Rewriting the way money moves with stablecoins

07.02.2025 | By: Rodolfo Gonzalez, Gracie Zaro

From Bridge’s $1B exit to Circle’s blockbuster IPO and Tether’s eye popping profitability, it’s been impossible to ignore the splash that stablecoins have made over the past 12-18 months. Still, we’re only at the tip of the iceberg. Stablecoin transactions are growing exponentially, but integration into traditional financial services remains nascent.

There is a massive opportunity to drive stablecoin adoption in the real world and onboard the next billion users to this technology. To get there, these new cohorts of transactors will rely on multiple technology providers for primitive development, regulatory license access and compliance, plus on- and off-chain integrations. On one side, we have a small (but quickly growing) cadre of startups who have been long-term believers in the stablecoin opportunity, and whose moment in the spotlight has finally arrived. On the other side, big players in the financial services industry have been sitting on the sidelines observing the development of the crypto industry, and they are finally seeing the combination of solid business cases, regulatory clarity, and internal buy-in, to turn internal experiments into fully live products that serve their end customers.

Traditional transaction rails require participation from many stakeholders, each wanting a piece of the pie and some oversight to go along with it. The average cost of a credit transaction in the form of interchange ranges 2-5%, and funds take a couple of days to settle.

Stablecoins are fiat-backed, digital assets that have the stability of the USD with the permissionless programmability of the blockchain. Moving funds can be as simple as updating a wallet address. This flow costs fractions of a penny and takes less than 1 second on networks like Solana.

Consider what that means at scale: Visa and Mastercard generated a combined $64B in revenue across 400B transactions last year. If these 400B transactions were executed on Solana, total fee revenue would be closer to $400M, a 99% reduction in cost to merchants. When you can bring down costs to relatively nothing (in terms of both money and time), you can drive massive change and adoption.

We’re already seeing incredible volume and revenue capture from incumbents and very early stage businesses as stablecoins gain acceptance as a real financial instrument. Circle’s IPO shattered all expectations and has continued to perform post opening-day pop – an illustration of wider-scale excitement for the stablecoin opportunity. Despite the company generating 99% of revenue from interest income and passing 50% of that revenue to Coinbase, Circle is trading at a $43B market cap (22x revenue / 143x EBITDA). From a pure metrics perspective, this comparable would value Tether at multi-hundred-billion (trillion?) dollar business.

As new infrastructure is developed, applications created to serve this emerging technology will change the way money is moved, stored, and exchanged. At Foundation Capital, we are excited about the paradigm-shifting possibilities founders can unlock in this space—particularly if they can make use of the currency’s most high-potential feature: composability.

Common assumptions and limitations

As we navigate the stablecoin startup landscape, we primarily focus on backing teams that can bring massive changes to bear. Some of them will happen on the marketplace via broader adoption by clients, increased liquidity and transaction volume. Some startups are already challenging a few early assumptions associated with stablecoins. Shoutout to Matt Brown for building out part of this framework in his piece, Stablecoins in 1000 Words:

- Stablecoins are a cheaper means of payment compared to traditional counterparts. However, we can’t forget the a la carte costs associated with KYC / KYB / risk – arguably more important as we think about blockchain activity.

- Stablecoins are faster than existing rails and operate 24/7. Concurrently, we are seeing a global push toward RTP payments at a private and public level (sans blockchain). Plus, if humans or traditional bank operations remain in the loop, 24/7 is totally theoretical.

- Stablecoin transactions are more secure given the immutability and visibility of the blockchain. This is exciting from an audibility standpoint. Still, these attributes are not always conducive with real-world behavior—like returns and disputes on-chain.

- Stablecoin’s best use case is cross-border transactions. This might be true today; but we believe the cost of payments will go to zero in what are now-niche corridors, just as they did in now-mainstream corridors. That means there will only be a couple of winners in what is currently a very noisy space. To build enduring business models, projects have to provide value outside of the raw movement of money from point a to point b.

Finally—and in our view, most importantly:

- Stablecoin projects are composable. Projects built on the blockchain should be able to talk to one another by default; they should also be able to talk to their off-chain stakeholders. This promises to drive efficiency and creation in our existing financial system. But to make composability a true benefit, we need greater ecosystem buy-in and off-chain integration. We are most excited to back projects that serve this mission.

