FC Ideas: FinTech

In this new era, the companies best positioned to disrupt or even displace the Financial Services incumbents will develop against four key consumer trends: Simplification, Transparency, Analytics, & Reduce Friction.

06.10.2023 | By Ashu Garg

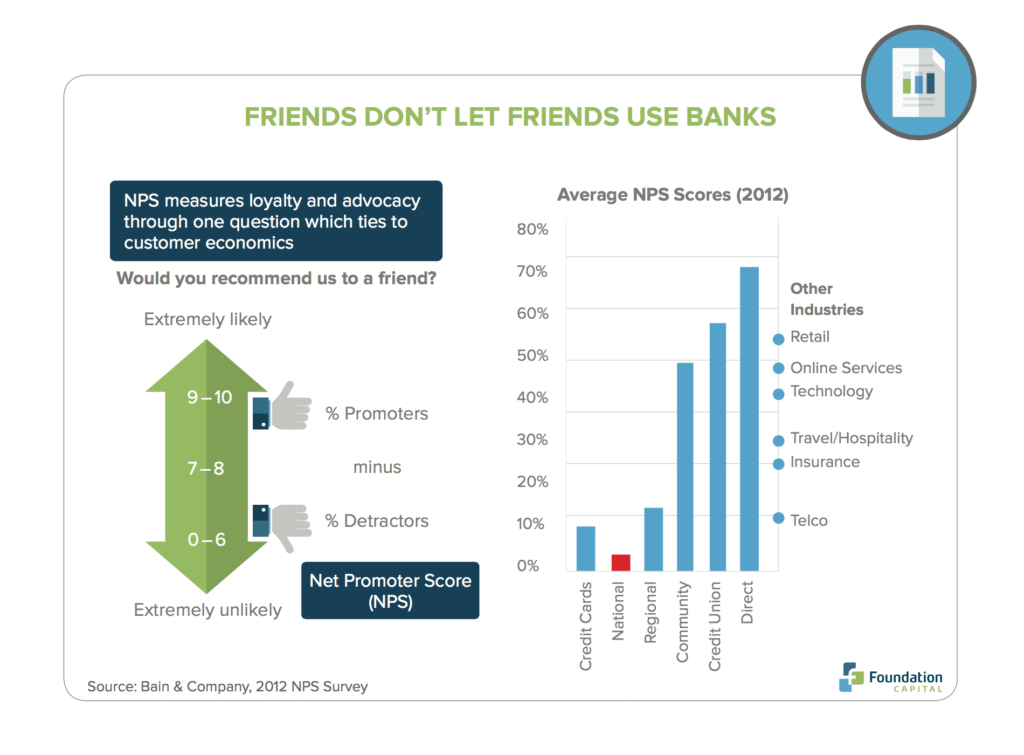

Friends Don’t Let Friends Use Banks

Young people are particularly disdainful of banks. Seven out of ten would rather go to the dentist than listen to what banks are saying. One-third believe they won’t need a bank at all. Half are counting on tech startups to overhaul the way banks work. And three-quarters would be more excited about a new financial services offering from a tech company than from their own national bank.

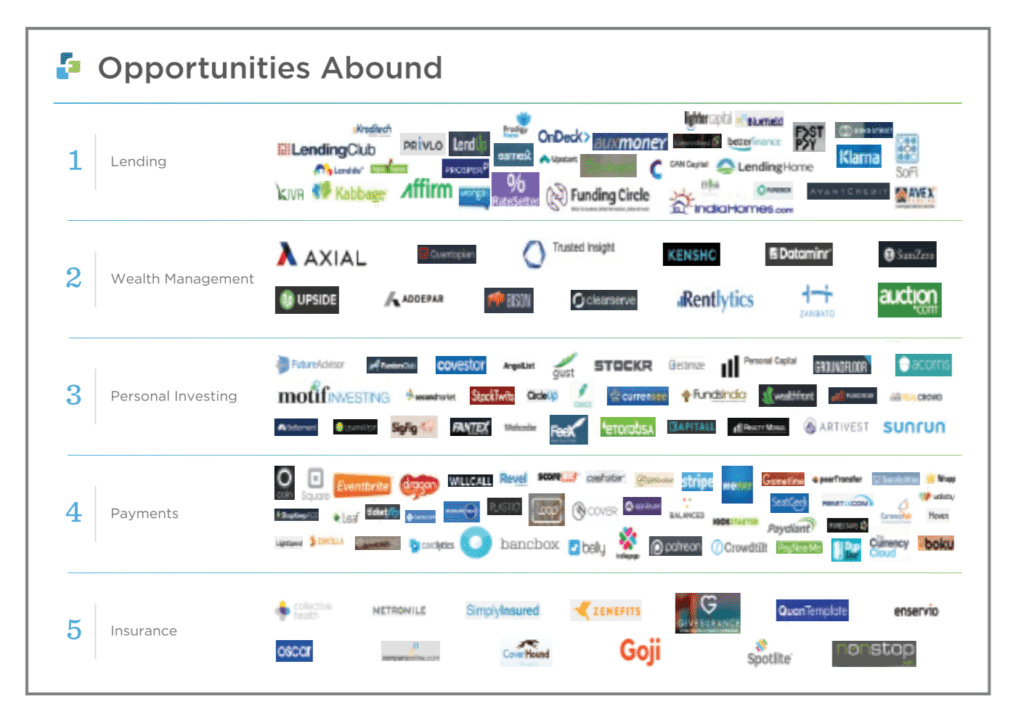

I believe marketplace lending will increasingly encroach upon – and take market share from – traditional banking. I believe this will happen across lending (consumer, real estate, SMB, purchase finance), payments, insurance, equity and beyond.

Big Ideas in Financial Technology: Opportunities Abound

When incumbents seem not only too big to fail but also too slow to react, innovative technology companies are looking at significant opportunities.

Bill Gates was right two decades ago when he observed banking is necessary but banks are not. Marketplace lending is now poised to demonstrate how accurate that observation was. Yes, banking is still largely being provided by banks. But marketplace lending is changing that.

Marketplace Lending is Disintermediating the Borrowing & Investing Experience

This industry held, and still holds, such tremendous potential: a giant market with incumbents that are universally disliked, offering outmoded products and services. I believe there exists a new model with the potential to displace that system. The marketplace model cuts several links out of today’s banking chain.