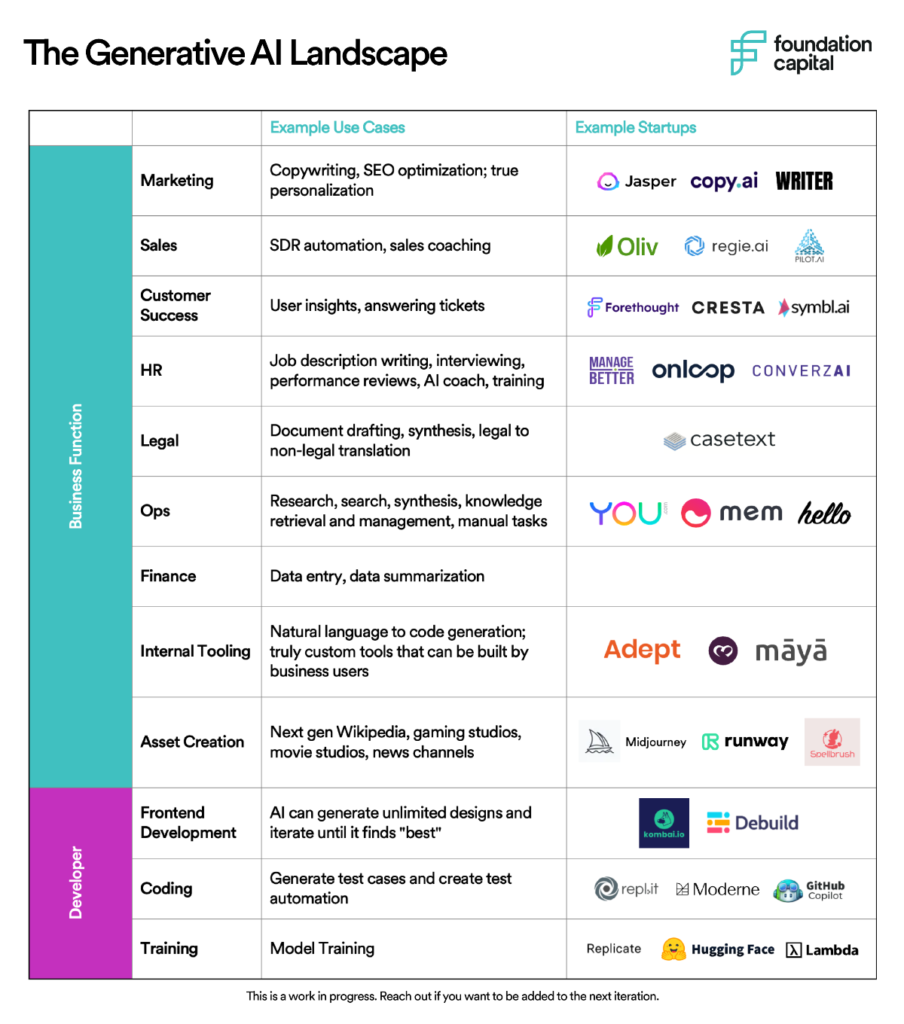

As everyone reading this is aware, “generative AI” is having its moment. My partner Joanne Chen recently wrote a blog post that provides some useful context on how we got here and what parts of the enterprise will be impacted by the technology. She starts by tracing Foundation’s history with content-creation automation, recounts how that led to us being the first seed investor in AI content platform Jasper, and the maps out opportunities that generative AI entrepreneurs should focus on. Welcome to the Imagination Age!

VI. Using Artificial Intelligence to Hunt for New Drugs

My partner Steve Vassallo has a group of extraordinary people he refers to as “Missionary Misfits.” They are, as he describes them, “Women and men who are supremely talented, endlessly curious, passionately committed, and unconstrained by disciplinary boundaries.” He has a series for Forbes in which he interviews these missionary misfits.

The latest is a conversation with Daphne Koller, whose CV is unbelievable: a computer science professor at Stanford, a MacArthur Fellow, one of the cofounders of Coursera, and a fellow of the American Academy of Arts. Most recently, she’s the founder and CEO of Insitro, a drug-discovery startup. Steve and Koller discuss her company’s mission to use machine learning to reduce the time and costs of drug discovery. And Steve gets her to share the one thing you need to do to avoid inconsolable regret in life.

VII. Me / We

I feel somewhat obligated, but also quite embarrassed, to share the news that Business Insider has named me to its list of the top 19 AI/ML venture investors. While I’m honored they chose to include me, what these lists leave out is the collective work, group learning, mutual support, and discussion and debate that goes into making the right investments. At Foundation Capital, at least, we play this as a team sport, and this is an honor I share with the rest of the team, especially my partners Steve Vassallo and Joanne Chen.

Published on 10.27.2022

Written By Ashu Garg