A new era of stablecoin-enabled financial services

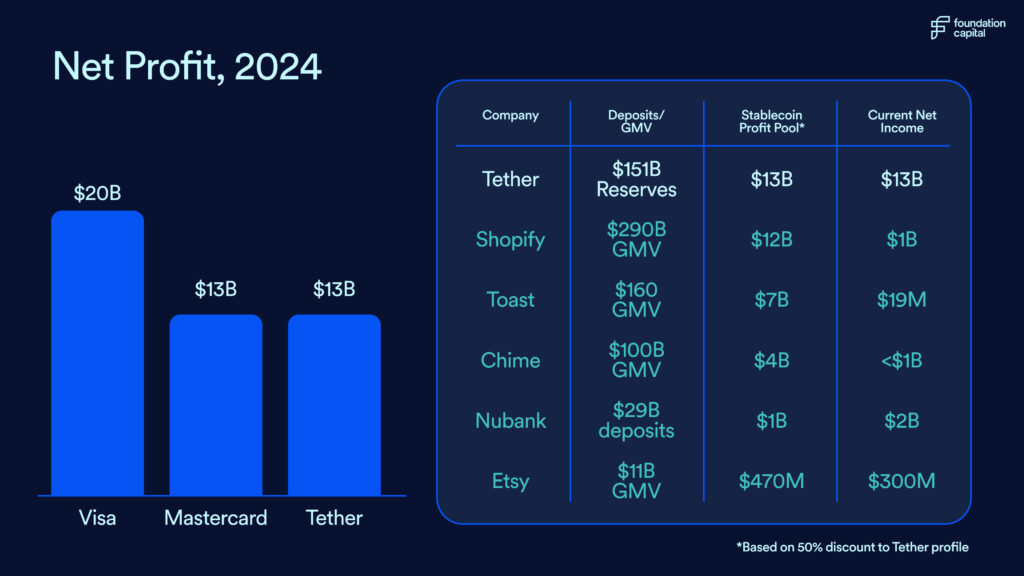

Web3 wallets and exchanges hold the majority of stablecoin reserves today. Some companies, like Dakota, want to make banking entirely-stablecoin based, ameliorating the need for fiat deposits altogether, while traditional FIs / fintechs have treated stablecoins as an untouchable asset. With regulatory clarity coming together as we speak, yield is the carrot that every slower-moving institution will run toward. As many of us know, Tether reportedly generated $14B in profit last year—largely off yields on underlying assets. If we look at a few fintech success stories, their theoretical yield opportunity would generate more profit than the entire business in its current state—even taking a 50% haircut to Tether’s margin profile.

