A Founder’s Guide to 2024 Planning

I advise founders on planning for 2024 amid intensely troubling world events. I recap my discussion with Matei Zaharia of Databricks at our Enterprise CEO Dinner. I spotlight our NY Tech Week event.

10.13.2023 | By: Ashu Garg

Typically, October marks a time for founders to look ahead and plan for the next year. This October, the routines of annual planning come at a dark moment for the world. The horrifying attacks this Saturday on Israel brought back haunting memories of the 26/11 atrocities in Mumbai. Such indiscriminate targeting of unarmed civilians and kidnappings of women and children are heinous acts of terror. Some of my friends and colleagues have lost loved ones or seen them injured. Even more have been called to serve to confront this evil. I worry for them, but I also understand that they have a job to do. Terrorism has no place in society.

Despite the pain and grief we are all feeling, founders must still find ways to move forward. In this month’s newsletter, we’ll review the highs and lows of the past three years and explore how founders can approach 2024 at this moment of grave uncertainty. I’ll close with three key pieces of advice to guide founders as they sketch out their strategies and financial plans for the year ahead.

2021: A Year of Reckless Exuberance

2021 was a year of excess in tech. Lavish startup spending and sky-high growth projections were the norm, with profitability relegated to the backseat. In board meetings, when board members expressed valid concerns about payback periods or gross margins, they were brushed aside. For the first time, I saw SaaS company gross margins fall well below 50% as CEOs scaled services and support teams in anticipation of demand. Guaranteed bonuses for new AEs became standard.

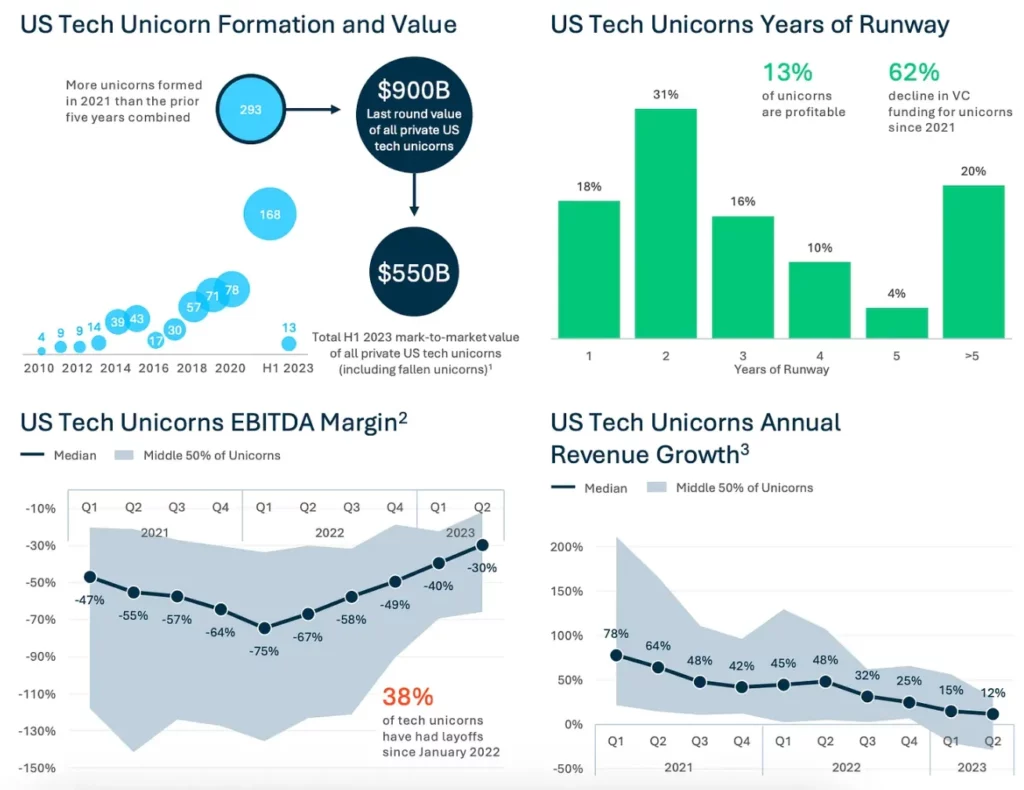

Liquidity events maintained a similarly frenzied pace, with 191 U.S. VC-backed tech IPOs and over 3,000 VC-backed M&A deals completed globally. Pent-up consumer demand and supply chain disruptions drove inflation to 7% to the year’s end, while interest rates stayed near historic lows. Venture flooded startups with $345 billion in the U.S. alone: nearly double 2020’s previous record. Round sizes, valuations, and revenue multiples neared all-time highs as investors showed a willingness to pay almost any price, shifting leverage firmly to founders. Employees also exercised newfound power as the “Great Resignation” took hold and quit rates in the U.S. hit new peaks.

