FC Fintech Newsletter November 2023

11.20.2023 | By: Foundation Capital

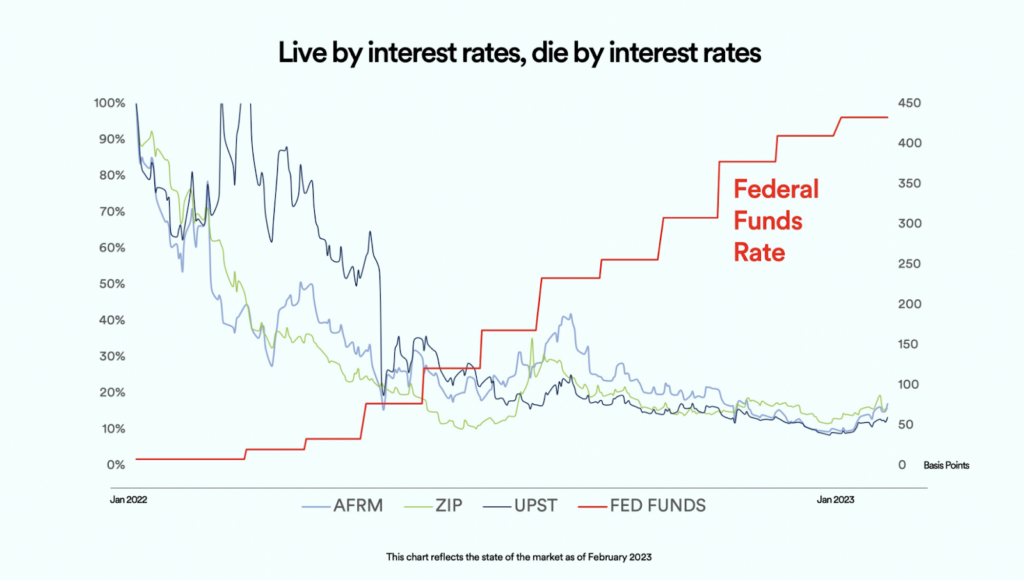

As the market tentatively rebounds from rate hikes and inflationary pressures, a major opportunity is emerging in LendingTech—a field that many of you, our readers and partners, have been journeying with us. Lenders today face a new reality—one where innovation isn’t just a buzzword but a survival kit.

While the financial landscape may be shifting, at Foundation Capital, our vision has not. Despite the current climate, our conviction in the potential of LendingTech remains unshaken. We believe the market is slowly but steadily moving towards a new “golden age” for alternative lending. Let’s explore why.

As the market tentatively rebounds from rate hikes and inflationary pressures, a major opportunity is emerging in LendingTech—a field that many of you, our readers and partners, have been journeying with us. Lenders today face a new reality—one where innovation isn’t just a buzzword but a survival kit.

The Future is Bright: Five Key Tailwinds for LendingTech

Foundation Capital has been investing in LendingTech leaders for well over a decade, starting with our early investments in LendingClub, LendingHome (now Kiavi), and Upgrade. Today, we’re seeing five trends that point to a coming golden era for alternative lending:

- The Return of Cheap, Abundant Capital: With inflation cooling, we’re likely to see interest rates stabilize and perhaps even fall in 2024. This shift will once again make alternative asset yields attractive. As the capital floodgates reopen, cash will become both readily available and affordable, reinvigorating the LendingTech space.

- Strong Value Prop to Consumers: When rates start to come down, traditional lenders will get greedy and be intentionally slow to respond. As incumbents take wider and wider spreads, alternative lenders are poised to step in and undercut them. By offering more competitive rates and innovative products, these upstarts can attract a new cohort of consumers disillusioned with slow-moving incumbents.

- Leaner, Meaner Operations: Having learned from the recent downturn, alternative lenders have streamlined operations and cut costs, making them more efficient than ever before. What’s more, while traditional competitors face internal obstacles to innovation, these smaller, more agile lenders can adopt emerging technologies like generative AI to enhance their marketing efforts, improve customer service, and even architect more performant risk models.

- Battle-Tested Risk Models: For those who have survived, the robust performance of alternative lending risk models during the recent period of economic turbulence has reinforced investor confidence.

- Market Share Gains: Many alternative lenders will wake up to a new dawn in which all of their competitors are dead, allowing them to quickly capture market share.

Upward and Onward

We remain enthusiastic about the future, bolstered by the knowledge that market performance is cyclical. The same resilience that has carried the strongest LendingTech companies through past downturns will propel them to new heights in the coming era.

Here’s to innovating through the storm and emerging stronger on the other side.

Charles Moldow

General Partner, Foundation Capital

***If you have reactions to or feedback for me about this idea or the overall newsletter, I’d love to hear from you! Drop me a line on LinkedIn.

Check out our post A New “Golden Age” for Alternative Lending to read more on this topic.

In Local News

New York Summer Happy Hour. Dispelling the myth that VCs take the summer off, Foundation Capital’s NY Fintech Team hosted a happy hour at the Gansevoort Rooftop in July. We brought together over 50 founders and operators across the NYC ecosystem to share a drink and perhaps a few thoughtful ideas.

There were a lot of events during NY Tech Week… hundreds, in fact! The NY Fintech Team did their best to keep up. Nico participated in Empire Startups and Google’s “reverse pitch” event, sharing the FC story with over 100 entrepreneurs. That evening, we partnered with Flying Fish VC to lead a discussion at our West Village office about opportunities for startups in the current AI wave. EvolutionIQ (FC portco) and Mahmoud Arram (our EIR) joined our panel of seasoned builders. A few blocks away, Alejandra co-hosted Road To Breakpoint with Solana Labs and our portcos Dialect and Teleport. The event gathered over 50 members of the Solana crypto community in advance of this year’s Solana Conference in Amsterdam.

Fintech is not dead at Money 20/20. Despite an admittedly slimmer social schedule (and no Post Malone!) at Money 20/20 this year, we’re still trying to give fintech the attention it deserves. Foundation Capital welcomed over 200 founders, investors, and industry experts to our fiesta-themed happy hour. We’re sorry if you didn’t get a fintech friendship bracelet – we promise to bring them back at another event near you! Also, a shout out to the many-talented Nico for partaking in SVB’s part-roast, part-panel to close out the conference on Tuesday night.

The Company We Keep

Fairmatic raises $46M to bring AI to commercial auto insurance. The company has exclusively licensed seven billion miles of driving data from Zendrive and has used it to build proprietary models for the light trucking industry (think: Amazon delivery trucks, Rotorooter vans, etc.). Fairmatic’s approach has delivered a 35% reduction in loss ratio compared to the industry average.

We led Coincover’s most recent financing with a $7.5M investment. The company has been on a tear, with major partnership announcements (Fireblocks, BitGo, Cobo) coming out practically weekly — and another announcement with one of the biggest names in crypto coming soon!

Trade Ledger signed a £2.3 million TCV deal with Barclays, moving it closer to its mission of creating a world where every business gets the capital it needs to thrive. This follows on the heels of recent wins with Virgin Money, Nord LB, and HSBC.

Four FC fintech companies are honored in the inaugural Embedded Fintech 50, a list highlighting the rising stars in fintech innovation. Congratulations to Coast, Canopy, Lili, and Northstar!

Published on 11.20.2023

Written by Foundation Capital