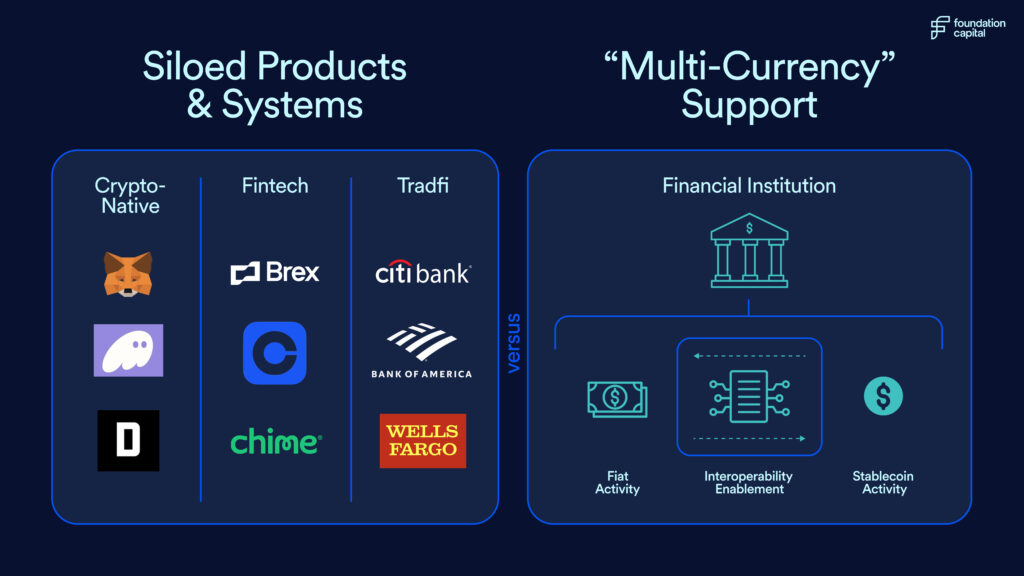

As the appeal of yield and regulatory clarity usher in a new wave of stablecoin adoption, we will see software providers building stablecoin enablement into their existing stack (like Fiserv’s collaboration with Solana, Paxos, and Circle), as well as net-new projects fostering adoption in traditional financial institutions (like Omnia, Stablesea, Ubyx). Picture a single stable and fiat balance at your bank, or interbank rails that might clear using stables, if that’s the most efficient route.

What does true integration get us?

From a tactical level, imagine a financial ecosystem where:

- Hybrid on-chain credit scoring enables normies to leverage the highly efficient lending protocols that exist on-chain today. This could mean T+0 credit decisioning and account funding.

- Traditional KYC and KYB functions can be ported on chain, resulting in pre-packaged, composable, and immutable web2 identity for all web3 activity. In other words, the pseudonymity of most blockchains would not remain a barrier to mainstream adoption.

- Off-chain balances of many kinds are accessible to blockchain applications, and on-chain balances are easily accessed by traditional institutions or programs, supporting communication with “the real world,” plus automated and instant payments or settlements in any currency.

- Complicated tax schema is prepackaged into smart contracts, enabling auto compliance for any trading, earning, or sending done on-chain.

- Governance, Risk and Compliance playbooks are built directly into protocols, providing real-time, rule-based risk and compliance monitoring for on-chain transactions.

We are already seeing the web3 experience in many money-movement products match or exceed those of web2 and traditional fintech ones. Over time, we see defi protocols and p2p transactions powering a large share of credit decisioning, insurance claims and payouts, consumer and business banking, treasury management. As more financial primitives come online and developers bring them into their products, we anticipate a new ‘best-in-class’ UI/UX fintech frontier to emerge, and massive companies to be built behind that.

Composability and programmability: the true unlock

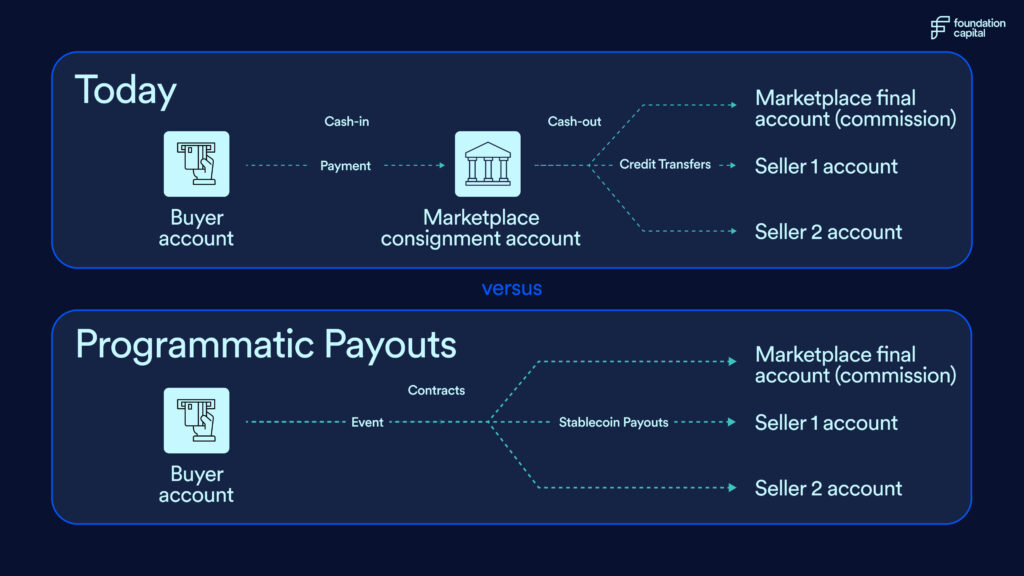

The role composability plays in stablecoin utilization goes hand-in-hand with the notion of programmability. Blockchain-native transaction execution based on events or triggers is particularly exciting when applied to complex workflows that require multiple steps with granular level of control. Workflows that involve intricate, rule-based movement of money across different accounts, geographies, and currencies are ripe for stablecoin disruption.