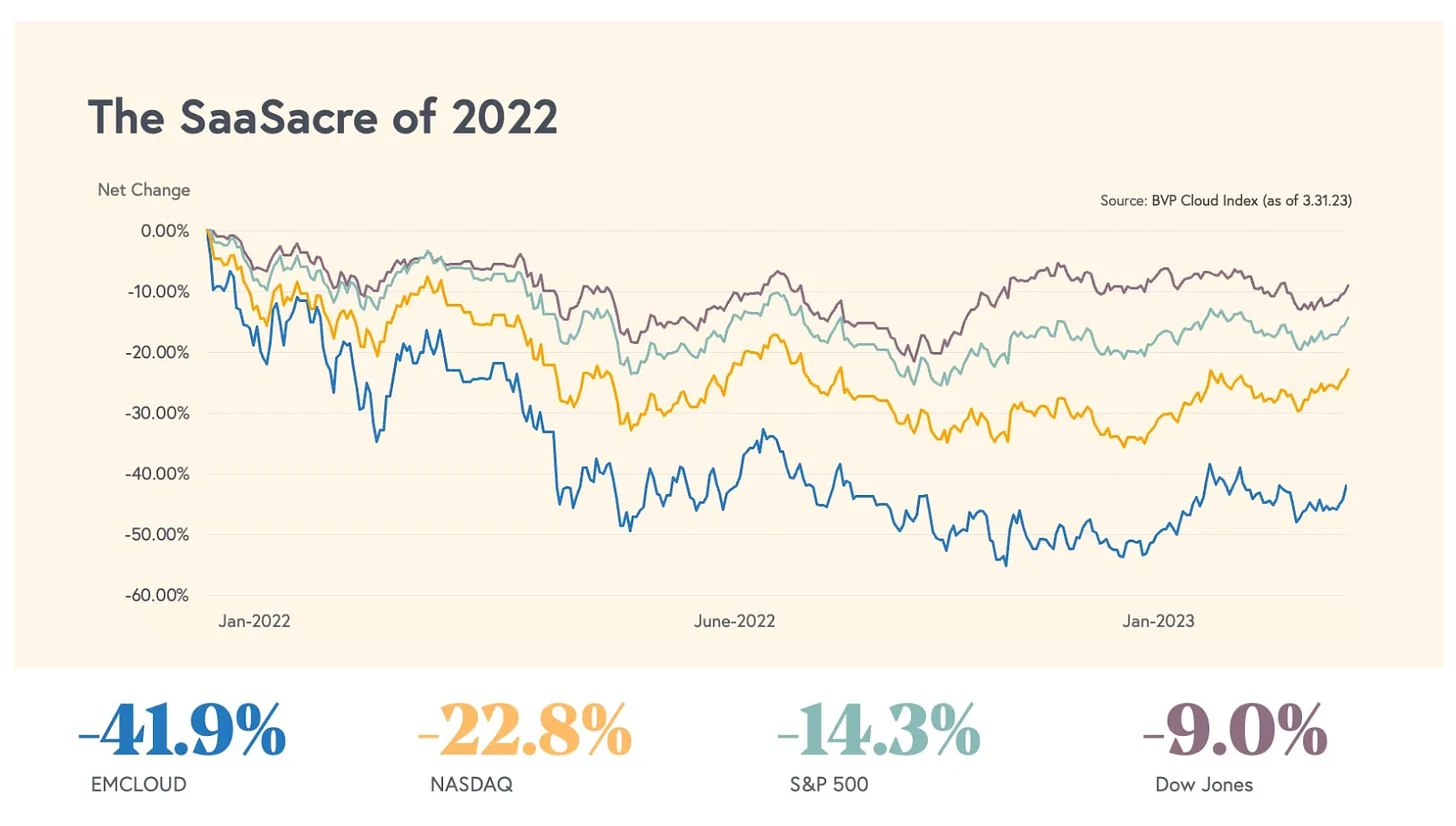

2022: Refocusing on Fundamentals

Buoyed by 2021’s momentum, most startups began 2022 with ambitious growth plans. Yet the year proved a harsh wake-up call. Inflation surged to a 40-year high. The Fed began rapidly hiking rates, which climbed to over 4% by the year’s end. Gridlocked supply chains, widespread worker shortages, and the war in Ukraine further strained the economy. Markets tumbled, with the S&P 500 logging its worst year since 2008. Venture funding, IPOs, and M&A activity dwindled to a halt.

By Q3, many startups started missing their targets. Some founders reacted quickly, cutting costs and/or raising capital in Q2/Q3. Personally, eight of my portfolio companies secured fresh funding in summer 2022. It wasn’t until November, with mass layoffs at Facebook and Twitter, that everyone got the memo. When founders responded, they did so aggressively, slashing headcount and GTM budgets, along with all non-essential costs. Most closed 2022 at 60-80% of their original forecasts.

2023: Pursuing Efficiency Amid Uncertainty

Founders set lower growth targets for 2023 but often had to keep cutting costs, as many were trying to catch a falling knife. Demand for enterprise software remained soft, purchase cycles lengthened, and procurement teams pressed for steep discounts.

The mood was bleak in January. The S&P 500 was down 20% year-over-year. Inflation, while slowing, remained above 6%. Interest rates reached 15-year highs and continued climbing. Venture funding across all stages and sectors continued to slow, with $76 billion deployed in Q1: a 53% year-over-year drop. A January survey of economists predicted a 61% chance of recession within the year. The collapse of Silicon Valley Bank in March, the largest bank failure since 2008, further reduced confidence levels.

By September though, the sentiment started to shift. The widely anticipated recession has yet to happen. Inflation seems under control, despite historically low unemployment. Markets have regained lost ground. Tech titans like Meta, Amazon, Apple, Microsoft and Google have recouped over $3 trillion in market cap since January. AI’s rapid advances infused new optimism into the tech sector and gave rise to a promising crop of AI-native startups. In parallel, software demand appears to be cautiously rebounding. Morgan Stanley’s Q3 CIO survey points to stabilized near-term IT spend, with early signs of 3.4% growth in 2024.

