Overhauling logistics with AI:

a $79 billion opportunity

LLMs and computer vision will knock out manual logistics tasks, from price quoting to packing automation.

10.10.2024 | By: Joanne Chen, Leo Lu, Jaya Gupta

Logistics problems have likely stalled something in your life, whether small (like a misdirected package) or large (like delivery of a new car). That’s because logistics—the middle sector of the supply chain that involves transporting, warehousing, and distributing goods—has so many deeply entrenched problems that they affect nearly everyone on the planet.

Ecommerce forces shippers to adapt

As ecommerce gains traction and consumers demand swift, precise deliveries, the cost of making those deliveries has soared. Trucking costs last year hit all-time highs. Suez Canal ship volume is down nearly 80% due to Houthi attacks, a problem that has subsequently ratcheted up air freight rates. More than three quarters of logistics operators say they experience labor shortages, not to mention labor disputes; recently a historic port strike lasted only 48 hours but cost the U.S. economy an estimated $5 billion a day. In most years, logistics inefficiencies add up to around $95 billion in losses. In 2024, we expect cyberattacks, hurricanes, and ongoing geopolitical conflicts to push the total much higher.

Despite a pressing need for innovation, the sector remains resistant to change, with 76% of digital transformations in logistics failing to meet critical metrics. As data complexity grows in some areas, so does the potential for error, since antiquated systems and manual processes in logistics abound.