Treasury management is a no-brainer, especially when we think about the added complexity of multi-nationals dealing with FX operations. With enhanced liquidity management, decreased market risk, and improved operational efficiency top of mind, intra-company money movement built on stablecoin infrastructure could be a silver bullet.

Any one-to-many payment scheme also deserves stablecoin consideration. Marketplaces, payroll, government aid, and liquidity events are all different forms of a similar complex transaction. With stablecoins, dollars can theoretically flow from buyer to seller or employer to employee automatically, with FX baked-in where necessary, eliminating unnecessary accounts, vendors, and people.

We can also leverage stablecoins and tokenized real-world assets to rewire and optimize capital markets. We have a ways to go in terms of system transformation—adoption of tokenized money market funds remains miniscule, at about .07% of total US assets held in money market funds—but the opportunity is massive. The U.S. repo market finances $2T+ of Treasuries daily; trading quickly in and out of particular assets with a focus on stability and yield generation is an A+ stablecoin use case.

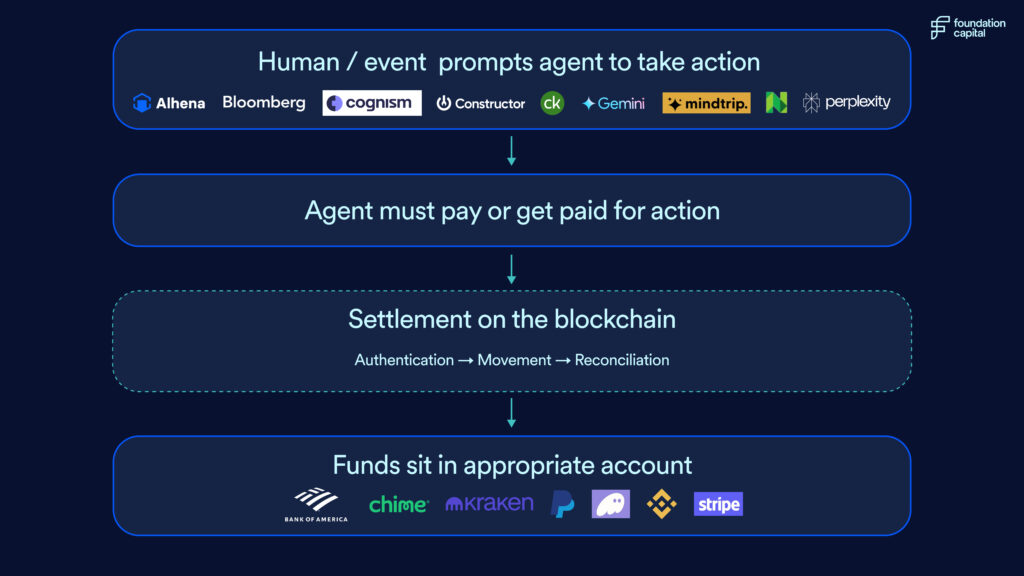

And we would be remiss to leave out any mention of stablecoins’ involvement in AI. Agents are new customers, and existing financial infrastructure is not built to serve them. Agentic transaction rules will be complex, deterministic, and real-time; thus, the means of money movement must be programmable, global, and run 24/7. Micro payments will proliferate as agents perform even the smallest of tasks, so low cost is crucial; meanwhile, existing wallet infrastructure supports balances without the need for a bank account. Lastly, digital workers’ behavior must be totally auditable. If we believe agents will be the transactors of the future, there will be demand to build up and down the stack, and programmability paired with money movement is a key piece to the puzzle.

Betting on “local founders”

We are only at the prologue of the multi-decade stablecoins story, and we’re very excited to see both the boldest predictions become true, along with many others we can barely imagine now. As we look ahead, we’re betting that founders who build companies focused on greater ecosystem buy-in and off-chain integration will be the key to unlocking composability.

Tactically, this means backing early-stage projects and “local founders”—those we believe are in it for the long haul, not just the hype. We want to support builders at their earliest stages of ideation who are creating n of 1 products that have the potential to build true network advantage and moat along the way. We’re also eager to hear from players around the existing financial services table.

If you’re working on something transformative in this space, we would love to learn more.

Published on July 2, 2025

Written by Foundation Capital