Back in school, back in debt

August 22, 2016

Charles Moldow

My daughter will soon start her freshman year of college. For her and our whole family, it’s a time of excitement and nerves. And for many across the country, those nerves also include financial stress. “It’s getting harder and harder to graduate college without taking on student loans,” MarketWatch wrote. Indeed, 71 percent of students fund their college education by taking out student loans—debt that now totals $1.3 trillion.

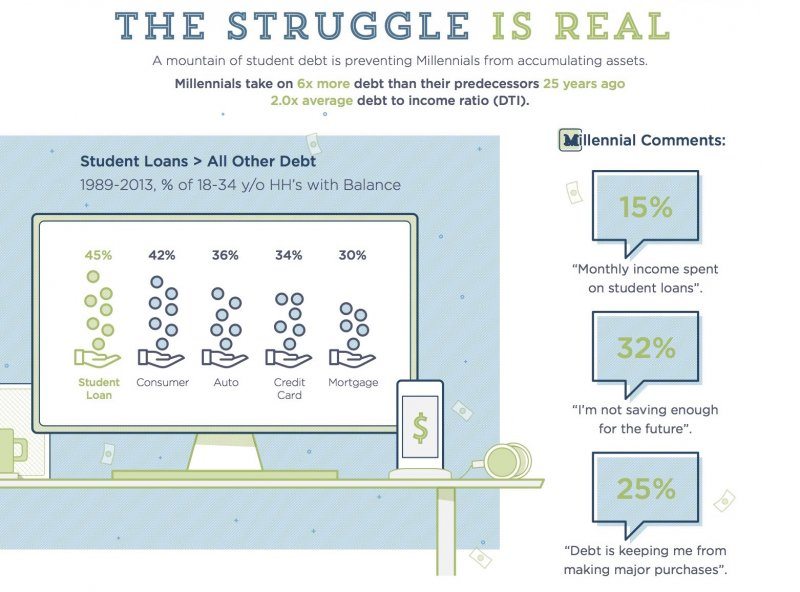

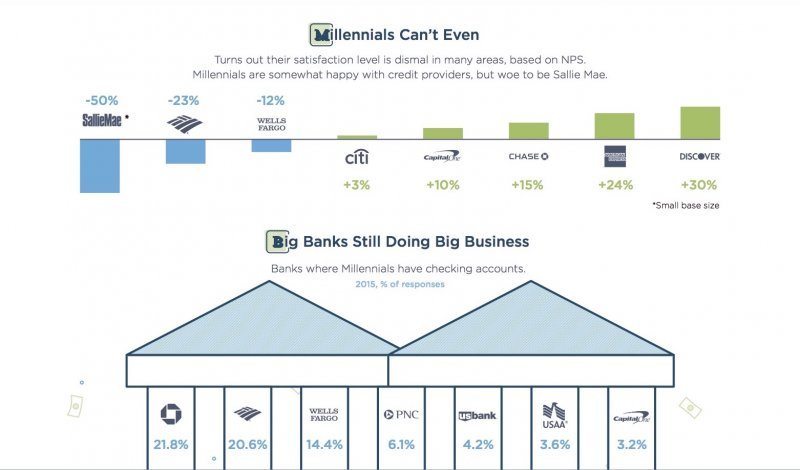

Foundation Capital surveyed Millennials about their finances to add some depth to our understanding of what that $1.3 trillion number really means. Compared against the Fed’s Survey of Consumer Finances, our findings revealed that today’s graduates are not only racking up debt, they won’t be able to pay it off as well as previous generations might have. In 2007, for instance, the typical college-educated Millennials earned $69,000 but in 2013 earned only $51,000—a 27 percent drop. What’s more, Millennials take on 6 times more debt than their predecessors, and have double the debt-to-income ratio. Both of those findings are part of our more complete infographic of insights on Millennial financial lives.

Numbers like those explain why we see headlines like, “Majority of Americans Want College to Be Free” and “Is student debt ruining the recovery?”

Since we first shared these insights, the class of 2016 has surpassed the class of 2015 as the most indebted ever, averaging roughly $37,000 in debt each. And student debt has been planted firmly at the center of the national conversation.

The two leading presidential candidates have weighed in. One said: “Let’s make debt-free college available to everyone… let’s liberate the millions of Americans who already have student debt.” Another said: “We’re going to work with all of our students who are drowning in debt to take the pressure off these young people just starting out their adult lives.” I don’t need to tell you which quote belongs to which candidate; the sentiment is practically the same.

So there’s bipartisan acknowledgement of the problem. But if recent history holds, there will also be bipartisan consensus on accomplishing very little after the election. Fortunately, it’s not all doom and gloom. Some of the greatest innovations were responses to frustrations. For the invention of “xerography,” we can thank a lawyer who got fed up with carbon copies. That led Xerox and to Xerox PARC, which is where Steve Jobs stumbled on his inspiration for the Macintosh. And the rest is history.

Indeed, some of the most interesting solutions to the debt crisis are being built today in the Silicon Valley. At Foundation, we’ve invested in Chegg to help students save on new, used, and electronic books. And while the Chegg team is focused on that chunk of students’ budgets, other emerging enterprises are taking a hard look at even bigger line items, like tuition.

A number of them are on my radar, including these:

- ·For those who are thinking ahead, CollegeBacker not only opens a 529 plan, it makes it easy for the entire family to participate in funding it. If you’ve got a grandmother, an aunt, or a parent who wants to invest in your education, they now have a way to infuse the seed financing and for you to watch it grow—tax-free.

- ·For those looking at student loans, Credible and Gradible both help families evaluate them and find better deals. Credible, which raised a $10 million series A in September 2015, gives customers fixed quotes from multiple lenders, so they can make an informed decision, without having to leave the platform.

- Once graduates have entered the workforce, SoFi and Gradifi help their employers offer a new kind of employee benefit—a Student Loan Paydown plan. It’s a lot like a 401(k) in that employers can match employee contributions or contribute a fixed amount, except the funds pay down debt (and in the future, they can be redirected toward building wealth). In March 2016, SoFi announced it had funded more than $1 billion in student loan refinancing through more than 400 employers. Gradifi was named a 2016 Game Changer by the Boston Globe and counts PwC as its first customer.

- For necessary big-ticket items, Pave and Upstart provide personal loans. But unlike traditional lenders, they care less about your credit history than they do about your credit future. Upstart, which has funded more than $300 million in loans, defines its customers as “future prime” borrowers—people who are on track to be great borrowers, even if their current employment and credit history don’t yet reflect that.

- And for an improvement on your everyday bank account, Simple, Digit, and Acorns all automatically set money aside for big-ticket items, so you don’t have to think about it. Acorns, which counts more than 1 million customers, invests your “spare change” by rounding up to the nearest dollar on credit card purchases. Simple crossed the $1 billion annual transactions mark in 2013.

We learned with our primary research, it’s risky to make sweeping generalizations about the largest and most diverse generation in American history—not to mention the debt crisis that has come to define it. But it’s a fact that my daughter’s generation is also the most educated generation in American history. If we want them to be the most debt-free generation, too, then our nation has some real work ahead of us.

These startups are building for Millennials and meeting Millennials where they already are—on mobile. While they represent the most visible slice of what’s out there, they’re only a slice. I, for one, will be watching this space very closely.

Download the full infographic here.