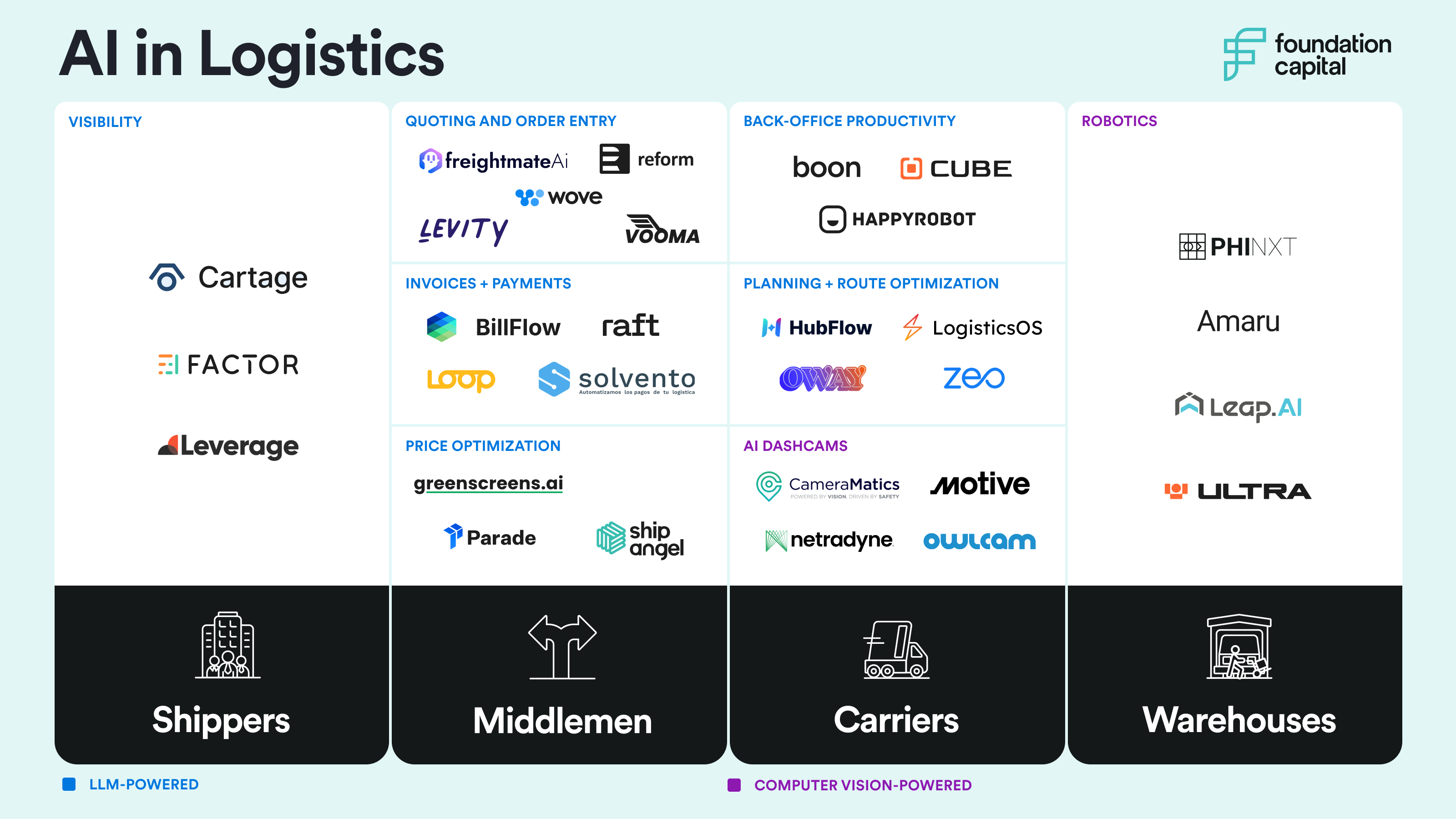

Such a mix of entrenched problems, manual work, and chaotic data makes logistics an ideal sector for AI-focused startups to thrive. Large Language Models excel at processing vast amounts of unstructured data from diverse sources. Computer vision technology bridges the physical and digital worlds, regularly acing tasks like equipment monitoring, predictive maintenance, and quality control for packages.

Applying AI in four key areas

Below we’ve mapped out seven critical LLM and computer vision use cases in logistics, particularly for four types of businesses:

- Shippers → entities who own the goods (i.e. manufacturers, suppliers, or retailers) and hire contractors to move them from one location to another (see our supply chain blog for more on this category)

- Carriers → companies or individuals that physically transport goods on behalf of shippers, using various modes of transportation such as trucks, ships, or airplanes

- Middlemen → intermediaries that facilitate transactions between shippers, carriers, and ultimately, consumers; the middlemen category includes brokers, freight forwarders, and 3PLs

- Warehouses → facilities for storing, managing, and distributing shippers’ goods

AI takes a $79B bite out of a vast global market

Because AI-native startups can step up efficiency for all four company types, we believe they have the potential to seize $79 billion worth of potential in an enormous global market. What’s at stake is not only a massive opportunity but also a chance to transform logistics from a historically frustrating industry that resists change into an adaptive sector that shifts nimbly according to producer and consumer needs.

Let’s dig into the pain points and market opportunities in logistics.

Carriers and middlemen are swamped with back-office tasks

Carriers (think XPO Logistics and Maersk) handle hundreds of thousands of shipments daily, creating a mountain of administrative tasks. At small and mid-sized carriers, many of these tasks are still handled manually and therefore error-prone. Two particularly error-prone tasks are price quoting and order entry.

Price quoting is often the earliest step for any carrier or broker in sending goods. “I’m shipping X number and goods type, from City X to City X. How much will it cost?” The calculation is based on factors like distance, weight, mode of transport, and market conditions. A customer service representative performing it gobbles up a tremendous amount of time comparing multiple data sources, cross-referencing rates, and adjusting for fluctuating variables.

An LLM plus cutting-edge machine learning algorithms can alleviate significant burden here, as AI agents can quickly analyze vast amounts of historical data, market trends, and shipment details while also auto-categorizing and inputting orders. This streamlining not only reduces manual data entry errors but also speeds up response times, allowing human employees at carriers to focus on core operations.

Middlemen companies in the logistics chain (think freight brokers, freight forwarders, and 3PL, or third-party logistics providers) struggle with similar back-office tasks. But as an order moves through many handoffs, it comes bundled with increased complexity. Currently, brokers can only book around 10 loads (shipments of goods) per day. But with an AI co-pilot, this could potentially scale to hundreds of loads per day per broker. Much of the current booking process uses semi-structured data and manual processes, with staffers sending hundreds of emails or spending hours on the phone with carriers daily getting quotes and placing orders. Worse still, brokers must then manually extract all details from emails and notes, inputting them into a system. The tedious details are enough to make most humans’ heads explode. Sorting through them is a perfect use case for an AI agent. Several startups are showing progress in this area, including Vooma Freightmate, HappyRobot, and Reform.

For middlemen companies, small errors lead to waste, which can lead to sacrificing precious profit margins. A report by the Council of Supply Chain Management Professionals noted that as many as 80% of freight invoices contain errors, leading to a 5% margin loss or higher. Hiring workers to manually correct these errors is challenging, as labor costs often outweigh the potential savings. AI excels at data extraction (optical character recognition) and categorization (natural language processing) from various unstructured sources like emails, PDFs, and contracts, making these two technologies ideal for cutting down errors and automating manual order entry and quoting processes. Promising startups here include Raft, Solvento, Billflow, and Loop.