Software companies big and small have also gotten back in shape. Since early 2022, the EBITDA margins of U.S. tech unicorns have ticked steadily up. Nearly 25% of the top 100 cloud companies are cash-flow positive, with two-thirds on track to reach this milestone by the end of 2024. Among unprofitable startups, burn rates improved from $2.10 per $1 of new revenue in 2022 to $1.60 today. Thanks to these meaningful efficiency gains, startup runway only fell 23% from its peak in Q4 2021, despite a 61% drop in VC investment.

2024: Navigating the Year Ahead

The focus on profitability in 2023 has forged stronger, leaner companies poised for sustainable growth in 2024. A handful of venture-backed IPOs (including Instacart, Klaviyo, and Arm) suggest that the IPO window is slowly opening. Venture funding may also pick back up. Q3 2022 saw $73 billion of venture dollars invested globally, up from Q2 but still down 15% year-over-year.

Still, economic uncertainty lingers. Recession fears are back as economists continue to debate the odds of a soft versus hard landing. Geopolitics, including the Israel-Hamas war, the war in Ukraine, China-Taiwan tensions, and the upcoming U.S. presidential election, add further uncertainty. Q3 saw a return to volatility in the public markets, with the S&P 500 falling 5% since August. If consumer spending and corporate earnings rebound, the Fed may hike rates further, making a recession more likely.

Three Pieces of Advice for Founders

As we enter 2024, founders will need to balance ambition and caution. Startups with proven PMF and sound unit economics should lean into capturing market share, but prepare to tap the brakes if economic conditions deteriorate.

Here are my three key pieces of advice for founders heading into 2024:

- Take a short-term, pragmatic approach to planning

- Rather than map out the whole year, focus your efforts on H1 2024. Be conservative with projections, but act now to set plans in motion.