Based on salary data from the Bureau of Labor Statistics for employees at carrier and middlemen companies, along with an estimate of LLM-related cost savings and productivity boosts, we estimate that back-office use cases represent $22 billion in market opportunity for AI startups.

Carriers struggle to map efficient routes

Once a goods order is placed and priced, a carrier must map out that order’s route. Here’s where ecommerce and the increased demand for flexible deliveries are making outsized impacts. Mapping optimal routes for slow-moving goods is tricky enough. But think of the quick turnaround time needed to deliver, say, a ‘fast fashion’ item or a product that’s trending online. Industry agency Freightwaves found that up to 30% of trucks on the road are currently running “empty miles,” meaning not carrying cargo—a stunning waste of fuel and labor.

As turnaround times for goods get tighter, trucks are not only running empty, but also purposely running less-than-full shipments, an industry sliver called LTL (less than truckload) shipping. A report earlier this year found that demand for LTL is extremely high, specifically due to online ordering.

This creates even greater demand for efficient route optimization and planning, a prime use case for AI. Machine learning algorithms use structured data to optimize route mapping, scheduling, and truck sharing. Additionally, LLMs can process unstructured data sources like emails and text messages to incorporate real-time changes. AI use here can make a significant dent in the “empty miles” problem for truckers, as well incorporating on-the-spot complexities (change in time window, new request for truck sizes, etc.).

Based on current BLS salary data and potential cost and productivity savings with LLMs, we believe route optimization and planning represents a $30B opportunity for AI companies.

Drivers and other operators need new safety equipment

Trucking is a dangerous business, but computer vision can help. Last year there were approximately 150,000 truck-related accidents, with each incident costing companies an average of $91,000, even when covered by insurance. This significant financial burden highlights the need for AI-powered dashcams, which can detect and prevent accidents in real time, giving carriers greater visibility into driver behavior and road conditions. Additionally, AI-powered safety devices can offer intelligent coaching solutions to improve driver safety.

Given the number of accidents in the U.S. and the average cost of a trucking accident ($91,000), we estimate the AI dashcam market represents a $13.6 billion opportunity for companies seeking to enhance safety and reduce operational costs.

Warehouses lack automation and face labor shortages

Warehousing sits at a critical juncture, with more than 80% of U.S. facilities operating without automation. At the same time, the companies running those facilities face significant labor shortages. As the sector grapples with an anticipated 2.1 million unfilled jobs by 2030, robotics solutions inside warehouses (robots-as-a-service) for packing, sorting, and order fulfillment, look increasingly promising. Recent breakthroughs in neural networks and computer vision enable these machines to navigate complex tasks in diverse warehouse environments. With robots, warehouses can not only address immediate labor challenges but also position themselves for increased efficiency and productivity.

Based on current BLS salary data and potential cost savings with both LLMs and computer vision, we believe robotics solutions for warehouses represent a $13 billion market opportunity.

Shippers lack visibility down the chain

Logistics focuses on the transporting and storing of goods, whereas supply chain management is much broader, touching on the entire network of processes that brings goods to market. We previously mapped out the opportunity for AI in three specific areas of supply chain: procurement, supplier intelligence, and demand planning. A critical area of overlap in both supply chain and logistics is visibility.

From a shipper’s perspective, many freight operations are siloed, with limited visibility across carriers, modes, and logistics partners. Let’s say a VP at the discount retailer Big Lots needs wicker chairs delivered to every U.S. store. The chairs may begin their journey by boat, continue it by air, and have final delivery to all stores by truck. Because the VP lacks visibility into any carrier’s system of record, coordinating and tracking such a shipment will be inefficient to say the least, with order information scattered across a number of Transportation Management Systems or buried in emails.

LLMs offer significantly improved visibility into such transactions, translating data from multiple sources, enabling real-time tracking between carriers and shippers, and serving it up in a dashboard. A few promising AI-focused startups are making progress here, including Cartage, Factor, and Leverage.

AI can make handoffs that carriers can’t

The sprawling nature of the logistics business has always made it a tricky space for innovation, since the handoffs between shippers, carriers, and other players don’t always happen smoothly. But AI can now serve as something of a link, connecting all those parts at speed and scale. AI-focused startups, leveraging technologies like LLMs and computer vision, have the potential to revolutionize the sector, improving everything from back-office operations to route optimization and warehouse automation.

If you’re building something that simplifies logistics and improves the world’s productivity, email us: jchen@foundationcap.com or llu@foundationcap.com.

Published on October 10, 2024

Written by Foundation Capital