- Apply zero-based budgeting to validate all expenses. Continue cutting costs and marginally profitable customer segments/geographies. E.g. Are your SMB customers profitable enough to justify given support needs? Should you prune underperforming marketing channels further?

- Reinvest savings and cautiously increase investment in initiatives that promise measurable improvements in revenues and/or gross margins in the next 6 months. Think creatively about H1 sales compensation, perhaps increasing the “kicker” for overachievement to motivate reps to extract the most juice from their pipeline.

- Prioritize customer segments, regions, and use cases with proven traction

- While expanding TAM is important long-term, focus for now on market segments where you have strong PMF and unit economics. For most companies, this means adding experienced AEs in core U.S. verticals.

- Make sure to add commensurate demand generation resources to ensure that AEs have enough pipeline.

- Invest in tools and training to boost sales and marketing efficiency

- Productivity across the GTM org comes to be critical. Now is the time to double down on sales training, and to let go of reps that don’t meet the bar on pitching.

- Explore how generative AI tools can augment sales workflows (e.g. by automating outreach campaigns, repetitive follow-up tasks, and sales enablement), reduce AE/SE ratios, and automate support and customer success functions.

- Check out Oliv.ai (sales process automation), Regie (sales content automation), and Docket.ai (GTM technical automation) in my portfolio for help on these areas.

Founders have learned hard-won lessons from the ups and downs of the past few years. Now is the time to apply them: remain vigilant about cash runway, concentrate resources on proven areas of strength, and optimize GTM efforts. For all its uncertainty, 2024 holds ample opportunities for startups that can embrace efficiency without sacrificing ambition.

Matei Zaharia Joins Our Enterprise CEO Dinner

In late September, we hosted our annual Enterprise Founders’ Dinner at our Palo Alto office. For me, this dinner is particularly special, as it’s our chance to thank the incredible founders and CEOs who are the very foundation of Foundation Capital! This year, we had the added privilege of hosting Matei Zaharia, co-founder and CTO of Databricks. I led a discussion with him on Databricks’ journey, LLMs, and the opportunities for AI-focused founders.

Here are five themes that stood out:

- Betting on the Cloud: While it may seem obvious today, Databricks’ decision to build cloud-first in 2013 was contrarian. Cloud product expertise was rare back then, yet this early commitment enabled faster product iteration and better measurement. This strategic bet early on also positioned them perfectly for the later widespread adoption of cloud.

- Pioneering the Data Platform: In 2013, enterprise data platforms existed but weren’t clearly defined. Databricks pioneered cloud-native data management, evolving from a single product to a multi-product company that solved problems across the data value chain. Customers wanted all their data housed in one place, and Databricks adapted to these emerging needs, establishing themselves as the one-stop shop for enterprise data management.

- The Power of Measurement: When building with LLMs, you often deal with highly subjective outputs. How you measure and improve output quality becomes your competitive advantage. There’s no guarantee that the latest base model will be good at the specific problem you’re trying to solve. Augmenting base models with proprietary data is key.

- Embracing Open Source: For Databricks, embracing open source was highly strategic. It expanded their marketing reach and enabled them to build an active community around the product. While competitors tried to predict what to build next, Databricks’ community helped co-create new features and integrations.

- LLMs’ Future Potential: The playbook for building an enduring business with LLMs is being written in real time. With innovations in deep learning, parallelization, and multimodality, the untapped potential is vast, especially in industries like healthcare, manufacturing, and robotics. This is an extremely exciting time to be an AI startup founder!

Join us at NY Tech Week!

On Wednesday, October 18, as part of NY TechWeek, our very own Nico Stainfeld is teaming with Heather Gorham, a principal at Flying Fish Partners. They’ll explore the ins-and-outs of building and scaling AI startups alongside founders with experience at leading companies like OpenAI, AmEx, Google, and DeepMind. These founders will share their entrepreneurial journeys, along with insights on solving real-world challenges, pursuing venture-scale opportunities, and differentiating AI startups. After the panel, there will be plenty of time for drinks and networking with the speakers, fellow founders, and investors in attendance.

If you’ll be in NYC, don’t miss out! RSVP here.

Published on 10.13.2023

Written by Ashu Garg